you position:Home > new york stock exchange > new york stock exchange

Hisense US Stock Price: An In-Depth Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving world of technology and consumer electronics, Hisense has emerged as a major player. As investors and market enthusiasts keep a keen eye on the Hisense US stock price, it's essential to understand the factors that influence it. This article delves into the Hisense US stock price, analyzing its trends, potential risks, and opportunities for investors.

Understanding Hisense's Market Presence

Hisense is a Chinese multinational consumer electronics company known for producing a wide range of products, including televisions, air conditioners, refrigerators, and washing machines. The company has expanded its global footprint, with a significant presence in the United States. Hisense's stock (HS.NYSE) has been a hot topic among investors, and for good reason.

Factors Influencing Hisense US Stock Price

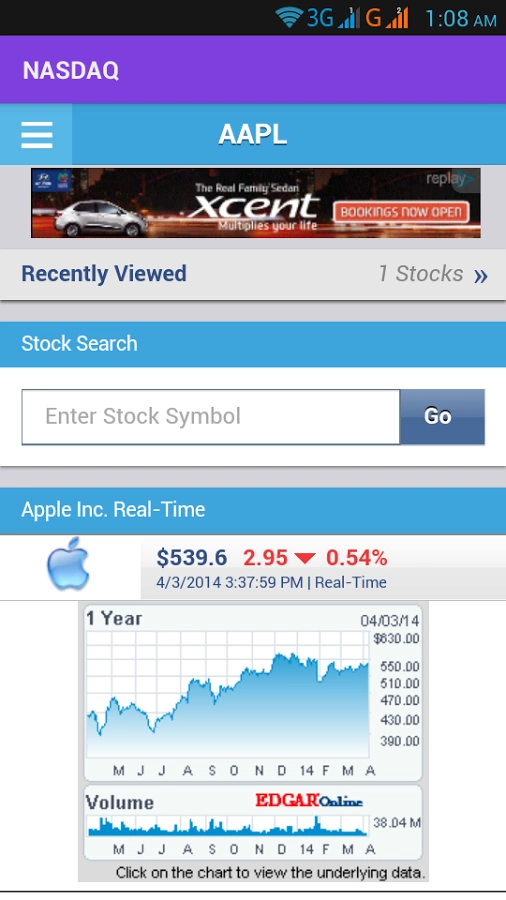

Market Trends: The consumer electronics market is highly dynamic, with constant technological advancements and shifting consumer preferences. Hisense's stock price is influenced by market trends, such as the increasing demand for smart TVs and other smart home devices.

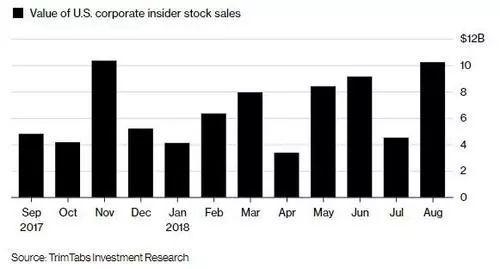

Economic Factors: Economic conditions, including inflation, interest rates, and currency fluctuations, can significantly impact the stock price. For instance, a strong US dollar can make Hisense's products more expensive for American consumers, potentially affecting sales and, consequently, the stock price.

Company Performance: Hisense's financial performance, including revenue, earnings, and growth prospects, plays a crucial role in determining its stock price. Positive earnings reports and strong growth forecasts can boost the stock, while negative news can lead to a decline.

Competition: Hisense operates in a highly competitive market, with major players like Samsung, LG, and Sony. Competitive pressures can affect the company's market share and, subsequently, its stock price.

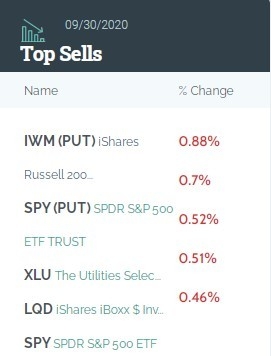

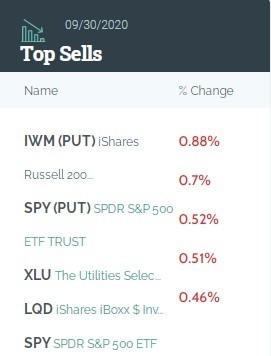

Hisense US Stock Price Trends

Over the past few years, the Hisense US stock price has shown a mixed trend. While there have been periods of strong growth, the stock has also experienced significant volatility. In 2020, the stock saw a surge in value, driven by the increasing demand for consumer electronics during the COVID-19 pandemic. However, the stock has since experienced a decline, reflecting broader market trends and economic uncertainties.

Case Study: Hisense's Acquisition of Vizio

One notable event that impacted Hisense's stock price was its acquisition of Vizio in 2016. The acquisition was seen as a strategic move to strengthen Hisense's position in the US market. While the deal initially faced regulatory hurdles, it was eventually approved, and the stock price experienced a surge. However, the long-term impact of the acquisition on the stock price remains a topic of debate among investors.

Conclusion

Understanding the Hisense US stock price requires a comprehensive analysis of various factors, including market trends, economic conditions, company performance, and competition. While the stock has shown volatility, it remains a potential investment opportunity for those willing to navigate the risks and rewards of the consumer electronics market. As Hisense continues to expand its global footprint, investors will need to stay informed about the latest developments and trends to make informed decisions.

so cool! ()

last:US Silver Stocks: A Comprehensive Guide to Investing in Silver

next:nothing

like

- US Silver Stocks: A Comprehensive Guide to Investing in Silver

- US Stock Market Agenda: Navigating the Investment Landscape

- US Stock Market August 26, 2025 Summary

- US Stock Features: What You Need to Know

- US Cellular Stock ROM LG G4 BoyCracked: Unveiling the Power of Custom ROMs

- http://stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol knd

- Dow Jones Total Stock Market US Small Cap Value Index: A Comprehensive Guide

- Tax Implications for US Investors in Canadian Bank Stocks Dividends

- Title: 1917 US Rifle Stock 3-GMK Inspector: The Unsung Hero of Firearms Quality A

- Title: NSX National Stock Exchange US: Revolutionizing the Stock Market Landscape

- Understanding the US Steel Stock Future: A Comprehensive Guide

- Title: Stock Drop: A Major Concern for the US Economy

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Hisense US Stock Price: An In-Depth Analysis

Hisense US Stock Price: An In-Depth Analysis

US Real Estate Stocks: A Comprehensive Guide t

Title: Historical US Stock Market Performance

Title: Top Rare Earth Stocks US: Unveiling the

Best US 5G Stocks: Your Guide to Investment Op

Semiconductor Companies in US Stock: A Compreh

Understanding the Role of a US Nonresident Sto

Understanding the Ishares US Preferred Stock E

Title: Toys "R" Us Stock Che

US Large Cap Stocks Momentum Analysis 2024

Title: Cognizant Indian and US Stock: A Compre

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How to Invest in US Stocks from Europe"

- Can I Buy US Stocks with CAD?"

- Stocks and Shares ISA for US Citizens: A Compr"

- Title: Cannibis Stock US: A Lucrative Investme"

- Top Momentum Stocks: September 2025 US Large C"

- Understanding the Power of US Compounding Stoc"

- Dyson Stock Price US: A Comprehensive Analysis"

- 2008 US Stock Market: A Year of Turbulence and"

- CannTrust Us Stock Symbol: A Comprehensive Gui"

- Understanding US Large Cap Stocks Sector Class"