you position:Home > new york stock exchange > new york stock exchange

How to Invest in US Stocks from Europe

![]() myandytime2026-01-13【us stock market today live cha】view

myandytime2026-01-13【us stock market today live cha】view

info:

Are you an investor in Europe looking to expand your portfolio into the US stock market? You're not alone. The US stock market is one of the largest and most influential in the world, offering a wide range of investment opportunities. But how do you get started? In this guide, we'll explore the steps you need to take to invest in US stocks from Europe.

Understanding the Basics

Before diving into the details, it's important to understand the basics of investing in US stocks from abroad. Here are a few key points to keep in mind:

- Currency Conversion: When investing in US stocks, you'll be dealing with US dollars. This means you'll need to convert your local currency to USD.

- Tax Implications: Depending on your country of residence, there may be tax implications for investing in US stocks. It's important to consult with a tax professional to understand these implications.

- Regulatory Differences: The regulations governing investing in US stocks from Europe may differ from those in your home country. Make sure you understand these differences before you start investing.

Steps to Invest in US Stocks from Europe

Now that you understand the basics, let's look at the steps you need to take to invest in US stocks from Europe:

1. Open a Brokerage Account

The first step is to open a brokerage account with a firm that allows you to trade US stocks. There are several brokerage firms that cater to international investors, including:

- E*TRADE

- Fidelity

- Charles Schwab

- Interactive Brokers

When choosing a brokerage firm, consider factors such as fees, customer service, and the types of investments available.

2. Fund Your Account

Once you've opened your brokerage account, you'll need to fund it. You can do this by transferring funds from your bank account or by wiring money directly to the brokerage firm.

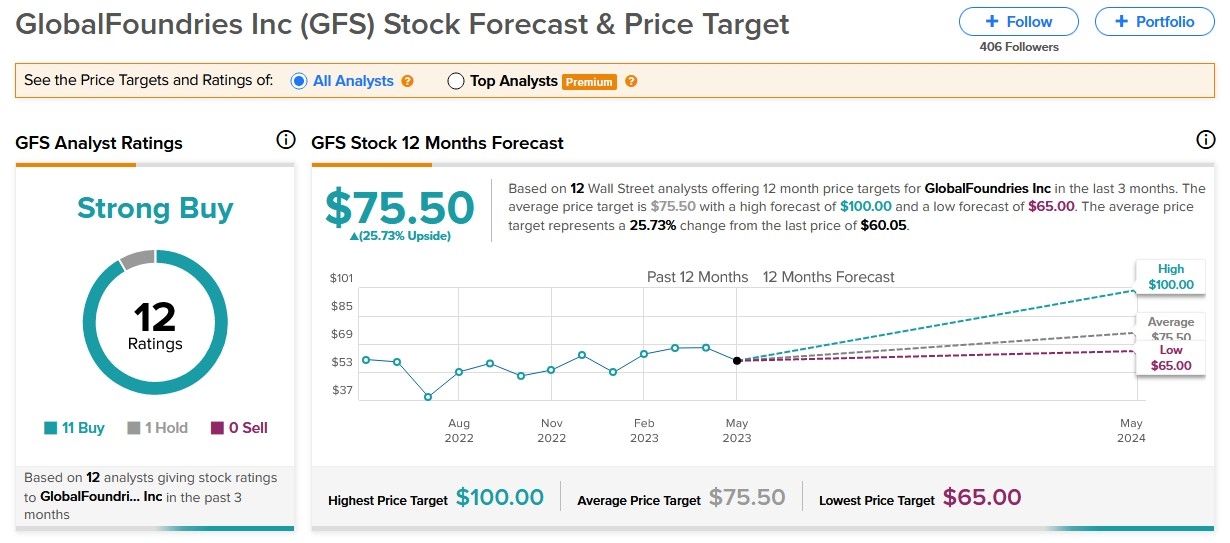

3. Research and Select Stocks

Next, it's time to research and select the stocks you want to invest in. There are many resources available to help you with this, including:

- Financial News Websites: Websites like Bloomberg, CNBC, and The Wall Street Journal provide up-to-date financial news and analysis.

- Stock Research Platforms: Platforms like Seeking Alpha and Motley Fool offer detailed stock research and analysis.

- Brokerage Firm Research: Many brokerage firms offer their own research tools and resources.

4. Place Your Order

Once you've selected the stocks you want to invest in, you can place your order through your brokerage account. You can choose to buy shares, sell short, or use various other investment strategies.

5. Monitor Your Investments

After placing your order, it's important to monitor your investments regularly. This will help you stay informed about market trends and make informed decisions about your investments.

Case Study: Investing in Apple from Europe

Let's say you're an investor in Europe who wants to invest in Apple (AAPL). Here's how you would do it:

- Open a Brokerage Account: You open an account with a brokerage firm that allows you to trade US stocks, such as E*TRADE or Fidelity.

- Fund Your Account: You transfer funds from your European bank account to your brokerage account.

- Research and Select Stocks: You research Apple and determine that it's a good investment for your portfolio.

- Place Your Order: You place an order to buy shares of Apple through your brokerage account.

- Monitor Your Investments: You monitor Apple's stock performance regularly and make informed decisions about your investment.

Investing in US stocks from Europe can be a great way to diversify your portfolio and gain access to some of the world's largest and most successful companies. By following these steps and doing your research, you can successfully invest in US stocks from anywhere in the world.

so cool! ()

like

- Housing Stock Market News US: A Comprehensive Update

- 2008 US Stock Market: A Year of Turbulence and Recovery

- Title: EU vs US Stock Market: A Comprehensive Comparison

- Online Stock Trading for Non-US Citizens: A Comprehensive Guide

- How Can Canadians Buy US Stocks?

- Momentum Stocks: Top Performers in the US Large Cap Market Over the Last 5 Days

- Kansas City Southern Railway: A Deep Dive into US Railroad Stocks

- Best US Value Stocks: Unveiling the Hidden Gems in the Market

- Most Popular US Stocks Trending: A Comprehensive Guide

- Institutional Investors Net Sellers of US Stocks in 2025: What It Means for the M

- Number of Listed Stocks in the US 2017: A Deep Dive

- Current US Stock Market Outlook: Navigating the Turbulent Waters

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- Institutional Investors Net Sellers of US Stoc"

- Best US Value Stocks: Unveiling the Hidden Gem"

- Current US Stock Market Outlook: Navigating th"

- 1 Year Expectations: Large US Stocks"

- Is the US Stock Market Open on Columbus Day?"

recommend

Housing Stock Market News US: A Comprehensive

Housing Stock Market News US: A Comprehensive

Can I Buy US Stocks with CAD?

How Can Canadians Buy US Stocks?

Amazon B Stock US: A Comprehensive Guide to Un

Convert Us Air Stock Certificates: A Comprehen

Online Stock Trading for Non-US Citizens: A Co

How Much Is Baba Stock in US Dollars?

Best Quantum Computing Stocks in the US

AMD US Stock Market: An In-Depth Analysis

Best US Value Stocks: Unveiling the Hidden Gem

Major US Airlines Stock: A Comprehensive Analy

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- A7III Stock US: Understanding the Investment O"

- Can Anyone Invest in the US Stock Market?"

- What Time Does the US Stock Market Open?"

- Is the US Stock Market Open on Columbus Day?"

- Best US Stock: Unveiling the Top Performers fo"

- Can I Buy US Stocks with CAD?"

- Newest Meme Stocks US September 2025: A Compre"

- Australia-US Stock Market: A Comprehensive Gui"

- Title: Geometric Average Return of US Stock Ma"

- Title: US Stock Market Time: Understanding the"