you position:Home > new york stock exchange > new york stock exchange

US Stock Features: What You Need to Know

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the dynamic world of investing, understanding the features of US stocks is crucial for any investor. Whether you're a seasoned trader or a beginner looking to dip your toes into the stock market, knowing what to expect can make all the difference. In this article, we'll delve into the key features of US stocks, helping you make informed decisions about your investments.

Understanding the Basics

1. Dividends

One of the most appealing features of US stocks is the potential for dividends. Dividends are payments made by a company to its shareholders, typically in the form of cash. These payments are often distributed on a quarterly basis and are a significant source of income for many investors. Dividend-paying stocks can be particularly attractive for investors seeking steady income.

2. Liquidity

US stocks are among the most liquid in the world. This means that you can easily buy and sell shares without significantly impacting the stock's price. This liquidity is a result of the vast number of investors and traders actively participating in the US stock market, providing a deep and liquid market for investors.

3. Market Capitalization

The market capitalization of a stock is its total value, calculated by multiplying the number of outstanding shares by the current share price. This figure is a critical measure of a company's size and market influence. Large-cap stocks are typically considered less risky than their smaller counterparts, while small-cap stocks offer the potential for higher growth but with increased risk.

4. Trading Hours

US stocks are traded during specific hours. The primary trading sessions for US stocks are from 9:30 AM to 4:00 PM Eastern Time. This schedule allows investors from around the world to participate in the market, making it accessible to a broad audience.

5. Reporting Requirements

US companies are subject to stringent reporting requirements, ensuring that investors have access to accurate and timely information. These requirements include quarterly and annual financial reports, which are submitted to the Securities and Exchange Commission (SEC). This transparency is a significant advantage for investors, allowing them to make informed decisions based on reliable data.

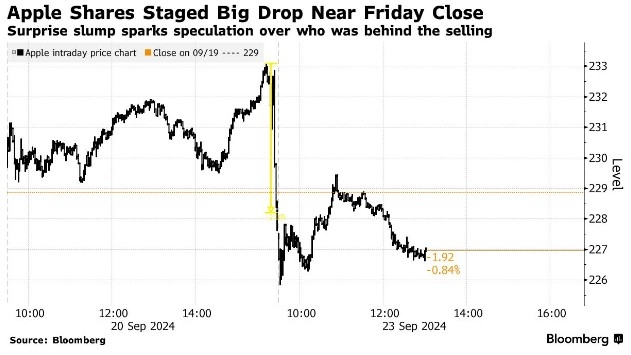

Case Study: Apple Inc.

To illustrate these features, let's consider the case of Apple Inc. (AAPL), one of the most valuable companies in the world.

- Dividends: Apple has a long history of paying dividends, offering investors a steady stream of income.

- Liquidity: With a market capitalization of over $2 trillion, Apple is one of the most actively traded stocks, providing ample liquidity.

- Market Capitalization: As a large-cap stock, Apple is considered a stable investment, with a well-established track record.

- Trading Hours: Investors can buy and sell Apple shares during the regular trading hours of the US stock market.

- Reporting Requirements: Apple adheres to stringent reporting requirements, providing investors with transparent and accurate financial information.

In conclusion, understanding the features of US stocks is essential for any investor. From dividends and liquidity to market capitalization and reporting requirements, these features can help you make informed decisions about your investments. Whether you're a beginner or an experienced investor, familiarizing yourself with these key aspects of the US stock market can set you on the path to successful investing.

so cool! ()

like

- US Cellular Stock ROM LG G4 BoyCracked: Unveiling the Power of Custom ROMs

- http://stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol knd

- Dow Jones Total Stock Market US Small Cap Value Index: A Comprehensive Guide

- Tax Implications for US Investors in Canadian Bank Stocks Dividends

- Title: 1917 US Rifle Stock 3-GMK Inspector: The Unsung Hero of Firearms Quality A

- Title: NSX National Stock Exchange US: Revolutionizing the Stock Market Landscape

- Understanding the US Steel Stock Future: A Comprehensive Guide

- Title: Stock Drop: A Major Concern for the US Economy

- Most Shorted Stocks in the US: A Deep Dive into the Market's Riskiest Invest

- Understanding the Relationship Between U.S. Fiscal Policy and the Stock Market

- Best Chinese Stocks Listed in the US: Your Guide to Top Investment Opportunities

- Analyst Upgrades US Stocks Premarket: A Promising Outlook for Investors

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Stock Features: What You Need to Know

US Stock Features: What You Need to Know

Understanding the US All Stock Index: A Compre

Dow Jones Total Stock Market US Small Cap Valu

Title: Discover the Real-Life Beauty of Lightw

2025 US Stock Market Holidays Schedule: A Comp

US Large Cap Stocks Momentum Analysis 2024

Trump Us Stocks: How the President's Poli

AMD US Stock Market: An In-Depth Analysis

Current US Stock Market Outlook: Navigating th

US Home Builder Stocks: A Guide to Investment

Earnings Calendar Next Week: US Stocks to Watc

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Stock Invest.us // UAB Exigam: The Ultimate Gu"

- Ossia Stock Symbol: US: A Comprehensive Guide"

- All Stock Exchanges in the US: A Comprehensive"

- SoftBank US Stock: A Comprehensive Guide to In"

- US Steel Stock: Why Robinhood Investors Should"

- Title: US Share of Global Stock Market Capital"

- US Global Jets ETF Stock Price: A Comprehensiv"

- Live Us Stocks: Your Ultimate Guide to Active "

- Top US Mid Cap Stocks: A Guide to Investment O"

- Dow Jones Total Stock Market US Small Cap Valu"