you position:Home > new york stock exchange > new york stock exchange

US Bank vs Wells Fargo Stock: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the world of finance, the competition between major banks is fierce. Two of the most prominent players in the banking sector are US Bank and Wells Fargo. This article aims to provide a comprehensive analysis of both banks, focusing on their stock performance, financial health, and future prospects. By comparing US Bank vs Wells Fargo stock, we can gain valuable insights into which bank may be a better investment choice.

Stock Performance

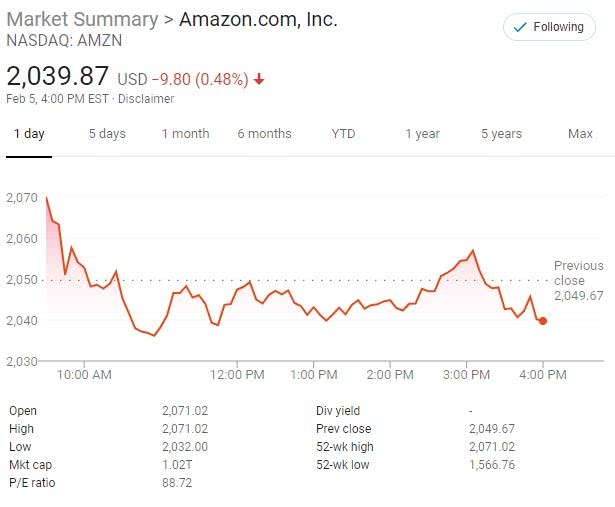

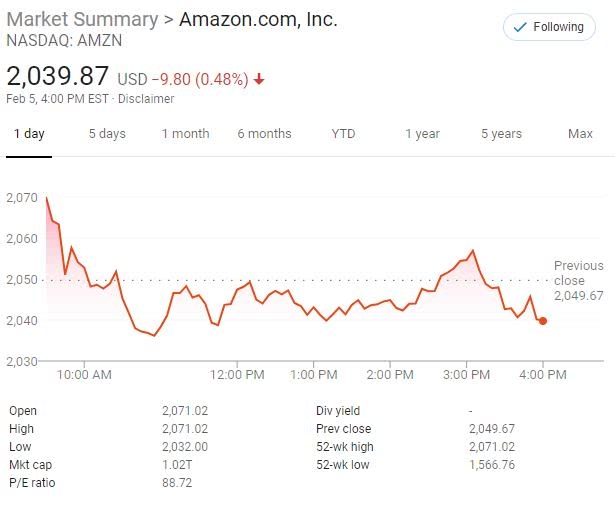

When comparing the stock performance of US Bank and Wells Fargo, it's important to consider their historical data and recent trends. Over the past few years, both banks have experienced fluctuations in their stock prices, but which one has performed better?

US Bank has shown consistent growth in its stock price. According to data from Yahoo Finance, the stock has seen a steady increase since 2015. This upward trend can be attributed to the bank's strong financial performance and its ability to adapt to changing market conditions.

Wells Fargo, on the other hand, has had a more volatile stock performance. The bank has faced numerous challenges, including a series of scandals and legal issues that have impacted its reputation and financial health. As a result, the stock has experienced significant fluctuations over the past few years.

Financial Health

Another critical factor to consider when comparing US Bank and Wells Fargo is their financial health. Both banks have strong balance sheets, but which one is in better shape?

US Bank has consistently maintained a strong capital ratio, which measures the bank's ability to absorb losses. According to the FDIC, the bank's capital ratio stood at 14.2% as of the second quarter of 2021. This indicates that US Bank is well-positioned to handle potential financial challenges.

Wells Fargo has faced financial challenges, including a decline in its capital ratio. The bank's capital ratio stood at 10.7% as of the second quarter of 2021, which is lower than US Bank's ratio. However, Wells Fargo has made strides to improve its financial health, including reducing its risk-weighted assets and settling legal issues.

Future Prospects

When considering future prospects, it's essential to analyze the strategic direction and growth initiatives of both banks.

US Bank has been focusing on expanding its retail banking and wealth management businesses. The bank has also been investing in technology to improve customer experience and streamline operations. These efforts could lead to further growth in the future.

Wells Fargo has been working to rebuild its reputation and improve its customer service. The bank has launched a series of initiatives, including the "Wells Fargo Promise," which aims to rebuild trust with customers. While these efforts are promising, it will take time for the bank to fully recover from its past issues.

Conclusion

When comparing US Bank vs Wells Fargo stock, it appears that US Bank may be the better investment choice. The bank has shown consistent growth in its stock price, maintains a strong financial health, and has a solid strategic direction for the future. However, it's important to conduct thorough research and consider your own investment goals and risk tolerance before making a decision.

Case Study: US Bank

One example of US Bank's success is its expansion into the commercial banking sector. The bank has been able to attract a significant number of corporate clients, which has contributed to its revenue growth. This expansion highlights US Bank's ability to adapt to market needs and seize opportunities for growth.

Case Study: Wells Fargo

Despite its challenges, Wells Fargo has made progress in improving its financial health. One notable example is the bank's efforts to reduce its risk-weighted assets. By doing so, Wells Fargo has lowered its exposure to potential losses, which could help the bank achieve more stable financial performance in the future.

In conclusion, the comparison between US Bank and Wells Fargo stock reveals that US Bank may be the more attractive investment option. However, it's important to conduct thorough research and consider your own investment goals before making a decision.

so cool! ()

last:US Stock Futures: Navigating Muted Rate Uncertainty

next:nothing

like

- US Stock Futures: Navigating Muted Rate Uncertainty

- Stock R Us Cebu: Your Ultimate Destination for Stock Market Education

- Momentum Stocks: US Large Cap 5-Day Performance Analysis

- Title: Top US Cannabis Stocks 2020: A Guide to the Leading Investments

- Understanding the Role of a US Nonresident Stockholder

- Bump Stock Ban: A Federal Decision That Shaped Gun Safety in the US

- Daqin Railway Stock: A Deep Dive into the Chinese Railway Sector's US Presen

- Title: US Border Pot Stocks: The Growing Industry at the Crossroads

- Top US Pot Stocks to Buy: Your Guide to Investing in the Cannabis Industry

- Nonresident Alien US Stock Capital Gains Tax: Understanding the Implications

- Bny Mellon US Stock Index III Fund: A Comprehensive Guide to Investment Opportuni

- Tech Stocks: US Indexes Lower Amid Market Volatility

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- Highest Yielding US Stocks: Your Guide to Top "

recommend

US Bank vs Wells Fargo Stock: A Comprehensive

US Bank vs Wells Fargo Stock: A Comprehensive

Title: EU vs US Stock Market: A Comprehensive

Stock Market Cap to GDP: An Insight into the U

Stock Trading in the US: A Comprehensive Guide

Average Annual Return US Stock Market Last 20

What Time Does the US Stock Market Open?

US Large Cap Stocks: Highest Gains Past Week M

The Last of Us 2 Out of Stock: A Comprehensive

10 US Stocks to Buy for Long-Term Investment

Latest US Stock Market News August 2025: A Com

How to Invest in US Stocks from Europe

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Latest US Stock Market News August 2025: A Com"

- Title: Current Outlook: US Stock Market Outloo"

- How to Buy US Stocks in the UAE: A Comprehensi"

- US Stem Cell, Inc. Stock Price: A Comprehensiv"

- Title: Size of the US Stock Market in 2018: A "

- Is the US Stock Market Open? Understanding Mar"

- Title: "US Education Stock: A Compreh"

- How Much Is Baba Stock in US Dollars?"

- US Stock Futures: Navigating Muted Rate Uncert"

- Title: Top US Cannabis Stocks 2020: A Guide to"