you position:Home > new york stock exchange > new york stock exchange

Understanding the US Steel Stock Future: A Comprehensive Guide

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In today's dynamic market, investing in the stock of US Steel Corporation (NYSE: X) can be a lucrative opportunity. However, understanding the future of the steel industry and how it might impact the stock's performance is crucial. This article delves into the factors influencing the US Steel stock future, providing investors with valuable insights.

1. The Current State of the Steel Industry

The steel industry has faced several challenges over the past few years, including global oversupply, trade tensions, and environmental regulations. Despite these challenges, the industry has shown resilience, with some segments experiencing growth. To understand the future of US Steel, it's essential to consider the current state of the steel industry.

2. Factors Influencing the US Steel Stock Future

a. Global Demand

Global demand for steel remains robust, with emerging markets like China and India driving the demand. The US Steel Corporation has a significant presence in these markets, which can be a positive factor for its stock. However, any downturn in demand could negatively impact the stock.

b. Trade Policies

Trade policies, particularly those related to steel imports, play a crucial role in the industry's future. The Trump administration's tariffs on steel imports have helped boost domestic production, but these policies remain a point of contention. Any changes in trade policies could impact the US Steel stock significantly.

c. Environmental Regulations

Environmental regulations have become increasingly stringent, forcing steel producers to invest in cleaner technologies. US Steel Corporation has made significant strides in this area, which can be a positive factor for the stock. However, compliance with these regulations remains a challenge and can impact the company's profitability.

3. US Steel Corporation's Strategy

To navigate the challenges of the steel industry, US Steel Corporation has adopted a strategic approach. The company focuses on improving operational efficiency, investing in new technologies, and diversifying its product portfolio. These strategies can help the company remain competitive and potentially drive stock price growth.

4. Key Metrics to Watch

When evaluating the future of US Steel, investors should pay close attention to key metrics such as revenue, earnings, and dividend yield. A strong financial performance can indicate a positive outlook for the stock.

5. Case Study: Nucor Corporation

To provide a broader perspective, let's consider Nucor Corporation (NYSE: NUE), a leading competitor in the steel industry. Nucor has been successful in adapting to the changing market conditions, focusing on innovation and operational efficiency. Its stock has shown strong performance over the years, offering valuable insights into the potential future of US Steel.

6. Conclusion

Investing in US Steel Corporation stock requires a thorough understanding of the industry's future. By considering factors like global demand, trade policies, and environmental regulations, investors can make informed decisions. While the stock presents potential risks, the right strategy and a positive outlook can lead to significant returns.

In conclusion, the future of US Steel stock hinges on various factors, including global demand, trade policies, and the company's strategic approach. By staying informed and analyzing key metrics, investors can make well-informed decisions and potentially benefit from the company's growth prospects.

so cool! ()

last:Title: Stock Drop: A Major Concern for the US Economy

next:nothing

like

- Title: Stock Drop: A Major Concern for the US Economy

- Most Shorted Stocks in the US: A Deep Dive into the Market's Riskiest Invest

- Understanding the Relationship Between U.S. Fiscal Policy and the Stock Market

- Best Chinese Stocks Listed in the US: Your Guide to Top Investment Opportunities

- Analyst Upgrades US Stocks Premarket: A Promising Outlook for Investors

- US Lumber Companies Stock: A Comprehensive Analysis

- Nestle US Stock Symbol: A Comprehensive Guide

- Title: Historical US Stock Market Performance Six Months Before Presidential Elec

- Stock Options: IFRS vs. US GAAP

- High Dividend US Stocks 2016: Top Investments for Income Seekers

- US Stem Cell Clinic Stock: A Game-Changer in Regenerative Medicine

- How Much Is the US Stock Market Down?

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

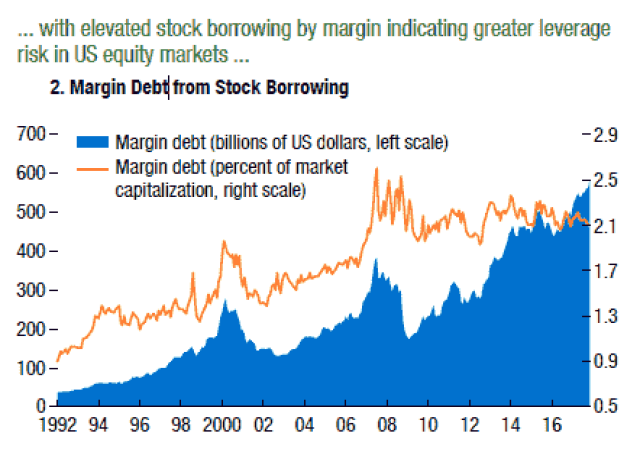

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding the US Steel Stock Future: A Com

Understanding the US Steel Stock Future: A Com

US Stock Market Basics: A Comprehensive Guide

Title: "US Stock Exchange Open UK Tim

Title: Toys "R" Us Stock Che

Title: If US Legalized Marijuana Stocks to Inv

First 24-Hour US Stock Exchange Approved: Revo

Best US Weed Stocks 2019: Top Investments in t

Kirkland Signature Chicken and Rice Cat Food 2

Taiwan Stock in US: A Comprehensive Guide for

US PE Ratio to Determine Undervalued Stock: A

Unlocking the Secrets of US Liquor Stock: A Co

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- 3D Oil Ltd: Your Ultimate Guide to Understandi"

- Best Medical Marijuana Stocks in the US"

- All Canadian and US Cannabis Stocks: A Compreh"

- US Electronic Stock Market Crossword"

- US Stock Market All-Time Graph: A Comprehensiv"

- Top US Penny Stocks to Buy Now: Your Guide to "

- Understanding the US Cobalt Stock Price: Trend"

- Momentum Stocks: US Large Cap 5-Day Performanc"

- Title: Geometric Average Return of US Stock Ma"

- Best Stocks to Buy Today: US Markets Analysis"