you position:Home > new york stock exchange > new york stock exchange

US Stock Market Agenda: Navigating the Investment Landscape

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the dynamic world of finance, staying informed about the US stock market agenda is crucial for any investor. Whether you're a seasoned trader or a beginner looking to dip your toes into the market, understanding the key events and trends is essential. This article will delve into the agenda that shapes the US stock market, offering insights and strategies for navigating this complex landscape.

Understanding the US Stock Market Agenda

The US stock market agenda is shaped by a variety of factors, including economic reports, corporate earnings, geopolitical events, and market sentiment. By keeping an eye on these key elements, investors can better anticipate market movements and make informed decisions.

1. Economic Reports

Economic reports are a cornerstone of the US stock market agenda. Key reports include the jobs report, inflation data, GDP growth, and consumer spending. These reports provide a snapshot of the economic health of the nation and can significantly impact market sentiment.

a. Jobs Report

The jobs report, released monthly, is one of the most closely watched economic indicators. It provides data on the number of jobs created, the unemployment rate, and wage growth. A strong jobs report can indicate a healthy economy and potentially boost stock prices, while a weak report can lead to market uncertainty.

b. Inflation Data

Inflation data, including the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), is crucial for understanding the purchasing power of consumers and the potential impact on interest rates. High inflation can erode profits and lead to lower stock prices, while low inflation can indicate economic growth and potentially support stock prices.

c. GDP Growth

Gross Domestic Product (GDP) growth measures the total value of goods and services produced within a country over a specific period. Strong GDP growth can signal economic prosperity and lead to higher stock prices, while weak growth can raise concerns about the economy's health.

d. Consumer Spending

Consumer spending is a significant driver of economic growth. Reports on retail sales, consumer confidence, and personal income can provide insights into consumer behavior and spending patterns, which in turn can influence market sentiment.

2. Corporate Earnings

Corporate earnings reports are another key component of the US stock market agenda. Companies release their earnings reports quarterly, providing information on their financial performance, revenue, and profit margins. Strong earnings reports can boost stock prices, while weak reports can lead to sell-offs.

3. Geopolitical Events

Geopolitical events, such as elections, trade wars, and geopolitical tensions, can have a significant impact on the US stock market agenda. These events can create uncertainty and volatility, leading to market fluctuations.

4. Market Sentiment

Market sentiment refers to the overall mood or attitude of investors towards the market. Sentiment can be influenced by a variety of factors, including economic reports, corporate earnings, and geopolitical events. Understanding market sentiment can help investors anticipate market movements and make informed decisions.

Navigating the US Stock Market Agenda

To navigate the US stock market agenda, investors should:

- Stay informed about economic reports, corporate earnings, and geopolitical events.

- Monitor market sentiment and adjust their investment strategies accordingly.

- Consider diversifying their portfolio to mitigate risk.

Case Study: The Impact of the 2020 Election on the Stock Market

The 2020 US presidential election was a significant event in the stock market agenda. The uncertainty surrounding the election led to increased volatility in the market. However, as the election results became clearer, the market began to stabilize. This case study illustrates the importance of staying informed about geopolitical events and understanding their potential impact on the market.

In conclusion, the US stock market agenda is a complex and dynamic landscape. By understanding the key factors that shape the market, investors can better navigate this landscape and make informed decisions. Whether you're a beginner or a seasoned investor, staying informed and adapting to market conditions is crucial for success.

so cool! ()

last:US Stock Market August 26, 2025 Summary

next:nothing

like

- US Stock Market August 26, 2025 Summary

- US Stock Features: What You Need to Know

- US Cellular Stock ROM LG G4 BoyCracked: Unveiling the Power of Custom ROMs

- http://stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol knd

- Dow Jones Total Stock Market US Small Cap Value Index: A Comprehensive Guide

- Tax Implications for US Investors in Canadian Bank Stocks Dividends

- Title: 1917 US Rifle Stock 3-GMK Inspector: The Unsung Hero of Firearms Quality A

- Title: NSX National Stock Exchange US: Revolutionizing the Stock Market Landscape

- Understanding the US Steel Stock Future: A Comprehensive Guide

- Title: Stock Drop: A Major Concern for the US Economy

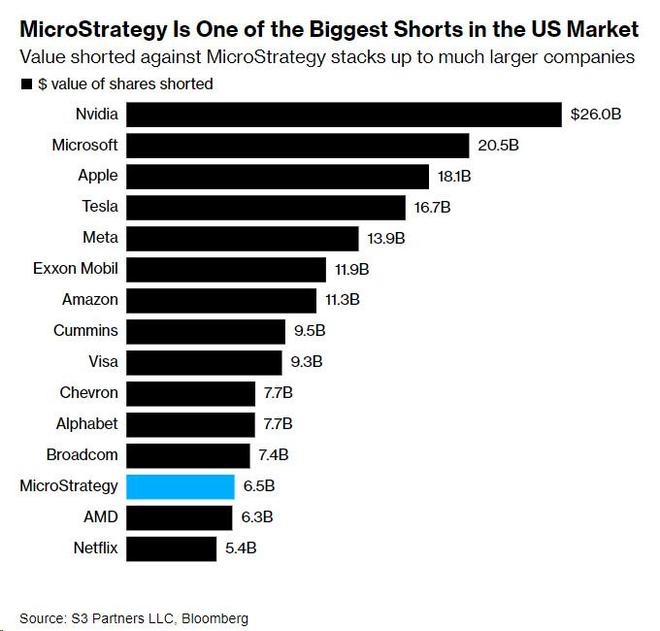

- Most Shorted Stocks in the US: A Deep Dive into the Market's Riskiest Invest

- Understanding the Relationship Between U.S. Fiscal Policy and the Stock Market

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Stock Market Agenda: Navigating the Investm

US Stock Market Agenda: Navigating the Investm

3D Oil Ltd: Your Ultimate Guide to Understandi

Halifax Stocks and Shares ISA Contact Us: Your

Bloomberg Stocks US: A Comprehensive Guide to

Understanding US Large Cap Stocks Sector Class

Stock Trading in the US: A Comprehensive Guide

Housing Stock Market News US: A Comprehensive

Understanding the Implications of US Stock Deb

Number of Listed Stocks in the US 2017: A Deep

Invest in Us Stock Market vs. India: A Compara

Is the US Stock Market Closing Early Today? Ev

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Understanding US Energy Stocks ETF: A Comprehe"

- Title: Top Rare Earth Stocks US: Unveiling the"

- US Stock Market Basics: A Comprehensive Guide "

- Title: Leverage Stock US: A Strategic Guide to"

- Tesla Stock: A Comprehensive Analysis in US Do"

- http stocks.us.reuters.com stocks fulldescript"

- China's Alleged Sixth-Generation Fighter "

- Best Medical Marijuana Stocks in the US"

- Title: Toys "R" Us Stock Che"

- Title: History of US vs. International Stock R"