you position:Home > new york stock exchange > new york stock exchange

Sibanye Stillwater Stock US: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving world of mining and precious metals, Sibanye Stillwater (NYSE: SSW) has emerged as a key player. This article delves into the details of Sibanye Stillwater stock, providing investors with a comprehensive analysis to help them make informed decisions.

Understanding Sibanye Stillwater

Sibanye Stillwater is a global mining company with a diverse portfolio of assets. The company is primarily focused on mining and refining gold, platinum group metals (PGMs), and palladium. With operations spanning across South Africa, the United States, and Australia, Sibanye Stillwater has a strong presence in key mining regions.

Stock Performance

In recent years, Sibanye Stillwater stock has experienced significant volatility. However, the company's strong fundamentals and strategic initiatives have led to a steady recovery. As of the latest data, Sibanye Stillwater stock has seen a notable increase in value, reflecting the company's commitment to growth and profitability.

Key Factors Influencing Stock Performance

Several factors have influenced the performance of Sibanye Stillwater stock. Here are some of the key factors to consider:

- Gold and PGM Prices: The price of gold and PGMs plays a crucial role in determining the company's profitability. As these prices rise, Sibanye Stillwater's revenue and earnings tend to increase.

- Operational Efficiency: Sibanye Stillwater has made significant strides in improving operational efficiency. The company's focus on cost reduction and productivity enhancements has led to improved margins and profitability.

- Strategic Initiatives: The company has implemented several strategic initiatives aimed at diversifying its revenue streams and enhancing shareholder value. These include the expansion of its PGM operations and the development of new projects.

- Market Conditions: Global economic conditions and mining industry trends also impact Sibanye Stillwater stock. Factors such as geopolitical events, currency fluctuations, and regulatory changes can influence the company's performance.

Case Study: Sibanye Stillwater's PGM Expansion

One notable example of Sibanye Stillwater's strategic initiatives is the expansion of its PGM operations. The company has made significant investments in its PGM assets, aiming to increase production and capture a larger share of the market. This expansion has been well-received by investors, leading to a positive impact on the company's stock performance.

Conclusion

Sibanye Stillwater stock (NYSE: SSW) presents a compelling investment opportunity for those interested in the mining and precious metals sector. With a strong focus on operational efficiency, strategic initiatives, and a diverse portfolio of assets, Sibanye Stillwater is well-positioned for future growth. As investors consider adding Sibanye Stillwater to their portfolios, it is important to stay informed about the key factors influencing the company's stock performance.

so cool! ()

like

- US ICBM Stock: A Comprehensive Guide to Investing in Intercontinental Ballistic M

- Title: 2018 US Stock Market Holidays: A Comprehensive Guide

- The First Stock Market in the US: A Pivotal Milestone in Financial History

- How to Invest in the US Stock Market: A Comprehensive Guide

- Title: Understanding the US Small Company Stock Index

- Title: Leverage Stock US: A Strategic Guide to Maximizing Your Investment Potenti

- Daily US Stock Market News Updates: September 2025

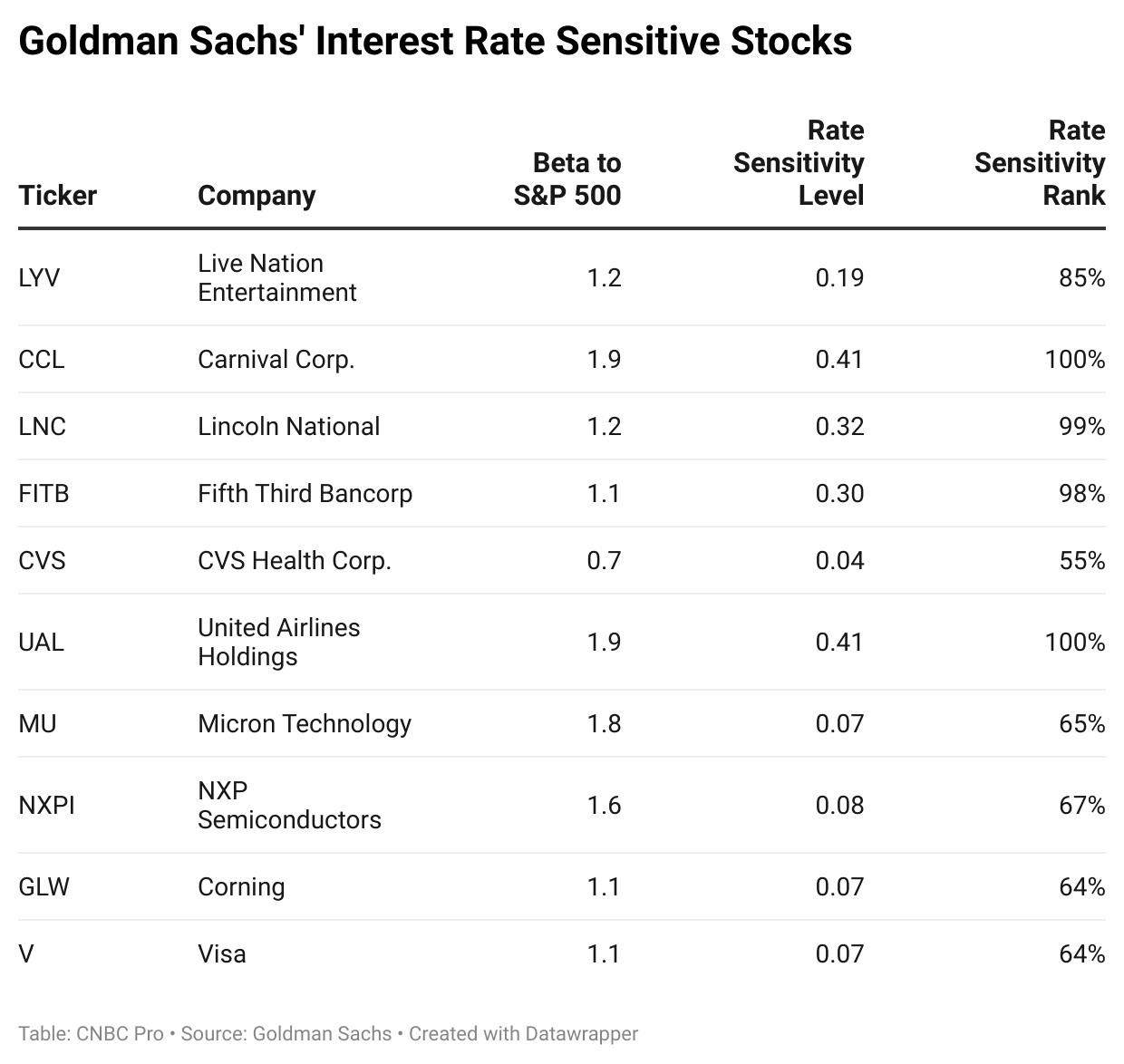

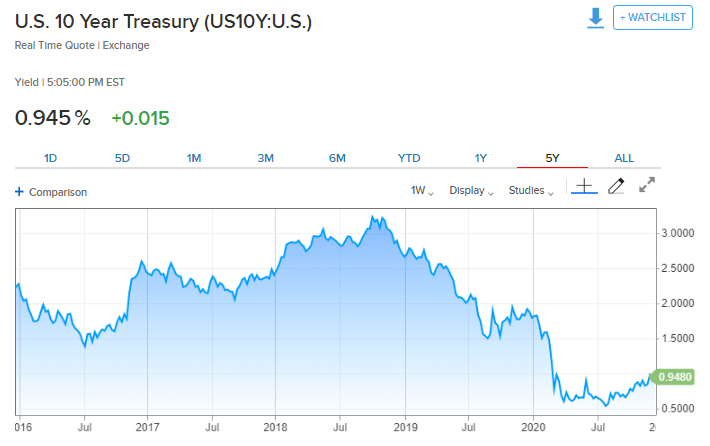

- US Interest Rate vs Stock Market: Understanding the Dynamics

- Understanding the US Cobalt Stock Price: Trends, Factors, and Insights

- Stocks by Volume Traded in US Market Beat

- Title: AMD Stock: A Closer Look at Its Value in US Dollars

- Toys "R" Us Daytime Stock Associate: A Rewarding Career in Reta

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

Sibanye Stillwater Stock US: A Comprehensive A

Sibanye Stillwater Stock US: A Comprehensive A

Best Medical Marijuana Stocks in the US

US Air Force Spouse Stock Photos: Capturing th

How Much Is Baba Stock in US Dollars?

Canadian Investing in the US Stock Market: A G

Title: Understanding the US Small Company Stoc

Airbnb Stock Price: A Comprehensive Analysis

Joint Stock Company Definition: A Deep Dive in

How Many Stocks Are on the US Stock Market?

Title: 2018 US Stock Market Holidays: A Compre

Stock Trading in the US: A Comprehensive Guide

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Cognizant Indian and US Stock: A Compre"

- US MSO Cannabis Stocks: The Future of Legal Ca"

- US Real Estate Stocks: A Comprehensive Guide t"

- Institutional Investors Net Sellers of US Stoc"

- Title: Leverage Stock US: A Strategic Guide to"

- US China Trade Talks Impact on Stock Market: A"

- Dyson Stock Price US: A Comprehensive Analysis"

- CATL Stock US: Understanding the Market Dynami"

- Title: Understanding the US Small Company Stoc"

- The Resilience and Growth of the US Stock Mark"