you position:Home > us stock market today > us stock market today

US History: The Stock Market Crash of 1929

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The stock market crash of 1929, also known as the Great Crash, is one of the most significant events in American financial history. This event marked the beginning of the Great Depression, which would have a profound impact on the United States and the world for years to come. In this article, we delve into the causes, effects, and aftermath of the 1929 stock market crash.

Causes of the 1929 Stock Market Crash

The 1929 stock market crash was the result of a perfect storm of factors. Economic boom during the 1920s led to a speculative frenzy, as investors bought stocks on margin, meaning they borrowed money to purchase stocks. This excessive speculation, combined with overvalued stocks and overconfidence, created an unstable market.

Another contributing factor was the tightening of monetary policy by the Federal Reserve. In an effort to curb inflation, the Fed raised interest rates, making it more expensive for businesses and consumers to borrow money. This, in turn, led to a decrease in consumer spending and investment, further destabilizing the economy.

Effects of the 1929 Stock Market Crash

The 1929 stock market crash had devastating effects on the American economy. The crash led to a sharp decline in stock prices, which wiped out the savings of many investors. This, in turn, led to a decrease in consumer spending and a reduction in business investment.

The crash also led to a massive increase in unemployment. As businesses cut costs, they laid off workers, leading to a rise in unemployment rates that would peak at over 25% during the Great Depression. The economic hardship caused by the crash also led to a rise in social tensions and political unrest.

Aftermath of the 1929 Stock Market Crash

The 1929 stock market crash and the subsequent Great Depression led to significant changes in American financial policy. The government implemented various measures to stabilize the economy, including the Glass-Steagall Act and the Federal Deposit Insurance Corporation (FDIC).

The crash also prompted a reassessment of the role of government in the economy. The New Deal, a series of programs and reforms introduced by President Franklin D. Roosevelt, aimed to restore economic stability and provide relief to those affected by the Great Depression.

Case Studies: The 1929 Stock Market Crash

One of the most famous examples of the 1929 stock market crash is the collapse of the brokerage firm Kuhn, Loeb & Co.. The firm, which was considered one of the most reputable in the country, was forced to liquidate its assets after its clients lost confidence in the market.

Another notable example is the fall of the United States Steel Corporation. The company, which was once the largest in the world, saw its stock price plummet from

The 1929 stock market crash and the Great Depression were a defining moment in American history. This event not only reshaped the financial landscape but also had a lasting impact on the social and political fabric of the nation. Understanding the causes and effects of the crash is crucial for comprehending the economic and social changes that have shaped the United States in the 20th and 21st centuries.

so cool! ()

last:Spy Us Stock Quote: Your Ultimate Guide to Stock Market Insights

next:nothing

like

- Spy Us Stock Quote: Your Ultimate Guide to Stock Market Insights

- Best US Stock to Buy in 2023: A Strategic Investment Guide

- Toys "R" Us Overnight Stocker Job Description: A Rewarding Oppo

- GSX US Stock: A Comprehensive Guide to Understanding and Investing in U.S. Stocks

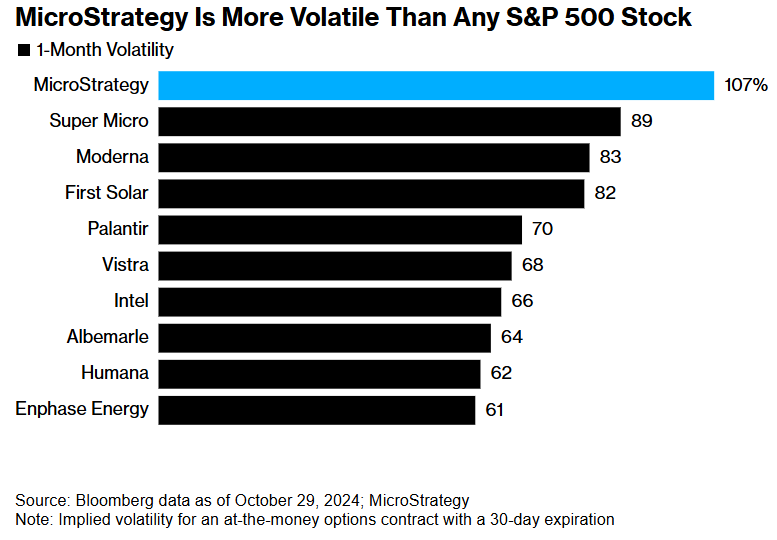

- Most Volatile US Stocks in 2022: A Deep Dive

- Radar US Stock Price: Insights and Analysis for Investors

- March 2022 IPOs: A Deep Dive into the US Stock Market

- US Long-Term Stocks to Invest: Apple – A Smart Choice for the Future

- Nike Stock US: What You Need to Know About the Iconic Brand’s Market Performanc

- US Stock Bubble 2017: A Detailed Analysis

- US Steel X 2008 Stock Price: A Comprehensive Analysis

- Am US Stock: Understanding the Basics and Benefits of Investing in American Stock

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

US History: The Stock Market Crash of 1929

US History: The Stock Market Crash of 1929

Nintendo Stock Symbol: US

US Steel X 2008 Stock Price: A Comprehensive A

Reuters US Stock News: Stay Ahead of the Curve

Indian ADRs in the US Stock Market: A Comprehe

Title: "http stocks.us.reuters.com st

Drone Delivery: The Future of US Stock Market

NVIDIA Stock Price in the US Market on May 23,

How Did the US Stock Market Crash Affect Germa

Can I Buy Aston Martin Stock on the US Stock E

Title: Best Indian Stocks Listed in US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How CPI Affects the U.S. Stock Market"

- US Marijuana Stocks on TSX: A Comprehensive Gu"

- Best US Pot Stocks for 2021: Top Picks for Inv"

- International vs US Stocks: A Comparative Anal"

- Barclays Strategists Believe US Stocks Are Ove"

- Title: US Stock Market Performance on May 9, 2"

- US Stock Futures Rise; NASDAQ Hits Record High"

- After Hours: Most Active Stocks Today in the U"

- Title: US Oil Stock Ticker: A Comprehensive Gu"

- US Machine Gun Folding Stock Adapter: The Ulti"