you position:Home > us stock market today > us stock market today

International vs US Stocks: A Comparative Analysis of 2019

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the world of investing, deciding between international stocks and US stocks can be a daunting task. The year 2019 provided some significant insights into the differences and similarities between these two investment options. This article delves into a comparative analysis of international and US stocks in 2019, highlighting key trends, performance metrics, and investment strategies.

Market Dynamics in 2019

International Stocks

The year 2019 was marked by several global events, including trade tensions and geopolitical uncertainties. However, despite these challenges, international stocks generally outperformed US stocks. Emerging markets, in particular, showcased robust growth, driven by favorable economic conditions and favorable currency movements.

One of the key drivers of this trend was the increase in international trade and the subsequent growth of global supply chains. As companies expanded their operations globally, they required more capital and investment, leading to increased demand for international stocks.

US Stocks

On the other hand, the US stock market faced some headwinds in 2019. While the S&P 500 index recorded positive returns, it was unable to match the performance of international stocks. This underperformance can be attributed to several factors, including rising interest rates, trade tensions, and political uncertainties.

Despite these challenges, US stocks remained attractive due to their strong economic fundamentals and robust corporate earnings. Many investors continued to prefer US stocks for their stability and diversification benefits.

Performance Metrics

International Stocks

In terms of performance metrics, international stocks outshone US stocks in 2019. The MSCI All Country World ex USA index, which tracks the performance of stocks from developed and emerging markets outside the United States, recorded a return of 24.9%. This was significantly higher than the S&P 500's return of 29.6%.

US Stocks

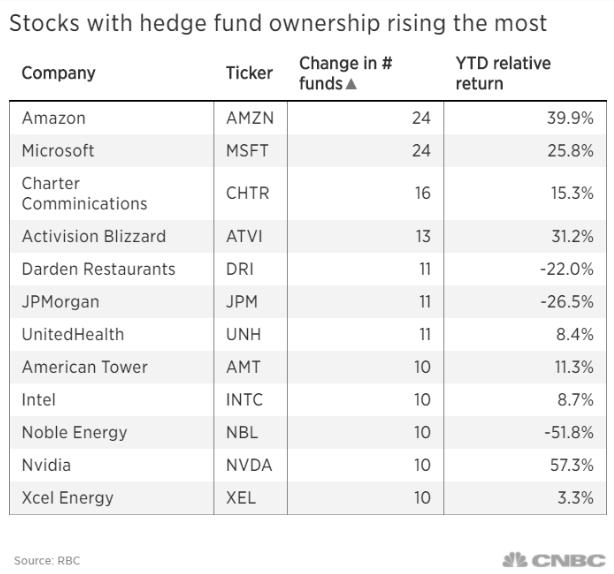

While the US stock market lagged behind international stocks in terms of overall performance, some sectors and individual stocks outperformed. The technology sector, for example, witnessed substantial growth, driven by companies like Apple, Amazon, and Microsoft.

Investment Strategies

When it comes to investment strategies, diversifying between international and US stocks can be a smart move. For investors looking for high-growth opportunities, investing in international stocks might be the way to go. Conversely, investors seeking stability and diversification might prefer US stocks.

One effective strategy in 2019 was to invest in a mix of international and US stocks, focusing on companies with strong fundamentals and growth potential. This approach helped investors capitalize on the strengths of both markets while mitigating the risks associated with any single market.

Case Studies

To illustrate the potential benefits of investing in both international and US stocks, let's consider a hypothetical case:

Investor A

Investor A decided to allocate 60% of their portfolio to international stocks and 40% to US stocks. By the end of 2019, this diversified approach yielded a return of 21.8%, which was slightly higher than the return from investing solely in international stocks.

Investor B

On the other hand, Investor B chose to invest 100% of their portfolio in US stocks. Despite the strong performance of the S&P 500 index, this strategy yielded a return of only 13.4%, which was significantly lower than the return from investing in international stocks.

In conclusion, the 2019 data suggests that international stocks outperformed US stocks in terms of overall performance. However, diversifying between the two markets can provide investors with the stability and growth potential they need to achieve their investment goals. As always, it is essential to conduct thorough research and consider individual investment preferences when making investment decisions.

so cool! ()

like

- US Stock Market Astrology Predictions for 2022: A Guide to the Stars and Stock Tr

- Ubiquiti AI Key Stock Status: Unveiling the US Store's Potential

- Title: Canada-US Stock Tax: Understanding the Implications and Strategies

- Title: US Army Prepositioning Stock: The Strategic Edge in Global Operations

- Title: Data of Margin Trading and Short Selling in the US Stock Market

- US Copper Stocks to Buy: A Comprehensive Guide for Investors

- US Marijuana Stocks on TSX: A Comprehensive Guide to Investing in Canada's P

- US Machine Gun Pap Stock: A Comprehensive Guide

- US Mining Companies Stocks: A Comprehensive Guide to Investment Opportunities

- Musks Stock Option Tweet May Invite Us Labor Board Complaint

- US China Trade Stock Market: A Comprehensive Analysis

- Top US Aluminum Stocks: A Comprehensive Guide to Investment Opportunities

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Toys "R" Us Items Located in"

- How to Trade Nintendo Stock in the US"

recommend

International vs US Stocks: A Comparative Anal

International vs US Stocks: A Comparative Anal

US China Trade Stock Market: A Comprehensive A

Highest Return Stocks in the US: Unveiling the

Nintendo US Stock Quote: A Comprehensive Guide

How to Buy MediaTek Stock in the US

Manipulate the US Stock Market: Understanding

Auro Canibui US Stock Quote: Unveiling the Inv

Primers in Stock: Your Ultimate Guide to High-

PDD US Stock Price: A Comprehensive Analysis

Drone Delivery: The Future of US Stock Market

When Does the US Stock Market Open?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Musks Stock Option Tweet May Invite Us Labor B"

- Title: US Mexico Tariff Stock Market: Understa"

- Most Expensive US Stocks: A Closer Look at the"

- Aluminum Stock US: A Comprehensive Guide to th"

- Stock Split Announced in US: What You Need to "

- Canadian Cannabis Traded in US Stock Market: A"

- Safest US Stocks: How to Invest Wisely in the "

- US Stock Futures Halted: What You Need to Know"

- Jet's US Stock: Unveiling the Investment "

- Auro Canibui US Stock Quote: Unveiling the Inv"