you position:Home > us stock market today > us stock market today

Barclays Strategists Believe US Stocks Are Overpriced vs. Europe

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving world of finance, it's crucial to stay informed about market trends and expert opinions. One such trend that has recently gained attention is the belief held by Barclays strategists that US stocks are overpriced compared to their European counterparts. This article delves into the reasons behind this viewpoint and explores the potential implications for investors.

Understanding the Overvaluation Concern

Barclays strategists argue that the US stock market is currently overvalued when compared to European markets. This assessment is based on several key factors, including valuation metrics, economic conditions, and market trends.

Valuation Metrics

One of the primary reasons for the overvaluation concern is the current valuation metrics of US stocks. The Shiller P/E ratio, also known as the cyclically adjusted price-to-earnings ratio, is a popular metric used to assess the overall valuation of the stock market. According to this ratio, US stocks are currently trading at levels that are higher than their historical averages, suggesting that they may be overvalued.

Economic Conditions

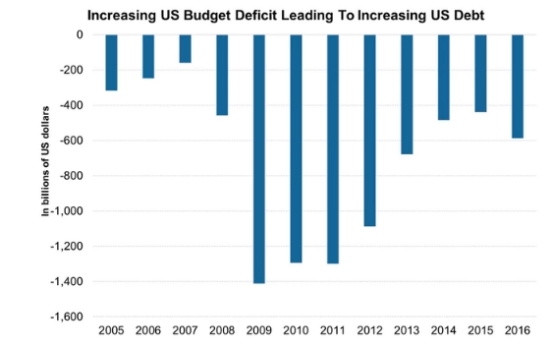

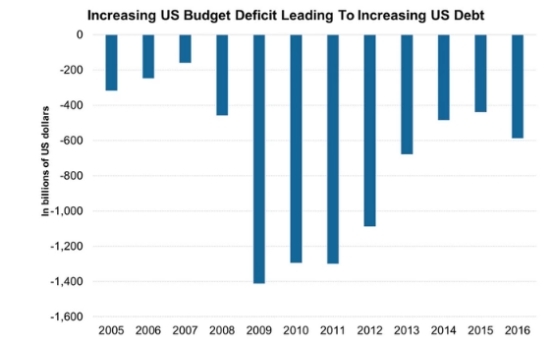

Another factor contributing to the overvaluation concern is the economic conditions in the US. While the US economy has been performing relatively well, there are signs of slowing growth and increasing inflation. These conditions may lead to a decrease in corporate earnings, which could negatively impact stock prices.

Market Trends

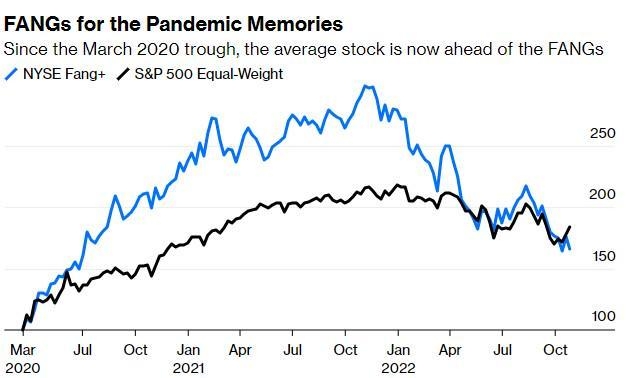

Market trends also play a significant role in the overvaluation concern. For instance, the tech sector, which has been a major driver of the US stock market's growth, has recently experienced some volatility. This volatility, coupled with the high valuations of some tech stocks, raises concerns about the overall stability of the US stock market.

Comparing US and European Markets

In contrast to the US stock market, European markets are seen as more attractively valued. This is due to several factors, including lower valuation metrics, stronger economic growth in some European countries, and a more diversified market structure.

Implications for Investors

For investors, the belief that US stocks are overpriced compared to European stocks presents both opportunities and risks. On one hand, investors may find more attractive investment opportunities in European markets. On the other hand, they may need to be cautious about the potential risks associated with investing in European stocks, such as political and economic uncertainties.

Case Studies

To illustrate the potential differences between US and European markets, let's consider a few case studies. For instance, the tech sector in the US has been dominated by a few large companies, such as Apple and Microsoft. In contrast, the tech sector in Europe is more diversified, with several promising companies, such as ASML and Infineon Technologies.

Similarly, the energy sector in Europe has been experiencing significant growth, driven by the region's increasing focus on renewable energy. This growth presents attractive investment opportunities for investors looking to invest in the energy sector.

Conclusion

In conclusion, the belief held by Barclays strategists that US stocks are overpriced compared to European stocks is based on several key factors, including valuation metrics, economic conditions, and market trends. While this viewpoint presents both opportunities and risks for investors, it's crucial to conduct thorough research and consider individual investment goals and risk tolerance before making any investment decisions.

so cool! ()

like

- Airbnb US Stock: A Comprehensive Guide to the Home Sharing Giant's Market Pe

- Ericsson Stock 1 yr Forecast: US Dollar Outlook

- Download All Stocks in the US Constituent List Datastream: A Comprehensive Guide

- Stock Invest: Understanding WTW in the US Market

- Title: Stockings from US Organization: A Comprehensive Guide

- http://stocks.us.reuters.com/stocks/fulldescription.asp?rpc=66&symbol=ast

- FCX US Stock Quote: A Comprehensive Guide to Understanding and Analyzing

- US Large Cap Stocks Momentum: Top Performers in October 2025

- Chart Us Index: Understanding the Stock Market

- Can I Trade US Stock in Australia? A Comprehensive Guide

- Understanding the US Stock Exchange Market Structure

- US Healthcare Stocks 2018: A Comprehensive Analysis

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Barclays Strategists Believe US Stocks Are Ove

Barclays Strategists Believe US Stocks Are Ove

Buy Toys "R" Us Stock: A Str

US Stock Data: A Comprehensive Guide to Unders

US Interest Rate Cut Effect on Japanese Stocks

US Large Cap Momentum Stocks: Best Performers

Toy R Us Stock Price: A Comprehensive Analysis

Shipping Company Stocks: A Comprehensive Guide

Trading US Stock Options in Singapore: A Compr

Ubiquiti AI Key Stock Status: Unveiling the US

Pyrogenesis Stock US: A Deep Dive into Investm

Soybean US Stock Price: Key Factors Influencin

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Musks Stock Option Tweet May Invite Us Labor B"

- Current US Stock Market Trends July 2025"

- Accurate Source for Company Balance Sheets for"

- US Listed Pot Stocks: A Comprehensive Guide to"

- Title: Stock Broker Outside of Us: How to Find"

- Top US AI Stocks: A Guide to Investing in the "

- Top US Mining Stocks to Watch in 2023"

- Top Performing US Stocks Past 5 Days: Unveilin"

- Title: US Stock Market Adhere to International"

- QCOM US Stock Price: A Comprehensive Analysis"