you position:Home > us stock market today > us stock market today

Title: US Government Stock Market: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction: The US government stock market, also known as the government bond market, is a crucial component of the financial system. It offers investors a unique opportunity to invest in government securities, providing stability and liquidity. In this article, we will delve into the intricacies of the US government stock market, including its key features, benefits, and risks. By the end of this guide, you will have a better understanding of how to navigate this market and make informed investment decisions.

Understanding the US Government Stock Market: The US government stock market primarily consists of government securities issued by the U.S. Treasury Department. These securities include Treasury bills (T-bills), Treasury notes, and Treasury bonds. Each of these instruments has its own characteristics and maturities, ranging from a few months to 30 years.

Key Features of the US Government Stock Market:

Stability: Government securities are considered one of the safest investments due to the backing of the U.S. government. This stability makes them an attractive option for conservative investors and those seeking a secure income stream.

Liquidity: The government bond market is highly liquid, meaning that investors can easily buy and sell securities without significantly impacting their prices. This liquidity provides flexibility and allows investors to access their funds quickly if needed.

Diversification: Investing in government securities can help diversify a portfolio, as they tend to have a low correlation with other asset classes like stocks and real estate. This diversification can help mitigate risk and potentially enhance overall returns.

Benefits of Investing in the US Government Stock Market:

Income Generation: Government securities offer fixed interest payments, providing a steady stream of income for investors. This can be particularly beneficial for those relying on investment income to cover expenses.

Inflation Protection: Some government securities, such as Treasury Inflation-Protected Securities (TIPS), are designed to protect investors against inflation. The principal value of TIPS adjusts with inflation, ensuring that investors receive a real return on their investment.

Tax Advantages: Interest earned on government securities is often exempt from state and local taxes, making them an attractive option for investors seeking tax-efficient income.

Risks Associated with the US Government Stock Market:

Interest Rate Risk: The value of government securities can fluctuate with changes in interest rates. When interest rates rise, the value of existing securities typically falls, potentially leading to capital losses.

Credit Risk: While government securities are considered very safe, there is still a small risk of default, albeit extremely low. This risk is particularly relevant for securities issued by foreign governments.

Liquidity Risk: While the government bond market is generally liquid, some securities, particularly those with longer maturities, may have lower liquidity, making it more challenging to sell them quickly at a favorable price.

Case Study: Treasury Inflation-Protected Securities (TIPS)

One notable example of government securities is Treasury Inflation-Protected Securities (TIPS). These securities are designed to protect investors against inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). For instance, if inflation is high, the principal value of a TIPS will increase, ensuring that investors receive a real return on their investment.

Conclusion:

The US government stock market offers investors a unique opportunity to invest in government securities, providing stability, liquidity, and potential income generation. By understanding the key features, benefits, and risks of this market, investors can make informed decisions and potentially enhance their portfolio's performance.

so cool! ()

last:Title: Best Oil Stocks in the US: A Comprehensive Guide for Investors

next:nothing

like

- Title: Best Oil Stocks in the US: A Comprehensive Guide for Investors

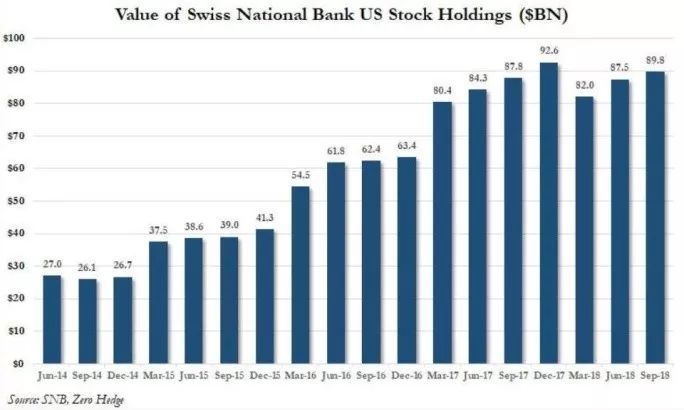

- Title: Swiss Central Bank Sells US Stocks: Implications and Insights

- Top Drone Stocks in the US: A Comprehensive Guide

- How to Buy US Stocks in Thailand

- Top Infrastructure Stocks in the US: A Guide to Investing in the Future

- Current US Stock Market Trends July 2025

- Manipulate the US Stock Market: Understanding the Techniques and Risks Involved

- US Stock Futures: A Comprehensive Guide to Understanding and Trading

- Toy R Us Stock Price: A Comprehensive Analysis

- Title: Total US Stock Market Market Capitalization: A Comprehensive Overview

- May 27, 2025 US Stock Market Closing Summary

- Title: US Stock Market Adhere to International Financial Reporting Standards

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Toys "R" Us Items Located in"

- Pyrogenesis Stock US: A Deep Dive into Investm"

recommend

Title: US Government Stock Market: A Comprehen

Title: US Government Stock Market: A Comprehen

Average Dividend Yield of US Stocks: A Compreh

Today's US Stock Futures: A Comprehensive

Palantir US Stock: A Deep Dive into the Data A

Is NASDAQ an US Stock Index?

US Stock Market Alternatives: Exploring Divers

US Military Family Stock Photo: Capturing the

Highest Return Stocks in the US: Unveiling the

Canadian Cannabis Traded in US Stock Market: A

Is the US Stock Market Open Today on Columbus

How Will Brexit Affect the US Stock Market?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Shoe Brand on US Stock Exchange: A Closer L"

- Get List of All US Stocks: A Comprehensive Gui"

- Marijuana Stock US: A Comprehensive Guide to I"

- Title: Total US Stock Market Market Capitaliza"

- Nintendo Stock Symbol: US"

- Title: US Alliance Stock Price: A Comprehensiv"

- Medreleaf Stock Price US: A Comprehensive Anal"

- US Dollar Bill Texture Stock: The Ultimate Gui"

- In the Year V: The US Stock Market Collapse"

- US Airline Stock Price: What You Need to Know"