you position:Home > us stock market today > us stock market today

US Stock Bubble 2017: A Detailed Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The year 2017 marked a pivotal moment in the United States stock market, as concerns of a potential bubble began to surface. This article delves into the factors contributing to this speculation, the impact it had on investors, and the lessons learned from this phenomenon.

Rising Stock Prices and Low Interest Rates

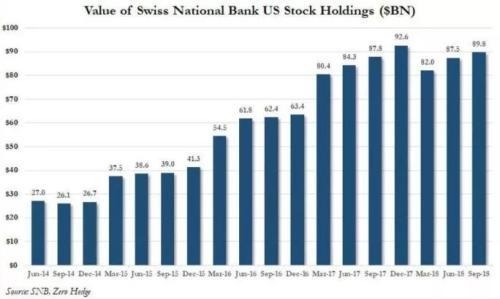

One of the primary factors fueling the 2017 stock bubble was the soaring stock prices. The S&P 500, a widely followed stock market index, reached an all-time high in early 2018, following a steady rise since the financial crisis of 2008. This surge was attributed to several factors, including low interest rates set by the Federal Reserve and strong corporate earnings.

The Federal Reserve's decision to keep interest rates low for an extended period was aimed at stimulating economic growth and aiding in the recovery from the financial crisis. However, this policy also had unintended consequences, as it led to a flight to quality by investors, pushing up stock prices.

Speculative Investments and P/E Ratios

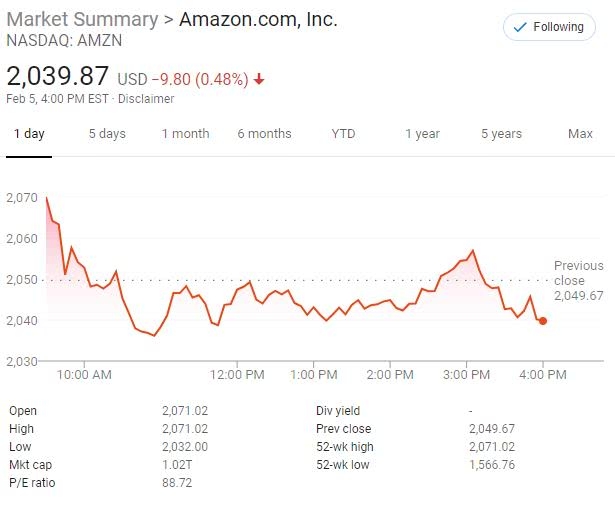

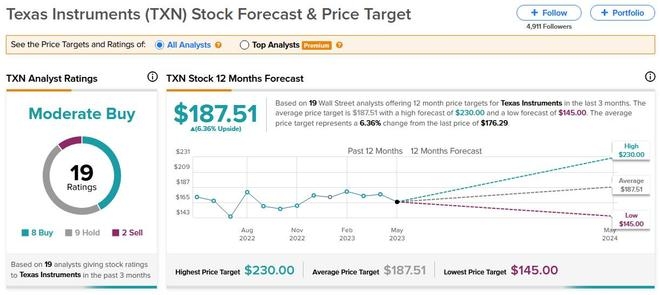

Another contributing factor to the stock bubble was the increasing number of speculative investments. Many investors were attracted to high-flying tech stocks, such as Facebook, Amazon, Netflix, and Google (collectively known as "FAANG" stocks), which were trading at exorbitant price-to-earnings (P/E) ratios.

The P/E ratio is a valuation metric that compares a company's stock price to its earnings per share. A high P/E ratio indicates that investors are willing to pay a premium for the stock, often due to high expectations of future growth. In the case of FAANG stocks, their high P/E ratios were attributed to their dominant market positions and promising growth prospects.

Impact on Investors and the Market

The stock bubble of 2017 had significant implications for investors. Those who invested heavily in speculative stocks, especially at the peak of the bubble, faced substantial losses when the market corrected. For instance, when the stock market correction began in early 2018, the S&P 500 dropped by approximately 20%, wiping out billions of dollars in investor wealth.

The bubble also highlighted the importance of diversification in investment portfolios. Investors who had a diversified approach and did not heavily invest in speculative stocks were better equipped to weather the market downturn.

Lessons Learned and Future Implications

The 2017 stock bubble serves as a valuable lesson for investors and policymakers alike. It underscores the risks associated with speculative investments and the importance of maintaining a balanced approach to investing.

For investors, the bubble highlights the need to remain vigilant and avoid chasing high-flying stocks without proper due diligence. It also underscores the importance of diversification and risk management in investment strategies.

For policymakers, the bubble serves as a reminder of the potential consequences of monetary policy on the stock market. It emphasizes the need for a careful balance between stimulating economic growth and avoiding asset bubbles.

In conclusion, the 2017 stock bubble was a complex phenomenon with multiple contributing factors. Understanding the causes and consequences of this bubble can help investors and policymakers navigate the challenges of the stock market and make informed decisions for the future.

so cool! ()

last:US Steel X 2008 Stock Price: A Comprehensive Analysis

next:nothing

like

- US Steel X 2008 Stock Price: A Comprehensive Analysis

- Am US Stock: Understanding the Basics and Benefits of Investing in American Stock

- US Coronavirus Stocks: Opportunities Amidst the Pandemic

- US or EU Stock Exchange: A Comprehensive Guide for Investors

- Invest in Us Weed Stocks: A Lucrative Opportunity in the Growing Cannabis Industr

- US Stock Market Astrology for 2024: Predictions and Implications

- Title: Tax on US Stocks for Indian Investors: What You Need to Know

- 2025 Second Half US Stock Market Outlook

- Title: US Stock Market on August 18: A Closer Look at Market Trends and Analysis

- Understanding the Intricacies of US Railroad Stock

- US Hotel Stock Index: A Comprehensive Guide to Understanding the Hotel Industry&#

- Best European Stocks Traded in the US: A Guide for Investors

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

US Stock Bubble 2017: A Detailed Analysis

US Stock Bubble 2017: A Detailed Analysis

Title: "http stocks.us.reuters.com st

When Does the US Stock Market Close Today? Und

Title: Sakura Us Stock: Unveiling the Japanese

US Stock Market Hits the 1 Trillion Milestone:

Toys "R" Us Items Located in

Mountain Motor Pro Stock US Nationals: A Thril

US HighTimes: A Good Stock to Invest In

Toys R Us Stock Checker UK: The Ultimate Guide

Market Wiped Out Almost $1 Trillion from US St

US Machine Gun Pap Stock: A Comprehensive Guid

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top Moving US Stocks Today: A Closer Look"

- IBM US Stock: A Comprehensive Guide to Investi"

- Title: Best Bank Stock in US: Top Picks for 20"

- US Shoe Brand on US Stock Exchange: A Closer L"

- Stock Trading Holidays in the US: What You Nee"

- Can People Outside the US Invest in the Stock "

- Sephora US Stock Price: A Comprehensive Analys"

- Tax Treatment of Stock Options in the U.S."

- Reddit US Stock Market: The Emerging Trendsett"

- US Interest Rate Cut Effect on Japanese Stocks"