you position:Home > new york stock exchange > new york stock exchange

Understanding the US 10-Year Treasury Stock: A Comprehensive Guide

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

Introduction:

In the world of finance, the US 10-year Treasury stock holds significant importance. It serves as a benchmark for bond yields and interest rates, influencing the broader market. This article delves into the details of the US 10-year Treasury stock, providing a comprehensive guide for investors and finance enthusiasts alike.

What is the US 10-Year Treasury Stock?

The US 10-year Treasury stock represents a government bond issued by the United States Treasury Department. These bonds have a maturity period of 10 years and are considered one of the safest investments in the world. Investors purchase these bonds with the expectation of receiving interest payments and the return of their principal at maturity.

Understanding the Importance of the US 10-Year Treasury Stock:

Benchmark for Bond Yields: The US 10-year Treasury stock serves as a benchmark for bond yields, which are the interest rates paid on bonds. Changes in the yield can indicate the direction of the broader market and affect other interest rates, such as mortgage rates.

Interest Rate Indicator: The yield on the US 10-year Treasury stock is closely watched by investors and policymakers. It reflects the market's perception of future economic conditions and inflation. An increase in yields often suggests expectations of higher inflation or economic growth, while a decrease may indicate concerns about economic slowdown.

Investment Vehicle: The US 10-year Treasury stock is a popular investment option for risk-averse investors. It provides a fixed income stream and is considered a safe haven during market downturns.

How to Invest in the US 10-Year Treasury Stock:

Direct Purchase: Investors can purchase US 10-year Treasury stocks directly from the US Treasury Department. This involves filling out an application, opening a TreasuryDirect account, and purchasing the bonds through an auction.

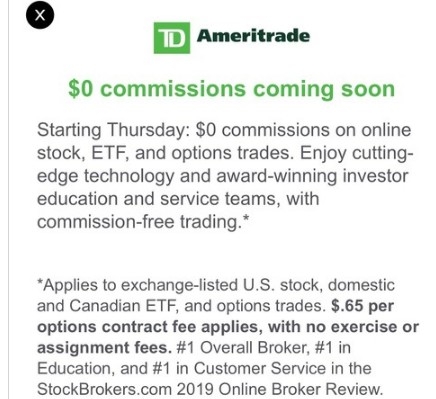

Brokerage Accounts: Investors can also buy US 10-year Treasury stocks through a brokerage account. Many brokerage firms offer access to government securities, allowing investors to purchase these bonds without going through the US Treasury.

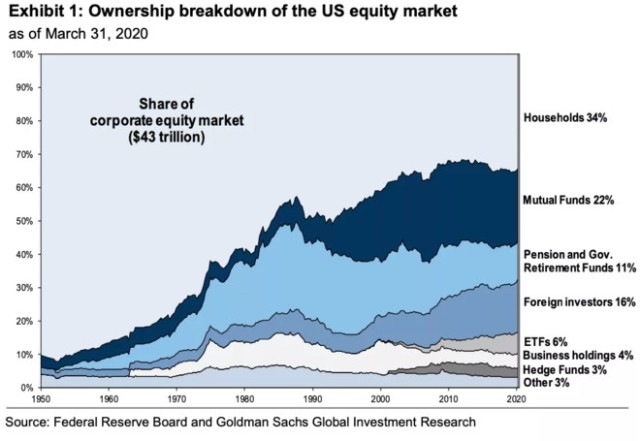

Mutual Funds and ETFs: Investors looking for diversification can invest in mutual funds or exchange-traded funds (ETFs) that hold US 10-year Treasury stocks. This provides exposure to the bond market without the need to manage individual bonds.

Case Study: The Impact of the US 10-Year Treasury Stock on Mortgage Rates

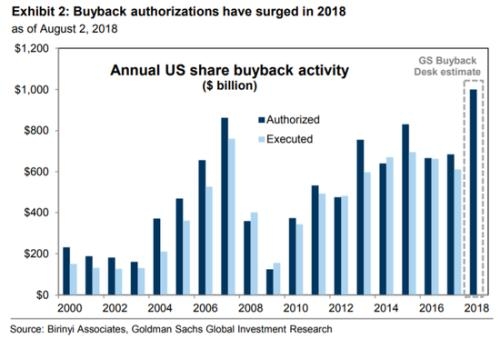

In 2018, the yield on the US 10-year Treasury stock increased significantly. This rise in yields had a direct impact on mortgage rates, which also increased. Homebuyers faced higher borrowing costs, leading to a slowdown in the housing market. This case study highlights the importance of the US 10-year Treasury stock in influencing other interest rates.

Conclusion:

The US 10-year Treasury stock is a vital component of the financial market, serving as a benchmark for bond yields and interest rates. Understanding its role and how to invest in it can help investors make informed decisions. By staying informed about the US 10-year Treasury stock, investors can navigate the financial markets with greater confidence.

so cool! ()

last:Top US Stocks to Buy in 2019: Your Guide to Investment Success

next:nothing

like

- Top US Stocks to Buy in 2019: Your Guide to Investment Success

- Us Listed Pot Stocks: The Future of Cannabis Investing

- Unlock the Potential of Acreage Holdings: US Stock Ticker Insights

- High Momentum US Stocks to Watch in September 2025

- Understanding Qualified Dividends on US Stocks

- US Stock Close Today: Key Takeaways and Analysis

- US Diesel Price Stock Chart: A Comprehensive Guide

- Sony F8331 US Stock Firmware: The Ultimate Guide

- Is the US Buying Stocks? A Comprehensive Analysis of the Current Market Trends

- Unleashing the Power of AI in US Stock Market: Revolutionizing Investment Strateg

- Understanding the Average Stock Portfolio Value in the US

- Momentum Stocks: 5-Day Performance Analysis of Large Cap US Stocks

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding the US 10-Year Treasury Stock: A

Understanding the US 10-Year Treasury Stock: A

How Brexit Will Impact the US Stock Market&

S&P 500 Chart: A Decade of Performance

Best US Biotech Stocks: A Guide to Investment

Unlocking the Potential of Investing in India

US Stock Indexes YTD: A Comprehensive Analysis

Title: Leverage Stock US: A Strategic Guide to

Investment Reporter: US Stocks - Top Insights

Chinese Companies Listed on the US Stock Excha

Stock Market Report: Key Insights and Trends T

Maximize Your Trading Potential with the Ultim

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- How to Buy Rolls-Royce Stock in the US: A Step"

- Top Losers in US Stock Market: Understanding t"

- Stocks and Shares ISA: The Ultimate Guide to U"

- US Brokers: Unlocking the World of Foreign Sto"

- Title: Defense Stocks ETF US: A Strategic Inve"

- Is the Dow Jones Industrial Open Today? Unders"

- New US Stocks: Your Ultimate Guide to Investin"

- How Much Is the US Stock Market Down?"

- MSN Stock Ticker: Your Ultimate Guide to Real-"

- China's Alleged Sixth-Generation Fighter "