you position:Home > new york stock exchange > new york stock exchange

Understanding Qualified Dividends on US Stocks

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

Dividends are a crucial aspect of investing in the stock market, and understanding their tax implications can significantly impact your investment strategy. One important question often asked by investors is, "If it's a US stock, is it a qualified dividend?" In this article, we'll delve into what qualified dividends are, how they differ from regular dividends, and the tax benefits they offer.

What Are Qualified Dividends?

Qualified dividends are dividends paid by U.S. corporations that meet specific criteria set by the IRS. These dividends are taxed at a lower rate compared to regular dividends, which can be a significant advantage for investors.

Criteria for Qualified Dividends

To be classified as a qualified dividend, a stock must meet the following criteria:

- U.S. Corporation: The dividend must be paid by a U.S. corporation.

- Holding Period: The investor must have held the stock for a minimum of 60 days during the 121-day period that begins 60 days before the ex-dividend date.

- Taxable Income: The investor must have a taxable income that exceeds the standard deduction and personal exemptions.

Tax Benefits of Qualified Dividends

The primary benefit of qualified dividends is the lower tax rate. Qualified dividends are taxed at the lower capital gains tax rates, which can be as low as 0% for investors in the lowest tax brackets. This is a significant advantage over regular dividends, which are taxed as ordinary income.

How to Determine If a Dividend Is Qualified

To determine if a dividend is qualified, you can check the ex-dividend date and the holding period. The ex-dividend date is the first trading day when the stock trades without the dividend. If you purchase the stock before the ex-dividend date and hold it for at least 60 days, the dividend will likely be qualified.

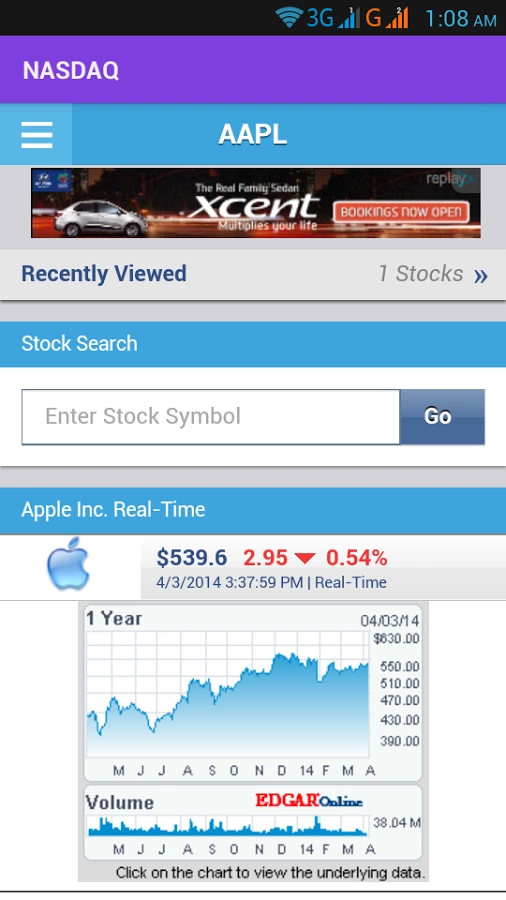

Case Study: Apple Inc.

Let's consider a hypothetical scenario with Apple Inc. (AAPL). Apple is a U.S. corporation, and its dividends are generally classified as qualified dividends. If you purchase 100 shares of Apple at $150 per share on February 1st and sell them on May 1st, you would have held the stock for at least 60 days during the 121-day period that begins 60 days before the ex-dividend date. As long as your taxable income exceeds the standard deduction and personal exemptions, the dividends you receive from Apple will likely be qualified.

Conclusion

Understanding whether a dividend is qualified or not is crucial for investors looking to optimize their tax strategy. By holding stocks for the required period and ensuring they meet the criteria, investors can benefit from the lower tax rate on qualified dividends. Always consult with a tax professional for personalized advice and to ensure you're taking full advantage of these tax benefits.

so cool! ()

last:US Stock Close Today: Key Takeaways and Analysis

next:nothing

like

- US Stock Close Today: Key Takeaways and Analysis

- US Diesel Price Stock Chart: A Comprehensive Guide

- Sony F8331 US Stock Firmware: The Ultimate Guide

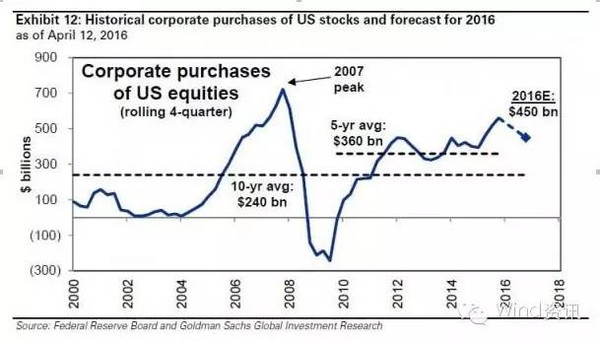

- Is the US Buying Stocks? A Comprehensive Analysis of the Current Market Trends

- Unleashing the Power of AI in US Stock Market: Revolutionizing Investment Strateg

- Understanding the Average Stock Portfolio Value in the US

- Momentum Stocks: 5-Day Performance Analysis of Large Cap US Stocks

- US Oil Stocks: A Comprehensive Guide to Investing in the Energy Sector

- Momentum Stocks: US Large Cap RSI Analysis

- Unlocking the Potential of BND: A Deep Dive into the BND Stock

- Best Stocks to Invest in 2017: Top Picks for US Investors

- "US Silica Stock Quote: The Ultimate Guide to Investing in the Industria

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding Qualified Dividends on US Stocks

Understanding Qualified Dividends on US Stocks

Reuters US Stock Market News: Latest Updates a

Top US Stocks That Affect Current Events

Financial Map: Navigate Your Financial Future

US Bank Stock Outlook: What to Expect in 2023

Leonardo Electronics US Inc Stock: A Comprehen

Samsung S8 Plus G955U Stock Firmware US Cellul

US 1 Industries Stock Quote: A Comprehensive G

Stock Ticker Live: Real-Time Market Insights a

Unveiling the Exciting World of SPAC US Stocks

Title: Stock Market Percentage in the US: A Co

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- All Canadian and US Cannabis Stocks: A Compreh"

- Unlocking Growth Potential: The US Development"

- Title: "http stocks.us.reuters.com st"

- Top Performing US Stock Sectors in 2025: A Com"

- Maximizing Returns: Mastering the Stock Exchan"

- Top 10 Most Influential Stock Prices in the US"

- Today's Top Momentum Stocks in the US Mar"

- Stock Market in US Open Today: Key Insights an"

- Top 10 US Stocks for Long-Term Investment: Sec"

- Is It US Stock Market Holiday Today? A Compreh"