you position:Home > new york stock exchange > new york stock exchange

How Much Is the US Stock Market Down?

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The U.S. stock market has been a hot topic in recent years, with investors closely monitoring its performance. One common question that often arises is, "How much is the US stock market down?" This article aims to provide a comprehensive overview of the current state of the U.S. stock market and shed light on the factors contributing to its recent performance.

Understanding the Stock Market

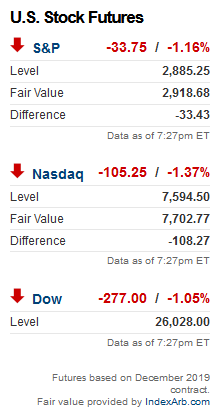

The U.S. stock market is a complex system that encompasses various indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices represent a basket of stocks from different sectors and provide a snapshot of the overall market's performance.

Recent Performance

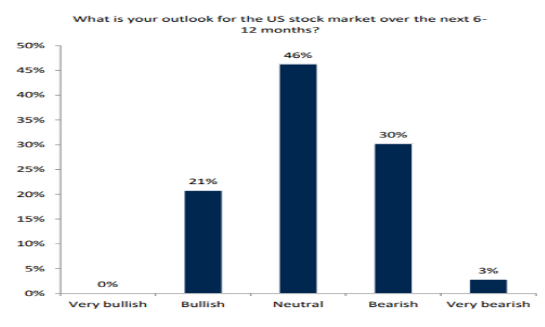

As of the latest data, the U.S. stock market has experienced a downturn. The S&P 500, for instance, has seen a decline of approximately 10% from its all-time high. This decline can be attributed to several factors, including rising inflation, geopolitical tensions, and concerns about the global economic outlook.

Rising Inflation

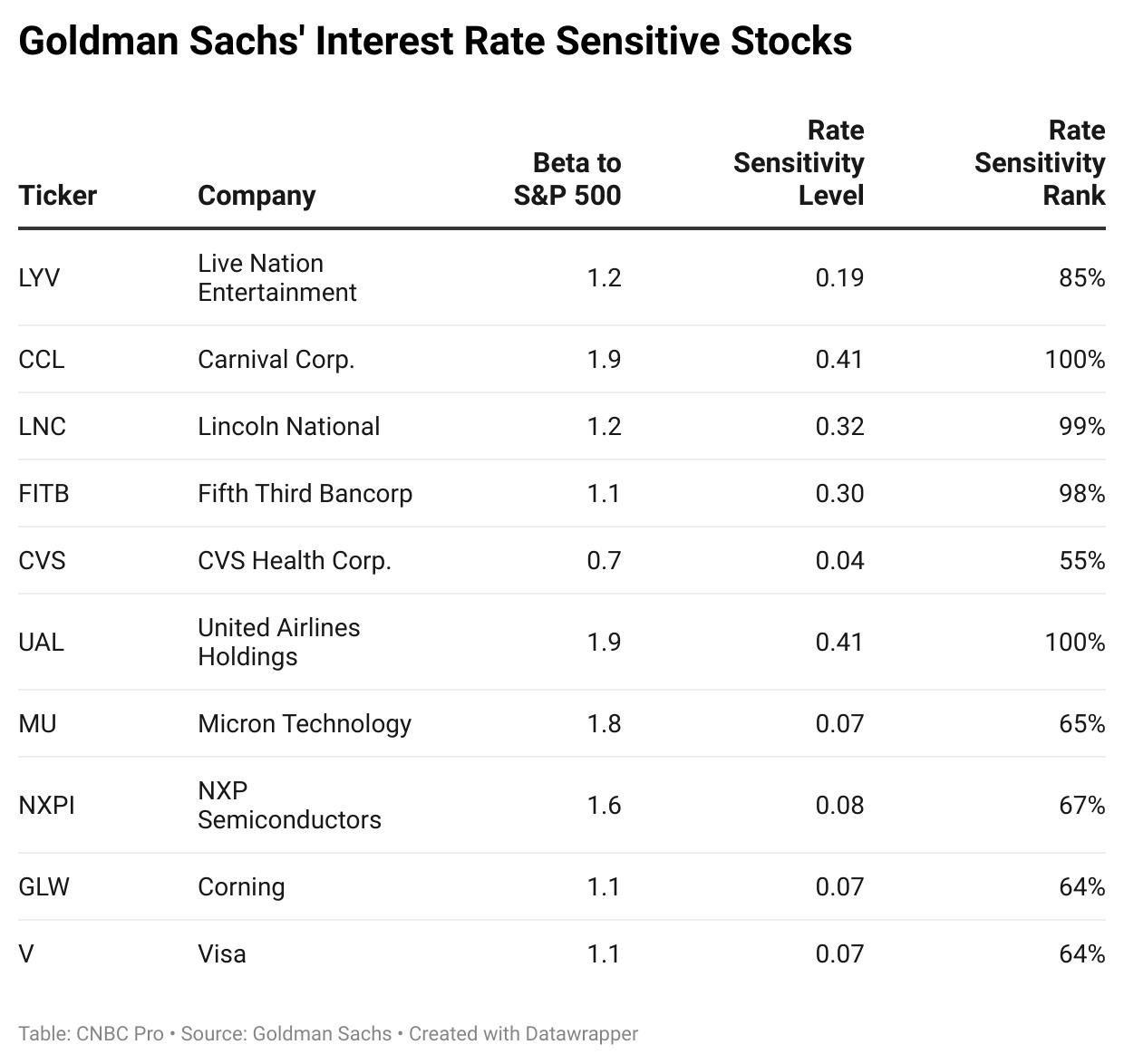

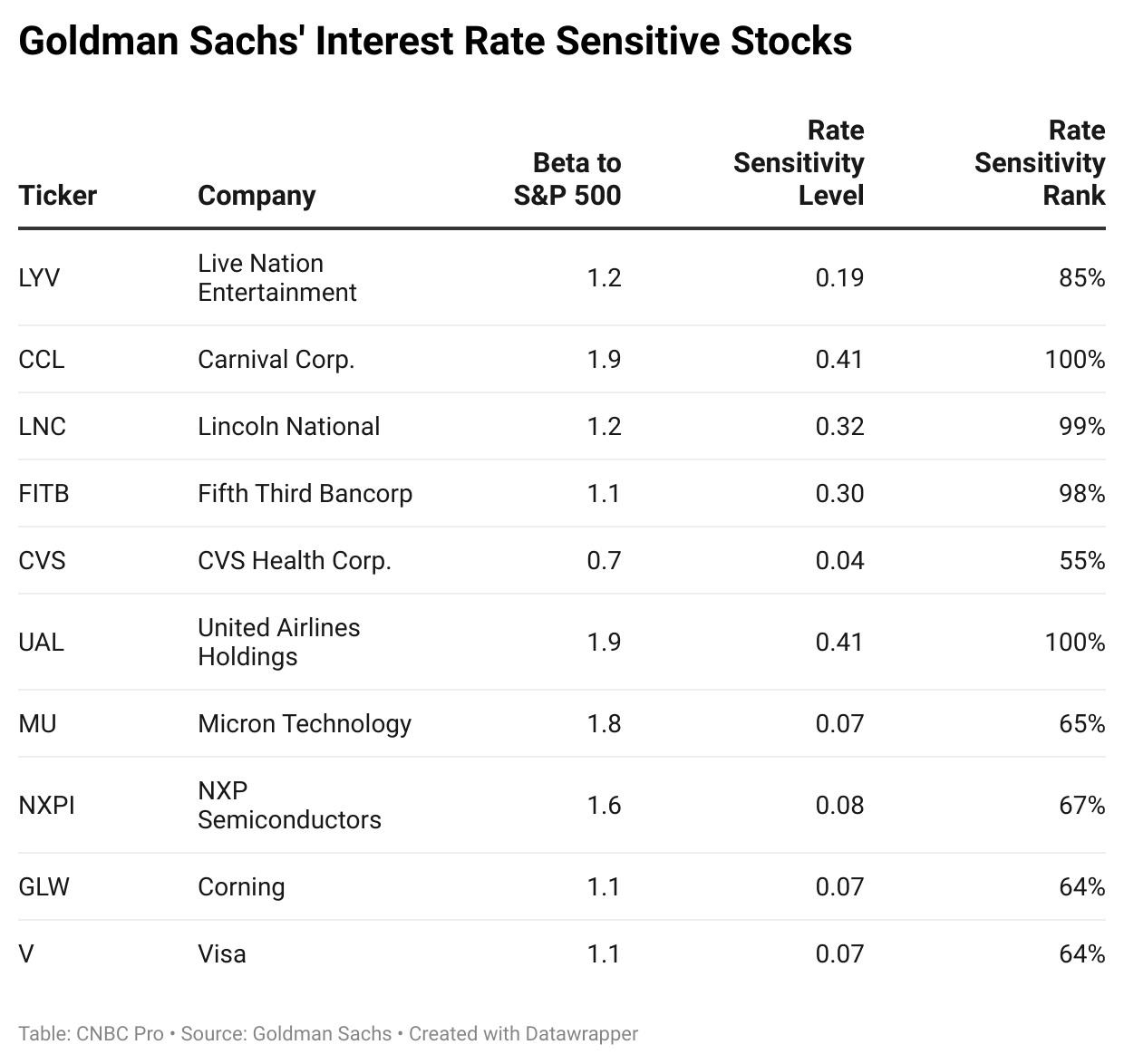

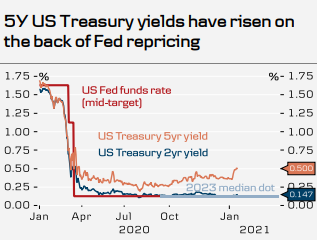

One of the primary reasons for the stock market's downturn is rising inflation. The Consumer Price Index (CPI) has been on the rise, leading to concerns about the Federal Reserve's monetary policy. As inflation continues to climb, investors are worried about the potential for higher interest rates, which can negatively impact stock prices.

Geopolitical Tensions

Geopolitical tensions, particularly those involving major economies like China and the United States, have also contributed to the stock market's decline. These tensions have raised concerns about global trade and economic stability, leading to uncertainty in the market.

Global Economic Outlook

The global economic outlook has also played a role in the stock market's downturn. As the COVID-19 pandemic continues to impact various economies, investors are concerned about the potential for a global recession. This uncertainty has led to a sell-off in the stock market.

Sector-Specific Impacts

The downturn in the U.S. stock market has not affected all sectors equally. Some sectors, such as technology and consumer discretionary, have seen significant declines, while others, such as healthcare and utilities, have held up relatively well.

Case Studies

To illustrate the impact of the stock market downturn, let's consider two case studies:

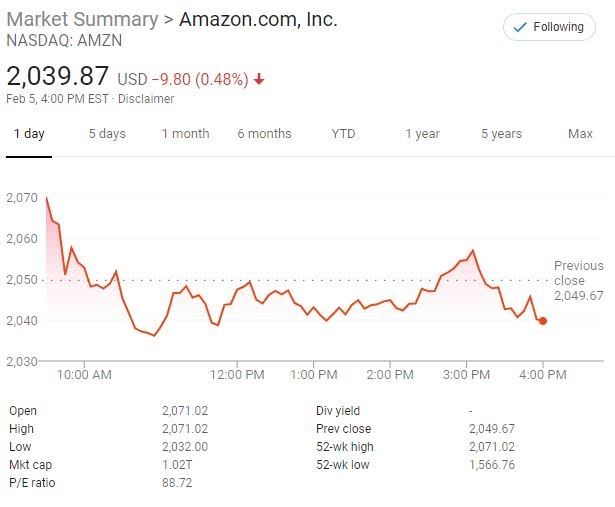

Technology Sector: The technology sector has been hit hard by the downturn, with major companies like Apple and Microsoft experiencing significant declines. This decline can be attributed to concerns about rising inflation and the potential for higher interest rates, which can impact consumer spending on technology products.

Healthcare Sector: In contrast, the healthcare sector has held up relatively well, with companies like Johnson & Johnson and Pfizer seeing modest declines. This resilience can be attributed to the sector's essential nature and the potential for growth in areas like biotechnology and pharmaceuticals.

Conclusion

In conclusion, the U.S. stock market has experienced a downturn in recent months, with a decline of approximately 10% from its all-time high. This downturn can be attributed to rising inflation, geopolitical tensions, and concerns about the global economic outlook. While the market's performance may continue to fluctuate, investors should remain vigilant and stay informed about the factors influencing the stock market's trajectory.

so cool! ()

last:Understanding US Energy Stocks ETF: A Comprehensive Guide

next:nothing

like

- Understanding US Energy Stocks ETF: A Comprehensive Guide

- Top US Mid Cap Stocks: A Guide to Investment Opportunities

- Title: Top Performing US Stocks Last 5 Trading Days July 2025

- Elekta US Stock: A Comprehensive Analysis

- Is the US Stock Market Closing Early Today? Everything You Need to Know

- Title: "President Trump's Tariff Threats on China Rattle US Stocks&

- ACB US Stock Listing: Everything You Need to Know

- Understanding the Role of Social Security Number in US Stock Exchange Transaction

- Best US 5G Stocks: Your Guide to Investment Opportunities in the Future of Connec

- Understanding the US Crude Oil Stock Prices: What You Need to Know

- Title: Good US Bank Stocks: Top Picks for Investors

- Alexion Pharmaceuticals: A Leader in US Biotech Stocks

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

How Much Is the US Stock Market Down?

How Much Is the US Stock Market Down?

SBD Capital Corp US Stock Symbol: A Comprehens

The Number of Companies Listed on US Stock Exc

Stock Invest: Top 100 Companies in the United

Title: Size of US Stock Market Capitalization:

Sibanye Stillwater Stock US: A Comprehensive A

Toys "R" Us Daytime Stock As

Title: Top Performing US Stocks Last 5 Trading

Title: Stock Cubes in the US: A Comprehensive

Best Quantum Computing Stocks in the US

Title: Stock Price in US Recession 2001: A Com

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- CATL Stock US: Understanding the Market Dynami"

- The Resilience and Growth of the US Stock Mark"

- Top US Mid Cap Stocks: A Guide to Investment O"

- Housing Stock Market News US: A Comprehensive "

- Semiconductor Companies in US Stock: A Compreh"

- Stock Market Correlation and the US President:"

- Hive US Stock Price: An In-Depth Analysis"

- How to Invest in the Stock Market in the US fo"

- Number of Listed Stocks in the US 2017: A Deep"

- US Stock Market 2017 Predictions: What to Expe"