you position:Home > new york stock exchange > new york stock exchange

Understanding the Average Stock Portfolio Value in the US

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

Investing in the stock market can be a daunting task, especially for beginners. One of the most common questions among investors is, "What is the average stock portfolio value in the US?" This figure can vary greatly depending on several factors, including the composition of the portfolio, the length of time the investments have been held, and the performance of the stock market.

The Importance of Diversification

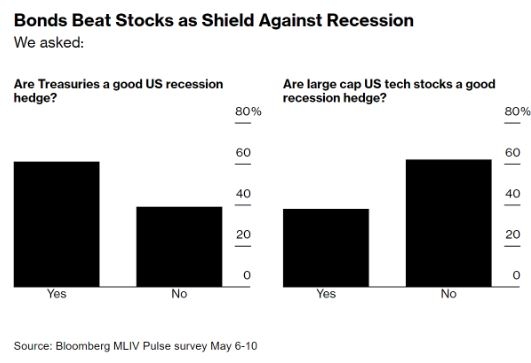

A well-diversified stock portfolio is crucial for achieving long-term financial stability. Diversification helps to spread out risk, ensuring that the performance of a single stock or sector does not drastically impact the overall value of the portfolio. The average stock portfolio in the US typically includes a mix of stocks from various sectors, including technology, healthcare, financial services, and consumer goods.

Determining the Average Stock Portfolio Value

Several studies have attempted to determine the average stock portfolio value in the US. According to a report by the Federal Reserve, the average stock portfolio value for households in the US was approximately $87,000 in 2020. However, this figure is subject to change, and it is important to note that the value of a stock portfolio can fluctuate significantly over time.

Factors Influencing Portfolio Value

Several factors can influence the value of a stock portfolio, including:

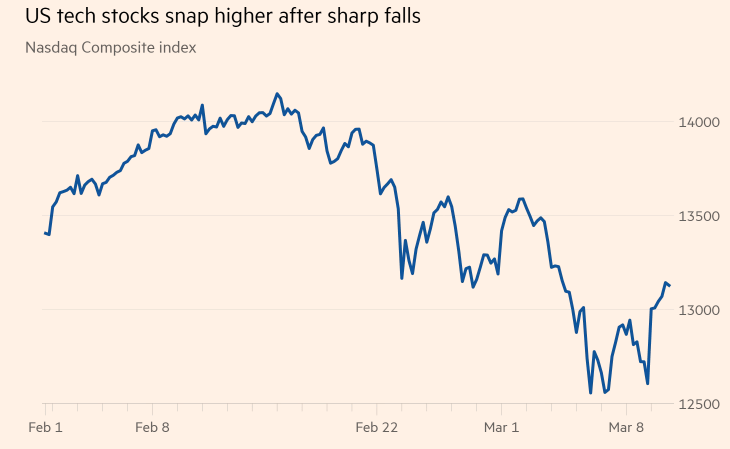

- Market Performance: The overall performance of the stock market can have a significant impact on the value of a stock portfolio. For example, during a bull market, the value of stocks tends to increase, leading to a higher portfolio value. Conversely, during a bear market, the value of stocks can decline, resulting in a lower portfolio value.

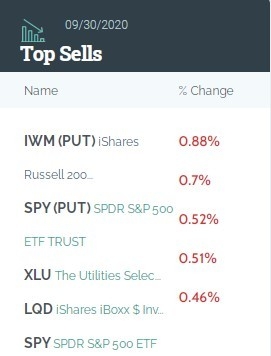

- Investment Strategy: The strategy used to select and manage stocks can also influence portfolio value. Active management, where an investor actively buys and sells stocks to maximize returns, may lead to higher portfolio values over time compared to passive management, which involves buying and holding a diversified portfolio of stocks.

- Time Horizon: The length of time an investor holds their stock portfolio can also affect its value. Investors with a long-term time horizon may experience greater growth in their portfolios compared to those with a short-term time horizon.

Case Study: The S&P 500

One of the most widely followed stock indices in the US is the S&P 500. This index includes the 500 largest publicly traded companies in the US across various sectors. The average stock portfolio in the US often includes a significant portion of S&P 500 stocks.

As of early 2021, the S&P 500 had a market capitalization of approximately $34.4 trillion. While the average stock portfolio in the US may not include the same percentage of S&P 500 stocks as a professional fund manager, it is a useful benchmark for understanding the performance of the broader stock market.

Conclusion

Understanding the average stock portfolio value in the US is essential for investors looking to gauge the performance of their portfolios. By diversifying their investments and adopting a well-thought-out investment strategy, investors can aim to achieve long-term financial stability and grow their portfolios over time.

so cool! ()

last:Momentum Stocks: 5-Day Performance Analysis of Large Cap US Stocks

next:nothing

like

- Momentum Stocks: 5-Day Performance Analysis of Large Cap US Stocks

- US Oil Stocks: A Comprehensive Guide to Investing in the Energy Sector

- Momentum Stocks: US Large Cap RSI Analysis

- Unlocking the Potential of BND: A Deep Dive into the BND Stock

- Best Stocks to Invest in 2017: Top Picks for US Investors

- "US Silica Stock Quote: The Ultimate Guide to Investing in the Industria

- Maximizing Returns with the Among Us App Stock: A Comprehensive Guide

- Invest in US Stock Market Easily: A Step-by-Step Guide

- How to Trade US Stocks from Nigeria: A Comprehensive Guide

- Japanese Real Estate Companies List in US Stock Market: A Comprehensive Guide

- US Small Cap Stock Index: A Lucrative Investment Avenue for Risk-Takers

- Maximizing Returns: Understanding US Stock Investment in India

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding the Average Stock Portfolio Valu

Understanding the Average Stock Portfolio Valu

Unlocking the Potential of US Capitol Stocks:

Title: Comprehensive List of All US Stock Symb

Understanding Stocks Market Futures: A Compreh

Cheapest US Stocks: Unlocking Value in the Mar

US Oil Companies Stock Prices: What You Need t

Understanding the US Stock Exchange Opening Be

February 2020 US Stock Market IPO Companies Li

Stock Closing Prices by Date: A Comprehensive

Are US Stocks Expensive? A Comprehensive Analy

Strong Fundamentals: Why US Stocks Are a Solid

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- How Major US Stock Indexes Fared Wednesday: A "

- Live Us Stock Market TV: Your Ultimate Guide t"

- Analyst Upgrades US Stocks: Pre-Market News to"

- Dow Jones 20 Year Historical Chart: A Comprehe"

- Does the U.S. Stock Market Close Early Today?"

- How to Invest in the US Stock Market from Outs"

- US Post Office Stock: A Comprehensive Guide to"

- Unlocking Growth: The Power of US Small Cap Te"

- US Small Cap Growth Stocks List: Your Guide to"

- Title: "US Election Effect on the Ind"