you position:Home > new york stock exchange > new york stock exchange

Tesla Stock: A Comprehensive Analysis in US Dollars

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Are you interested in understanding the current status and future potential of Tesla stock? If so, you've come to the right place. In this article, we will delve into the intricacies of Tesla's stock performance, analyzing its trajectory in US dollars. We will explore the factors that have influenced its value, compare it with its competitors, and provide a comprehensive overview of where Tesla stands in the market.

Understanding Tesla Stock

Tesla, Inc. (NASDAQ: TSLA) is an American electric vehicle (EV) and clean energy company founded by Martin Eberhard and Marc Tarpenning in 2003. Since then, Tesla has become a global leader in the EV industry, revolutionizing the automotive sector with its innovative technology and commitment to sustainability.

The company's stock, known as TSLA, is traded on the NASDAQ Global Select Market, a premier index representing approximately 3,200 companies from around the world. As of the latest data available, Tesla's market capitalization stands at over $1 trillion, making it one of the most valuable companies in the world.

Factors Influencing Tesla Stock Value

Several factors have contributed to the fluctuating value of Tesla stock over the years. These include:

- Revenue Growth: Tesla has seen remarkable revenue growth, largely driven by the increasing demand for its electric vehicles. As more consumers turn to sustainable transportation options, Tesla's sales continue to rise, positively impacting its stock value.

- Innovation: The company's commitment to innovation has also played a significant role in its stock performance. Tesla's advancements in battery technology, self-driving capabilities, and renewable energy solutions have set it apart from its competitors.

- Market Competition: As the EV market continues to grow, competition has intensified. However, Tesla has managed to maintain its market dominance, leading to increased investor confidence and a higher stock value.

- Regulatory Environment: Government policies and regulations regarding emissions and clean energy have a direct impact on Tesla's stock performance. As more countries adopt stricter environmental standards, the demand for EVs is expected to rise, further bolstering Tesla's position in the market.

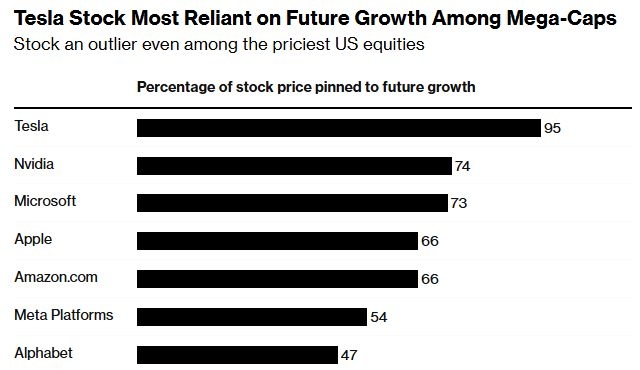

Comparing Tesla Stock with Competitors

When comparing Tesla's stock performance with its competitors, such as General Motors (GM), Ford (F), and Nikola (NKLA), it's clear that Tesla stands out. Tesla's stock has consistently outperformed its peers, largely due to its superior growth potential and innovative technology.

For example, Tesla's revenue grew by 87% in 2020, while General Motors and Ford reported a decline of 5% and 7%, respectively. This demonstrates Tesla's ability to navigate through economic downturns and capitalize on market opportunities.

Conclusion

In conclusion, Tesla stock has become a significant investment opportunity for investors looking to capitalize on the growing EV market. With its commitment to innovation, strong revenue growth, and competitive advantage, Tesla continues to be a leading player in the industry. As the demand for sustainable transportation options increases, Tesla's stock value is likely to remain robust, making it an attractive investment for the years to come.

so cool! ()

last:Understanding RRSP US Stock Withholding Tax

next:nothing

like

- Understanding RRSP US Stock Withholding Tax

- Brainsway Stock in US Dollars: A Comprehensive Analysis

- Best Momentum Stocks to Watch in the US in September 2025

- Ossia Stock Symbol: US: A Comprehensive Guide

- Major US Stocks: The Cornerstones of Financial Markets

- IPOs March 2020: A Deep Dive into the US Stock Market List

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol oa: U

- US Stock Futures Ticker: A Comprehensive Guide to Understanding the Market

- Title: US Stock Market on November 25, 2016: A Look Back

- Best US Stocks 2020: Top Performers and What They Mean for Investors

- US Cobalt Inc Stock: A Comprehensive Guide to Investing in the Future of Battery

- Trend of the US Stock Market: Navigating the Current Landscape

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- Highest Yielding US Stocks: Your Guide to Top "

recommend

Tesla Stock: A Comprehensive Analysis in US Do

Tesla Stock: A Comprehensive Analysis in US Do

Title: AMD Stock: A Closer Look at Its Value i

Understanding US Large Cap Stocks Sector Class

Online Stock Trading for Non-US Citizens: A Co

NVIDIA and FedEx Warnings Send Us Stocks Plumm

Asian Stock Market Times in US Time: Keeping U

Title: Cognizant Indian and US Stock: A Compre

Us Laughing Stock: The Misunderstood Side of A

The Largest Stock Markets in the US: A Compreh

Title: Size of the US Stock Market in 2018: A

Title: Buying Stocks in Taiwan Stock Exchange:

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- The Last of Us 2 Out of Stock: A Comprehensive"

- List of US Stock Market Holidays in 2019"

- http stocks.us.reuters.com stocks fulldescript"

- Largest Stock Exchanges in the US: A Comprehen"

- Top US Restaurant Stocks: A Guide to Investing"

- Best Quantum Computing Stocks in the US"

- Title: Stock Price in US Recession 2001: A Com"

- Hatchimals Toys R Us in Stock: The Ultimate Gu"

- Title: Best US Stocks to Buy Now for Long-Term"

- Title: Leverage Stock US: A Strategic Guide to"