you position:Home > new york stock exchange > new york stock exchange

Title: US Stock Market 2018: A Comprehensive Review

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction:

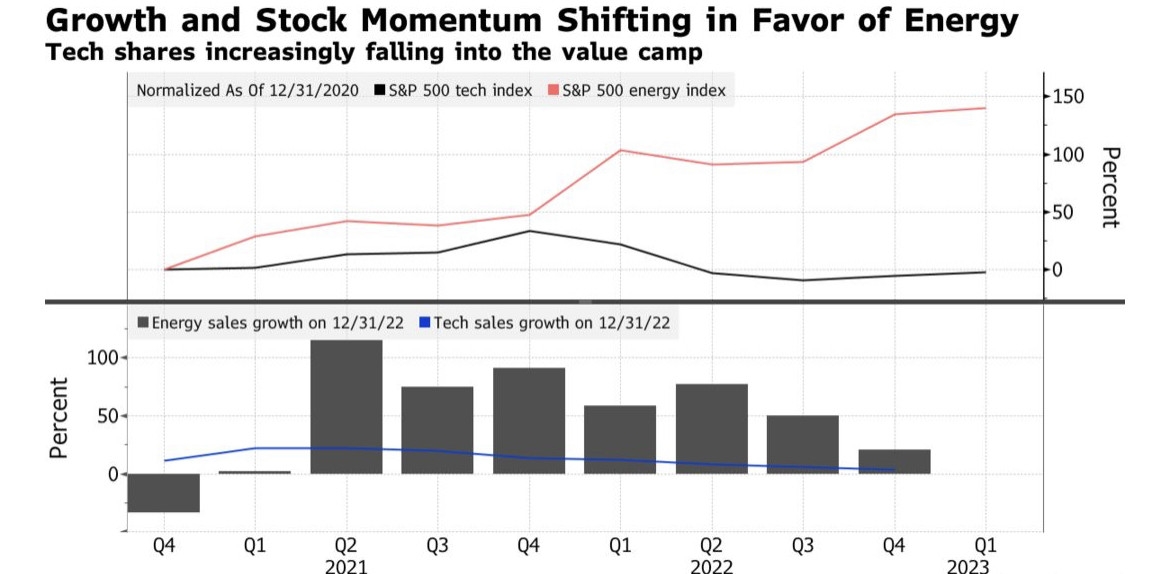

Market Performance: The S&P 500, a widely followed benchmark index, closed the year with a gain of 6.2%. However, the performance varied significantly across different sectors. Technology stocks, particularly those in the FAANG (Facebook, Apple, Amazon, Netflix, and Google) group, surged throughout the year, leading the market higher. On the other hand, energy and financial stocks lagged behind, partly due to rising interest rates and trade tensions.

Major Events: Several major events shaped the US stock market in 2018. Here are some of the key events:

Rising Interest Rates: The Federal Reserve raised interest rates four times in 2018, reflecting strong economic growth and inflation concerns. This led to increased borrowing costs for companies and consumers, negatively impacting financial and real estate stocks.

Trade Tensions: The US-China trade war escalated throughout the year, leading to increased uncertainty and volatility in the stock market. Investors were concerned about the potential impact of tariffs on global trade and economic growth.

Economic Data: The US economy continued to grow in 2018, with low unemployment and strong consumer spending. However, there were concerns about the sustainability of this growth, particularly as the Federal Reserve raised interest rates.

Sector Performance:

Technology Stocks: As mentioned earlier, technology stocks led the market higher in 2018. The FAANG group, in particular, saw significant gains, driven by strong earnings and growth prospects.

Healthcare Stocks: Healthcare stocks also performed well in 2018, benefiting from a strong biotech sector and the approval of new drugs and therapies.

Financial Stocks: Financial stocks lagged behind, as rising interest rates and trade tensions weighed on the sector. However, some financial companies still saw strong earnings growth, particularly those with a significant presence in the US consumer banking market.

Energy Stocks: Energy stocks faced significant headwinds in 2018, as rising interest rates and trade tensions impacted the oil and gas industry. However, some companies saw modest gains, particularly those focused on natural gas and renewable energy.

Conclusion: 2018 was a challenging year for the US stock market, with rising interest rates, trade tensions, and economic uncertainty creating a volatile environment. However, technology and healthcare stocks performed well, offsetting the weaknesses in other sectors. Investors should remain vigilant and focus on companies with strong fundamentals and growth prospects to navigate the uncertain market conditions in the coming years.

so cool! ()

like

- RAAS US Stock: A Comprehensive Guide to Understanding and Investing in Real Estat

- Dow Jones US Broad Stock Market: A Comprehensive Overview

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Hisense US Stock Price: An In-Depth Analysis

- US Silver Stocks: A Comprehensive Guide to Investing in Silver

- US Stock Market Agenda: Navigating the Investment Landscape

- US Stock Market August 26, 2025 Summary

- US Stock Features: What You Need to Know

- US Cellular Stock ROM LG G4 BoyCracked: Unveiling the Power of Custom ROMs

- http://stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol knd

- Dow Jones Total Stock Market US Small Cap Value Index: A Comprehensive Guide

- Tax Implications for US Investors in Canadian Bank Stocks Dividends

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Title: US Stock Market 2018: A Comprehensive R

Title: US Stock Market 2018: A Comprehensive R

US Hemp Stocks: A Growing Industry to Watch

FCX US Stock Quote: Everything You Need to Kno

Australia-US Stock Market: A Comprehensive Gui

Title: "http stocks.us.reuters.com st

Live Us Stocks: Your Ultimate Guide to Active

Stocks Third in Line at the US Justice Departm

Major US Stocks: The Cornerstones of Financial

US Stock Market 2017 Predictions: What to Expe

Toys "R" Us Daytime Stock As

High Dividend US Stocks 2022: A Guide to Top-Y

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Broker for UK Residents: Your Ultimat"

- Title: Understanding Stock Options Taxation in"

- Taiwan Stock in US: A Comprehensive Guide for "

- NSE Offering US Stocks: A Game-Changer for Glo"

- Title: Gift Tax for Non-US Citizens on Stock o"

- Acronym and Name of US Stock Exchange: Codycro"

- Title: Total US Stock Market Capitalization Au"

- US Stock Exchange Chart: A Comprehensive Analy"

- Title: Top US Cannabis Stocks 2020: A Guide to"

- US Fund Stock: Your Guide to Investing in Amer"