you position:Home > new york stock exchange > new york stock exchange

Tech Stocks: US Indexes Lower Amid Market Volatility

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-fluctuating world of stock markets, the recent trend of lower US indexes has been a topic of concern among investors and market analysts. Specifically, the decline in tech stocks has played a significant role in this downward trend. This article delves into the reasons behind this decline and examines the broader implications for the US market.

Tech Stocks: A Major Driver of Index Decline

The tech industry has traditionally been a major driver of the US stock market, with companies like Apple, Microsoft, and Google leading the charge. However, in recent months, these companies have faced a decline in their stock prices, significantly impacting the broader market indexes.

Several factors have contributed to this decline in tech stocks. Firstly, the Federal Reserve's aggressive stance on interest rates has made borrowing more expensive for companies, which has increased their costs and decreased their profitability. Secondly, the rise in inflation has eroded the purchasing power of consumers, leading to lower demand for tech products and services. Finally, investors have become increasingly concerned about the potential for a technology bubble, leading to a sell-off of tech stocks.

Impact on US Indexes

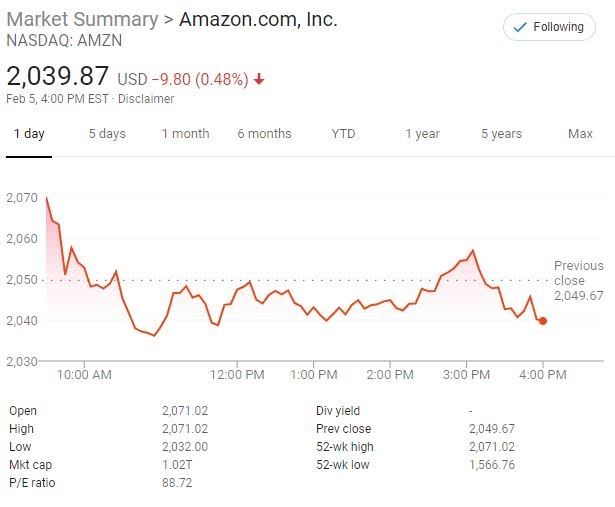

The decline in tech stocks has had a ripple effect on US indexes, with major indices such as the S&P 500 and the NASDAQ experiencing notable drops. The S&P 500, which tracks the performance of 500 large companies, has seen its index fall by approximately 20% over the past year. Similarly, the NASDAQ, which is heavily weighted towards tech stocks, has also seen a significant decline.

One of the most notable examples of this trend is the performance of Apple, which is one of the largest companies in the S&P 500. Over the past year, Apple's stock has dropped by more than 20%, contributing significantly to the index's decline.

Market Volatility and Risk

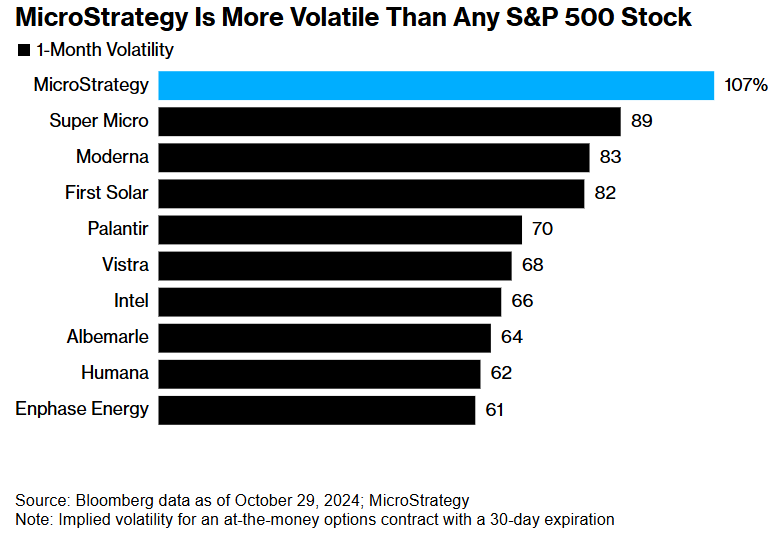

The decline in tech stocks and the resulting impact on US indexes highlight the volatility and risk associated with the stock market. Investors need to be aware of the potential for significant fluctuations in their portfolios, particularly when investing in sectors like technology.

Furthermore, the recent market trends underscore the importance of diversification. Investors who have a heavily concentrated position in tech stocks may find themselves exposed to the risks associated with this sector. Diversifying their portfolios across various sectors and asset classes can help mitigate these risks.

Case Study: Microsoft's Stock Performance

To illustrate the impact of tech stock performance on US indexes, let's look at Microsoft. As one of the largest tech companies in the world, Microsoft has a significant presence in the S&P 500 and the NASDAQ.

Over the past year, Microsoft's stock has dropped by approximately 10%. This decline has contributed to the overall decline in the S&P 500 and the NASDAQ. However, it's important to note that Microsoft has also maintained a strong position in the market, demonstrating the resilience of the tech sector.

In conclusion, the recent decline in tech stocks has played a significant role in the lower US indexes. This trend highlights the volatility and risk associated with the stock market, emphasizing the importance of diversification and a well-balanced investment strategy. As the market continues to evolve, investors should stay informed and be prepared to adapt to changing conditions.

so cool! ()

last:How Much Are Our Tower Stream Stocks Worth in US Dollars?

next:nothing

like

- How Much Are Our Tower Stream Stocks Worth in US Dollars?

- US Stock Exchange Chart: A Comprehensive Analysis of the Market in January 2018

- Ukraine War: How It Impacts the US Stock Market

- US Stock Earnings Announcements: The Key to Investment Decisions

- US Large Cap Stocks: Highest Gains Past Week Momentum Analysis

- Stock Invest.us // UAB Exigam: The Ultimate Guide to Understanding and Leveraging

- Understanding the US All Stock Index: A Comprehensive Guide

- Unlocking the Potential of NSE US Stock: A Comprehensive Guide

- US Navy Stocking: A Comprehensive Guide to Navy Uniforms and Their Accessories

- US Food Holdings Corp Stock: A Comprehensive Analysis

- Title: Size of US Stock Market Capitalization: A Comprehensive Overview

- Title: Current Outlook: US Stock Market Outlook 2025

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

Tech Stocks: US Indexes Lower Amid Market Vola

Tech Stocks: US Indexes Lower Amid Market Vola

Stock Invest: Top 100 Companies in the United

Title: "US Stock Exchange Open UK Tim

Title: EU vs US Stock Market: A Comprehensive

Title: Latest Momentum Stocks in the US

Sibanye Stillwater Stock US: A Comprehensive A

2025 US Stock Market Holidays Schedule: A Comp

Best Quantum Computing Stocks in the US

Coronavirus and Us Stock Market: The Unravelin

Marijuana Stocks to Buy: A Guide for US Invest

US Regional Banks Stock: A Comprehensive Guide

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US China Trade Talks Impact on Stock Market: A"

- Australia-US Stock Market: A Comprehensive Gui"

- US Corps of Engineers Stocking: Ensuring Prepa"

- SoftBank US Stock: A Comprehensive Guide to In"

- Stocks by Volume Traded in US Market Beat"

- Newest Meme Stocks US September 2025: A Compre"

- Can US Investors Buy Shenzhen Stock? A Compreh"

- Convert Us Air Stock Certificates: A Comprehen"

- Top US Penny Stocks to Buy Now: Your Guide to "

- Best US Stock: Unveiling the Top Performers fo"