you position:Home > new york stock exchange > new york stock exchange

Newest Meme Stocks US September 2025: A Comprehensive Guide

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

Introduction:

In the fast-paced world of finance, meme stocks have become a significant trend, capturing the interest of retail investors worldwide. As we approach September 2025, we take a closer look at the newest meme stocks in the United States. This article delves into the factors driving their popularity, their potential risks, and provides insights into some of the most buzzed-about stocks to watch.

What Are Meme Stocks?

Meme stocks are shares of companies that have gained popularity through social media and online forums, often driven by humorous or viral content. These stocks often see rapid price movements and can attract a lot of attention from retail investors looking for quick gains. Unlike traditional investment strategies, meme stocks are driven by sentiment and often have little to no fundamental analysis.

The Factors Driving Meme Stocks in September 2025

Social Media Influence: Platforms like Reddit, Twitter, and TikTok play a crucial role in driving meme stock trends. The viral nature of these platforms ensures that the newest meme stocks quickly gain traction.

Retail Investors: As more individuals participate in the stock market, they look for unconventional investment opportunities. Meme stocks provide a unique way for retail investors to engage with the market and potentially earn high returns.

Economic Factors: The current economic climate, including interest rates, inflation, and political events, can also influence the popularity of meme stocks. In September 2025, investors may be looking for stocks that offer protection against economic uncertainty.

Top Meme Stocks to Watch in September 2025

GameStop (GME): GameStop has been a staple in the meme stock universe, attracting attention from retail investors and Wall Street short sellers alike. With its recent surge in popularity, GME remains a top meme stock to watch.

Dogecoin (DOGE): As one of the most popular meme cryptocurrencies, Dogecoin has seen a surge in interest among investors. Its humorous origins and potential as a digital asset make it a compelling meme stock.

BB&T Corporation (BBT): This regional bank has gained popularity among meme stock investors, driven by its unique brand and social media presence. As a financial institution, BBT offers exposure to the broader financial sector.

AMC Entertainment Holdings (AMC): After facing significant challenges during the COVID-19 pandemic, AMC has gained a following among meme stock investors. Its resilience and potential for growth make it an intriguing stock to watch.

Hershey Company (HSY): As a consumer goods company, Hershey has seen increased attention from meme stock investors. Its strong brand and potential for growth in the food industry make it a compelling investment opportunity.

Potential Risks of Investing in Meme Stocks

While meme stocks can offer high returns, they also come with significant risks. These risks include:

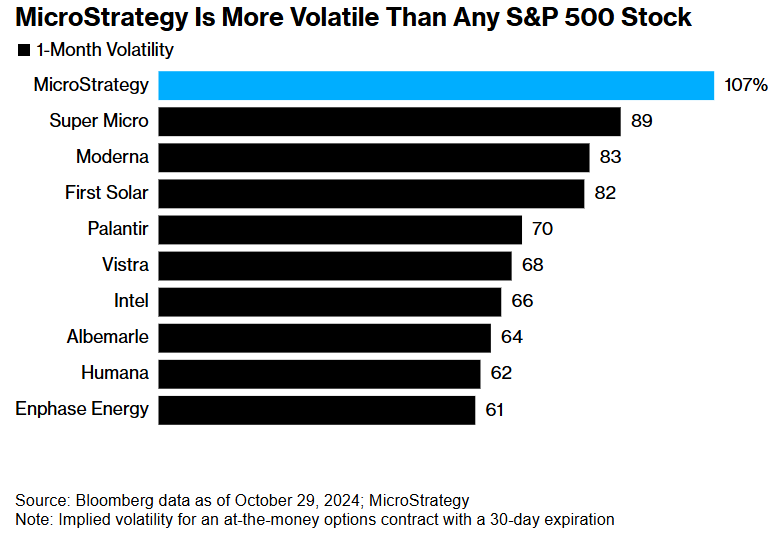

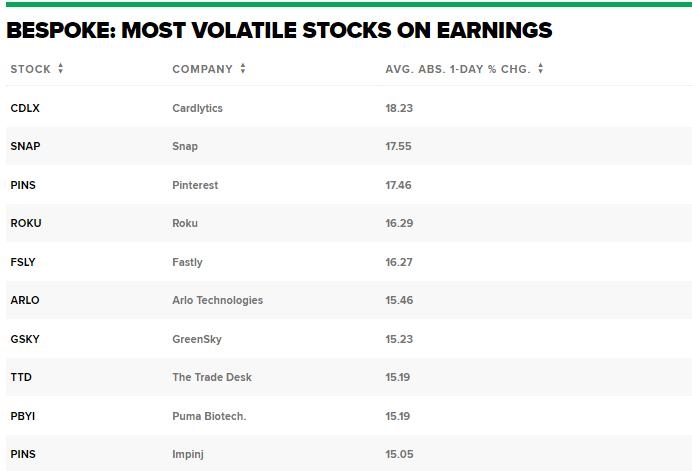

Market Volatility: Meme stocks can be highly volatile, with prices fluctuating rapidly. This volatility can lead to significant losses for investors.

Lack of Fundamental Analysis: Meme stocks are often driven by sentiment and viral content, rather than traditional fundamental analysis. This can lead to investments based on emotions rather than logical reasoning.

High Risk of Short Squeezes: Meme stocks are often targeted by short sellers, leading to potential short squeezes. These events can cause rapid price increases, which may not be sustainable in the long term.

Conclusion:

As we approach September 2025, meme stocks continue to capture the interest of retail investors worldwide. While these stocks offer potential for high returns, they also come with significant risks. By understanding the factors driving meme stocks and conducting thorough research, investors can make informed decisions and potentially capitalize on this unique investment trend.

so cool! ()

like

- Housing Stock Market News US: A Comprehensive Update

- 2008 US Stock Market: A Year of Turbulence and Recovery

- Title: EU vs US Stock Market: A Comprehensive Comparison

- Online Stock Trading for Non-US Citizens: A Comprehensive Guide

- How Can Canadians Buy US Stocks?

- Momentum Stocks: Top Performers in the US Large Cap Market Over the Last 5 Days

- Kansas City Southern Railway: A Deep Dive into US Railroad Stocks

- Best US Value Stocks: Unveiling the Hidden Gems in the Market

- Most Popular US Stocks Trending: A Comprehensive Guide

- Institutional Investors Net Sellers of US Stocks in 2025: What It Means for the M

- Number of Listed Stocks in the US 2017: A Deep Dive

- Current US Stock Market Outlook: Navigating the Turbulent Waters

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- Institutional Investors Net Sellers of US Stoc"

- Best US Value Stocks: Unveiling the Hidden Gem"

- Current US Stock Market Outlook: Navigating th"

- 1 Year Expectations: Large US Stocks"

- Is the US Stock Market Open on Columbus Day?"

recommend

Housing Stock Market News US: A Comprehensive

Housing Stock Market News US: A Comprehensive

Best US Value Stocks: Unveiling the Hidden Gem

Can I Buy US Stocks with CAD?

Amazon B Stock US: A Comprehensive Guide to Un

How Can Canadians Buy US Stocks?

Online Stock Trading for Non-US Citizens: A Co

Convert Us Air Stock Certificates: A Comprehen

Major US Airlines Stock: A Comprehensive Analy

Best Quantum Computing Stocks in the US

How Much Is Baba Stock in US Dollars?

AMD US Stock Market: An In-Depth Analysis

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Newest Meme Stocks US September 2025: A Compre"

- Is the US Stock Market Open on Columbus Day?"

- What Time Does the US Stock Market Open?"

- Can I Buy US Stocks with CAD?"

- Can Anyone Invest in the US Stock Market?"

- Best US Stock: Unveiling the Top Performers fo"

- Australia-US Stock Market: A Comprehensive Gui"

- Title: US Stock Market Time: Understanding the"

- A7III Stock US: Understanding the Investment O"

- Title: Geometric Average Return of US Stock Ma"