you position:Home > new york stock exchange > new york stock exchange

Understanding the US All Stock Index: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving world of finance, the US All Stock Index serves as a vital indicator of the overall performance of the American stock market. This index encompasses a broad range of companies across various sectors, providing investors with a comprehensive view of the market's health. In this article, we will delve into the intricacies of the US All Stock Index, its significance, and how it can guide investors in making informed decisions.

What is the US All Stock Index?

The US All Stock Index, also known as the S&P 500 Total Stock Market Index, is a market capitalization-weighted index that includes all publicly-traded companies in the United States. This index is designed to provide a comprehensive view of the entire stock market, making it an essential tool for investors and financial analysts alike.

Significance of the US All Stock Index

Market Health Indicator: The US All Stock Index serves as a reliable gauge of the overall health of the American stock market. By tracking the performance of a wide range of companies across various sectors, the index provides a holistic view of market trends and conditions.

Investor Confidence: The index's performance can influence investor confidence. A rising index often indicates a positive market sentiment, while a falling index may signal potential risks or challenges ahead.

Investment Strategy: The US All Stock Index can be used as a benchmark for investment strategies. Investors can compare the performance of their portfolios against the index to assess their investment returns and make informed adjustments.

Understanding the Components of the US All Stock Index

The US All Stock Index includes companies from various sectors, such as technology, healthcare, finance, and consumer goods. Some of the key components of the index include:

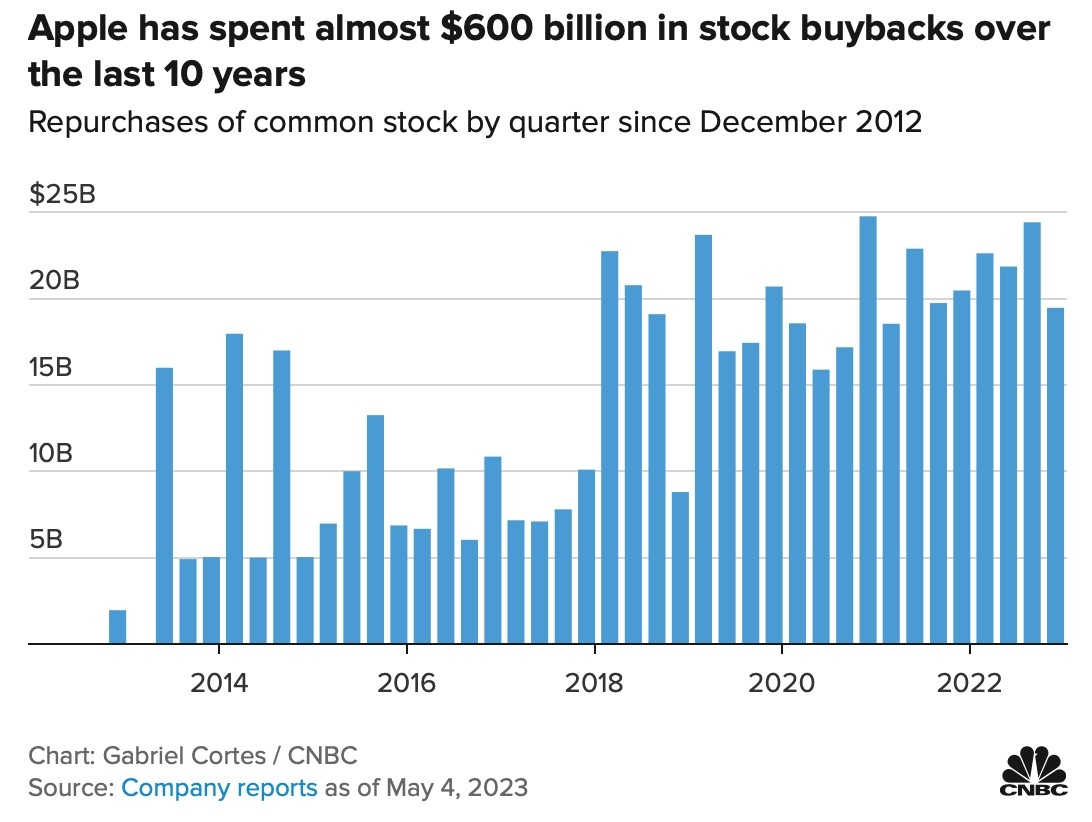

Technology: Companies like Apple, Microsoft, and Amazon, which dominate the technology sector, have a significant impact on the index's performance.

Healthcare: The healthcare sector includes pharmaceutical companies, biotech firms, and medical device manufacturers, such as Johnson & Johnson and Pfizer.

Finance: Major financial institutions like JPMorgan Chase, Bank of America, and Wells Fargo contribute to the index's performance.

Consumer Goods: Companies like Procter & Gamble, Coca-Cola, and Walmart represent the consumer goods sector.

Case Studies: Impact of the US All Stock Index on Investment Decisions

Tech Sector Performance: In 2021, the technology sector experienced significant growth, contributing to the overall rise in the US All Stock Index. Investors who allocated a portion of their portfolios to technology stocks during this period likely enjoyed substantial returns.

Healthcare Sector Resilience: The healthcare sector demonstrated resilience during the COVID-19 pandemic, as demand for medical supplies and pharmaceuticals surged. Companies like Johnson & Johnson and Pfizer saw their stock prices rise, positively impacting the US All Stock Index.

Conclusion

The US All Stock Index is a crucial tool for investors seeking to understand the overall performance of the American stock market. By tracking the performance of a diverse range of companies across various sectors, the index provides valuable insights into market trends and conditions. Understanding the US All Stock Index can help investors make informed decisions and navigate the complexities of the stock market.

so cool! ()

last:Unlocking the Potential of NSE US Stock: A Comprehensive Guide

next:nothing

like

- Unlocking the Potential of NSE US Stock: A Comprehensive Guide

- US Navy Stocking: A Comprehensive Guide to Navy Uniforms and Their Accessories

- US Food Holdings Corp Stock: A Comprehensive Analysis

- Title: Size of US Stock Market Capitalization: A Comprehensive Overview

- Title: Current Outlook: US Stock Market Outlook 2025

- US PE Ratio to Determine Undervalued Stock: A Comprehensive Guide

- Can US Investors Buy Shenzhen Stock? A Comprehensive Guide

- Title: TGIF Stock US: Unveiling the Potential of US Stocks for the Week-End

- Title: National Stock Exchange US: The Cornerstone of America's Financial Ma

- Market Cap of the US Stock Market in 2015: A Look Back

- Understanding US Capital Gains Tax on Stock Options

- How Much is 1 Penny US Dollars in the Stock Market Today?

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

Understanding the US All Stock Index: A Compre

Understanding the US All Stock Index: A Compre

Title: US Flag on Wooden Gun Stock: A Symbol o

Is the US Stock Market Going to Crash Soon?

Daily US Stock Market News Updates: September

US Cellular Stock Price Performance: A Compreh

US Electronic Stock Market Crossword

How to Buy Raspberry Pi Stock in the US

Carver Black Tip 32.5 C7 In Stock: Your Ultima

Institutional Investors Net Sellers of US Stoc

Toys "R" Us Off-Hours Stock

Investing in ETF US Value Stocks: A Strategic

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Opening Hours of US Stock Market: Everything Y"

- How Much Is Baba Stock in US Dollars?"

- Understanding US Large Cap Stocks Sector Class"

- Top US Dividend Stocks 2015: A Look Back at th"

- US Solar Stock Performance in May 2025: A Deep"

- Iraq Agrees to Establish a Strategic Stock Exc"

- Title: Gift Tax for Non-US Citizens on Stock o"

- Average Annual Return US Stock Market Last 20 "

- Most Popular US Stocks Trending: A Comprehensi"

- NSE Offering US Stocks: A Game-Changer for Glo"