you position:Home > new york stock exchange > new york stock exchange

Stocks by Volume Traded in US Market Beat

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the dynamic world of finance, volume traded in the stock market is a critical indicator of investor confidence and market activity. The US market, in particular, has seen remarkable growth in the volume of stocks traded. This article delves into the factors contributing to this rise and explores the implications for investors and the broader economy.

The Surge in Trading Volume

The US stock market has witnessed an unprecedented surge in the volume of stocks traded. This growth can be attributed to several key factors:

Technological Advancements: The rise of online trading platforms and mobile applications has made it easier than ever for investors to trade stocks. These technologies have democratized access to the market, allowing individuals to trade from the comfort of their homes or offices.

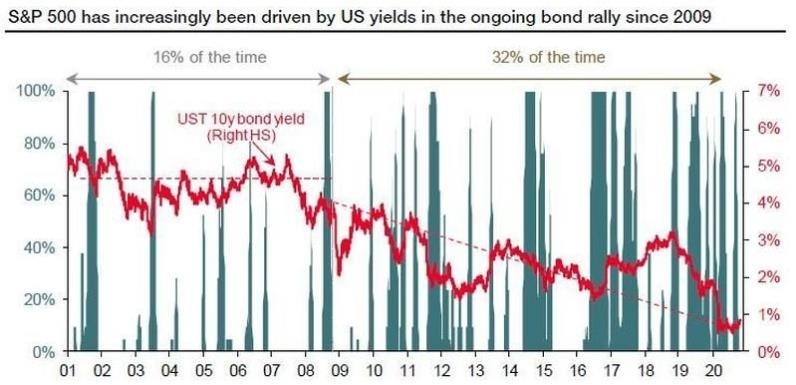

Low Interest Rates: The Federal Reserve's policy of low-interest rates has incentivized investors to seek higher returns in the stock market. With bonds and other fixed-income investments offering limited returns, investors have turned to stocks as an alternative.

Economic Growth: The US economy has experienced robust growth over the past few years, leading to increased corporate earnings and stock prices. This positive economic outlook has encouraged investors to participate in the market.

Implications for Investors

The surge in trading volume has several implications for investors:

Increased Liquidity: The higher volume of stocks traded ensures greater liquidity in the market. This means that investors can enter and exit positions more easily, without significantly impacting stock prices.

Higher Volatility: With more investors participating in the market, stock prices can become more volatile. This volatility can create opportunities for astute investors to capitalize on price discrepancies.

Increased Competition: The increased number of investors in the market can lead to higher competition, making it more challenging for individual investors to outperform the market.

Case Studies

To illustrate the impact of trading volume, let's consider two recent examples:

Tesla, Inc. (TSLA): Tesla's stock has seen significant trading volume, particularly after the company reported its earnings. The stock's price has often experienced sharp movements in response to these announcements, showcasing the impact of trading volume on stock prices.

Amazon.com, Inc. (AMZN): Amazon's stock has also seen substantial trading volume, driven by the company's strong financial performance and growth prospects. The stock's price has risen steadily over the years, reflecting investor confidence in the company's future.

Conclusion

The rise in trading volume in the US stock market is a testament to the growing investor interest and technological advancements. While this trend presents both opportunities and challenges for investors, it is crucial to stay informed and make informed decisions based on thorough research and analysis.

so cool! ()

last:Title: AMD Stock: A Closer Look at Its Value in US Dollars

next:nothing

like

- Title: AMD Stock: A Closer Look at Its Value in US Dollars

- Toys "R" Us Daytime Stock Associate: A Rewarding Career in Reta

- Stock Market Correlation and the US President: Unveiling the Connection

- MedMen US Stock Market: A Comprehensive Analysis

- Title: US Stock Futures Drop as Oil Prices Fall; OPEC+ Impact Analyzed

- Current Margin Debt in the US Stock Market: An In-Depth Analysis

- How to Buy Raspberry Pi Stock in the US

- How to Buy US Stocks in the UAE: A Comprehensive Guide

- Taiwan Stock in US: A Comprehensive Guide for Investors

- TLS US Stock: A Comprehensive Guide to Understanding and Investing in US Stocks

- US Carbine 30 Cal W Folding Stock: A Comprehensive Review

- List of US Stock Market Holidays in 2019

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

- Opening Hours of US Stock Market: Everything Y"

recommend

Stocks by Volume Traded in US Market Beat

Stocks by Volume Traded in US Market Beat

US Real Estate Stocks: A Comprehensive Guide t

Online Stock Trading for Non-US Citizens: A Co

Impact of Middle East War on US Stock Market

Momentum Stocks: Top Performers in the US Larg

Stocks to Buy if the US Goes to War

Hatchimals Toys R Us in Stock: The Ultimate Gu

Samsung S8 Plus G955U Stock Firmware US Cellul

Current Margin Debt in the US Stock Market: An

Chinese Companies Listed on the US Stock Excha

LG Chem Stock in US Dollars: A Comprehensive G

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Amazon B Stock US: A Comprehensive Guide to Un"

- How to Buy US Stocks in the UAE: A Comprehensi"

- Best UK Broker for US Stocks: Your Ultimate Gu"

- Current US Stock Market Outlook: Navigating th"

- Is the US Stock Market Open on Columbus Day?"

- Stock Invest: Top 100 Companies in the United "

- Canadian Investing in the US Stock Market: A G"

- The Resilience and Growth of the US Stock Mark"

- Best US Weed Stocks 2019: Top Investments in t"

- Top US Airline Stocks to Watch in 2023"