you position:Home > new york stock exchange > new york stock exchange

Can US Investors Buy Shenzhen Stock? A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In recent years, the allure of Chinese stocks has grown exponentially, drawing the attention of investors worldwide. Among the numerous bourses in China, the Shenzhen Stock Exchange stands out as a beacon for potential investors. But can U.S. investors participate in this vibrant market? This article delves into the intricacies of buying Shenzhen stocks from the perspective of American investors, offering a comprehensive guide to navigate this dynamic landscape.

Understanding the Shenzhen Stock Exchange

The Shenzhen Stock Exchange (SZSE) is the second-largest stock exchange in China, after the Shanghai Stock Exchange. It was established in 1991 and has since grown to list more than 1,800 companies. The exchange is a hub for technology, biotech, and other innovative sectors, offering a diverse range of investment opportunities.

Eligibility for US Investors

US investors can indeed purchase stocks listed on the Shenzhen Stock Exchange, but there are certain requirements and limitations to consider.

Qualified Foreign Institutional Investor (QFII) Program: This program allows foreign investors, including US investors, to invest in Chinese stocks. To participate, investors must apply for a QFII license and adhere to specific regulations.

Stock Connect Program: The Stock Connect program allows US investors to trade A-shares (stocks denominated in Chinese yuan) directly on the Shanghai Stock Exchange. While not directly applicable to the Shenzhen Stock Exchange, some A-shares listed on the Shenzhen exchange can be accessed through the program.

Steps to Buy Shenzhen Stocks

Open a QFII Account: If you wish to invest directly in Shenzhen stocks, you will need to open a QFII account with a Chinese securities firm. This process involves providing extensive documentation and undergoing a thorough review.

Choose a Broker: Select a reputable broker that offers access to the Shenzhen Stock Exchange. Ensure that the broker is licensed to provide services to foreign investors.

Understand the Risks: Investing in foreign markets, especially those like China with different regulatory frameworks, carries inherent risks. Be prepared to research and understand these risks before making any investment decisions.

Benefits of Investing in Shenzhen Stocks

Access to Innovative Companies: The Shenzhen Stock Exchange is home to numerous innovative companies in sectors like technology, biotech, and consumer goods.

Potential for High Returns: Historically, the Chinese stock market has offered significant returns for investors willing to take on the associated risks.

Global Exposure: Investing in Shenzhen stocks can provide exposure to the rapidly growing Chinese economy and its diverse industries.

Case Study: Tencent

A prime example of a successful investment in Shenzhen stocks is Tencent, a tech giant listed on both the Hong Kong Stock Exchange and the Shenzhen Stock Exchange. By investing in Tencent, US investors have gained exposure to the rapid growth of the Chinese tech sector.

In conclusion, while buying Shenzhen stocks can be a lucrative investment opportunity for US investors, it requires careful planning and understanding of the unique challenges and rewards. By following the outlined steps and conducting thorough research, investors can navigate this dynamic market and potentially reap substantial returns.

so cool! ()

like

- Title: TGIF Stock US: Unveiling the Potential of US Stocks for the Week-End

- Title: National Stock Exchange US: The Cornerstone of America's Financial Ma

- Market Cap of the US Stock Market in 2015: A Look Back

- Understanding US Capital Gains Tax on Stock Options

- How Much is 1 Penny US Dollars in the Stock Market Today?

- Investing in ETF US Value Stocks: A Strategic Approach

- BOFA Hartnett US Stock Flows: A Deep Dive into the Current Market Trends

- Ukraine Russia US Stock Market: How the Conflict Impacts American Investors

- Unh Us Stock: The Ultimate Guide to Understanding and Investing in U.S. Stocks

- Understanding US Large Cap Stocks Sector Classification

- 2025 US Stock Market Holidays Schedule: A Comprehensive Guide

- Top US Restaurant Stocks: A Guide to Investing in the Food Industry

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

Can US Investors Buy Shenzhen Stock? A Compreh

Can US Investors Buy Shenzhen Stock? A Compreh

Title: Buying Stocks in Taiwan Stock Exchange:

CannTrust Us Stock Symbol: A Comprehensive Gui

Invest in Us Oil Stocks: A Smart Move for Your

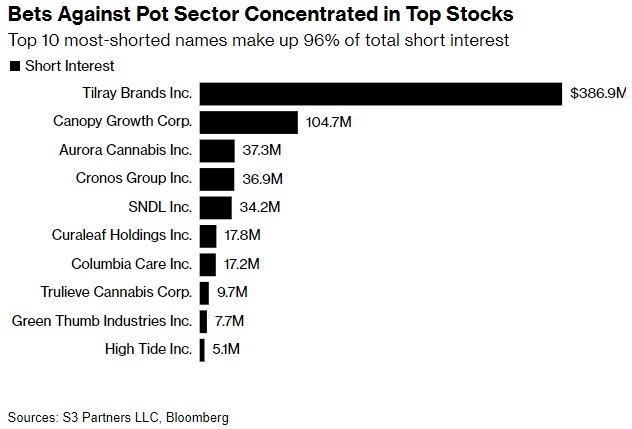

Pot Stock About to Explode: How U.S. Citizens

Title: US Airways Stock Certificate: A Guide t

US Natural Gas Stock Quote: A Comprehensive Gu

Is the US Stock Market Open on January 2, 2023

How to Invest in US Stocks from Europe

How Is the Stock Market Doing Today in US?

US Stock Broker for UK Residents: Your Ultimat

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: 2018 US Stock Market Holidays: A Compre"

- Samsung S8 Plus G955U Stock Firmware US Cellul"

- Opening Hours of US Stock Market: Everything Y"

- Carver Black Tip 32.5 C7 In Stock: Your Ultima"

- Marine Harvest US Stock: An In-Depth Analysis"

- Stock Invest: Top 100 Companies in the United "

- Largest Stock Exchanges in the US: A Comprehen"

- Title: "http stocks.us.reuters.com st"

- Stocks by Volume Traded in US Market Beat"

- US Materials Stocks: The Cornerstone of Indust"