you position:Home > new york stock exchange > new york stock exchange

Understanding US Capital Gains Tax on Stock Options

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the dynamic world of finance, stock options have become a crucial component of employee compensation, especially in the tech industry. However, understanding the tax implications of these options, particularly the capital gains tax, can be a complex task. This article aims to demystify the process of calculating and paying capital gains tax on stock options in the United States.

What are Stock Options?

Stock options are a form of equity compensation that gives employees the right to purchase a certain number of company shares at a predetermined price, known as the exercise price. There are two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs).

Incentive Stock Options (ISOs):

ISOs are a type of employee stock option that offers significant tax advantages. They are taxed when the employee exercises the option, not when the shares are sold. The capital gains tax on ISOs is calculated based on the difference between the fair market value of the shares on the day of exercise and the exercise price.

Non-Qualified Stock Options (NSOs):

NSOs are taxed differently from ISOs. The entire gain from exercising an NSO is considered taxable income in the year of exercise. The capital gains tax on NSOs is calculated based on the difference between the fair market value of the shares on the day of sale and the exercise price.

Calculating Capital Gains Tax on Stock Options:

The calculation of capital gains tax on stock options involves several factors:

- Exercise Price: The price at which the employee can purchase the shares.

- Fair Market Value (FMV): The current market price of the shares.

- Cost Basis: The total cost of purchasing the shares, including any taxes paid on exercising the options.

The formula for calculating capital gains tax on stock options is:

Capital Gains Tax = (FMV - Exercise Price) - Cost Basis

Example:

Let's say an employee exercises an ISO to purchase 1,000 shares of a company at an exercise price of

Capital Gains Tax = (

Tax Considerations:

When selling stock options, it's important to consider the holding period. If the shares are held for more than one year, the gains are taxed at the long-term capital gains rate, which is generally lower than the short-term capital gains rate.

Conclusion:

Understanding the capital gains tax on stock options is essential for employees who receive these forms of compensation. By familiarizing themselves with the tax implications and following the proper procedures, individuals can ensure they are in compliance with tax regulations and make informed financial decisions.

so cool! ()

last:How Much is 1 Penny US Dollars in the Stock Market Today?

next:nothing

like

- How Much is 1 Penny US Dollars in the Stock Market Today?

- Investing in ETF US Value Stocks: A Strategic Approach

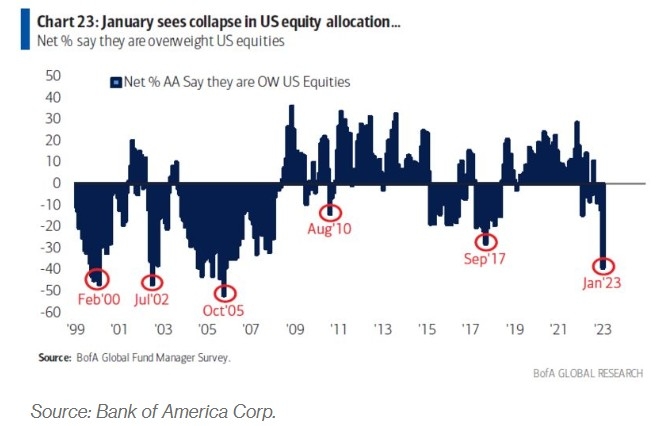

- BOFA Hartnett US Stock Flows: A Deep Dive into the Current Market Trends

- Ukraine Russia US Stock Market: How the Conflict Impacts American Investors

- Unh Us Stock: The Ultimate Guide to Understanding and Investing in U.S. Stocks

- Understanding US Large Cap Stocks Sector Classification

- 2025 US Stock Market Holidays Schedule: A Comprehensive Guide

- Top US Restaurant Stocks: A Guide to Investing in the Food Industry

- Sibanye Stillwater Stock US: A Comprehensive Analysis

- US ICBM Stock: A Comprehensive Guide to Investing in Intercontinental Ballistic M

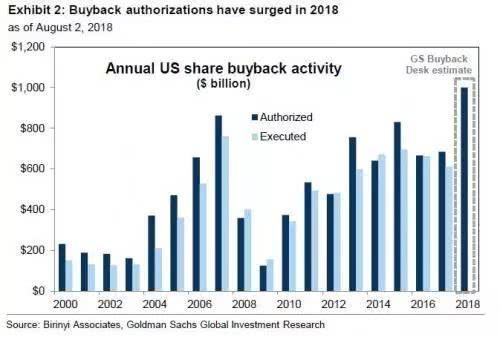

- Title: 2018 US Stock Market Holidays: A Comprehensive Guide

- The First Stock Market in the US: A Pivotal Milestone in Financial History

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

Understanding US Capital Gains Tax on Stock Op

Understanding US Capital Gains Tax on Stock Op

US Stock Broker for UK Residents: Your Ultimat

Airbnb Stock Price: A Comprehensive Analysis

Title: Stock Price in US Recession 2001: A Com

Top 10 Penny Stocks in the US Market: Your Gui

US Stem Cell, Inc. Stock Price: A Comprehensiv

Highest Dividend Stocks in the US Market: A Co

Title: Stock Cubes in the US: A Comprehensive

US Intel Stock: A Comprehensive Guide to Inves

Toshiba US Stock Symbol: Everything You Need t

Title: AMD Stock: A Closer Look at Its Value i

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- European Stocks Outperforming US Stocks Despit"

- Does US Stocks Give Dividends? Understanding D"

- Chinese Companies Listed on the US Stock Excha"

- Is Stock Market Open Tomorrow in US?"

- US MSO Cannabis Stocks: The Future of Legal Ca"

- Is the US Stock Market Going to Crash Soon?"

- Smarter Web Company US Stock: Unveiling the Fu"

- US Regional Banks Stock: A Comprehensive Guide"

- How to Invest in the US Stock Market from Indi"

- Title: Geometric Average Return of US Stock Ma"