you position:Home > new york stock exchange > new york stock exchange

US PE Ratio to Determine Undervalued Stock: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the world of investing, identifying undervalued stocks is a key to maximizing returns. One of the most popular methods for doing so is by analyzing the Price-to-Earnings (PE) ratio. The PE ratio is a valuation metric that compares the price of a stock to its per-share earnings. In this article, we will delve into how to use the US PE ratio to determine undervalued stocks, providing you with the knowledge to make informed investment decisions.

Understanding the PE Ratio

The PE ratio is calculated by dividing the stock price by the earnings per share (EPS). A higher PE ratio indicates that investors are willing to pay more for each dollar of earnings, which could suggest that the stock is overvalued. Conversely, a lower PE ratio suggests that the stock may be undervalued.

How to Use the PE Ratio to Identify Undervalued Stocks

Compare the PE Ratio to the Industry Average: To determine if a stock is undervalued, compare its PE ratio to the industry average. If the stock's PE ratio is significantly lower than the industry average, it may be undervalued.

Consider Historical PE Ratios: Look at the stock's historical PE ratio to see if it is currently trading below its long-term average. This can help you identify if the stock is undervalued relative to its past performance.

Analyze the PE Ratio in Context: It's important to consider the broader economic and market conditions when analyzing the PE ratio. For example, during a bear market, lower PE ratios may be more common, making it more challenging to identify undervalued stocks.

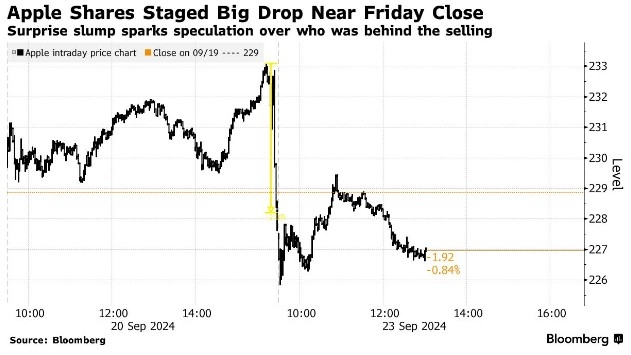

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. As of this writing, Apple's PE ratio is 27.4, compared to the technology industry average of 29.3. This suggests that Apple may be undervalued relative to its peers. Additionally, Apple's PE ratio has historically been around 30, so the current ratio is lower than its long-term average, further supporting the notion that the stock may be undervalued.

Additional Factors to Consider

While the PE ratio is a valuable tool for identifying undervalued stocks, it's important to consider other factors as well. These may include:

- Earnings Growth: Look for companies with strong earnings growth prospects, as this can drive stock prices higher.

- Dividend Yield: Companies with a high dividend yield can provide additional income to investors.

- Valuation Metrics: Consider other valuation metrics, such as the Price-to-Book (PB) ratio and Enterprise Value (EV)/EBITDA ratio, to get a more comprehensive picture of a stock's value.

Conclusion

Using the US PE ratio to determine undervalued stocks is a valuable strategy for investors. By comparing the PE ratio to the industry average, analyzing historical PE ratios, and considering other factors, you can make informed investment decisions. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Can US Investors Buy Shenzhen Stock? A Comprehensive Guide

next:nothing

like

- Can US Investors Buy Shenzhen Stock? A Comprehensive Guide

- Title: TGIF Stock US: Unveiling the Potential of US Stocks for the Week-End

- Title: National Stock Exchange US: The Cornerstone of America's Financial Ma

- Market Cap of the US Stock Market in 2015: A Look Back

- Understanding US Capital Gains Tax on Stock Options

- How Much is 1 Penny US Dollars in the Stock Market Today?

- Investing in ETF US Value Stocks: A Strategic Approach

- BOFA Hartnett US Stock Flows: A Deep Dive into the Current Market Trends

- Ukraine Russia US Stock Market: How the Conflict Impacts American Investors

- Unh Us Stock: The Ultimate Guide to Understanding and Investing in U.S. Stocks

- Understanding US Large Cap Stocks Sector Classification

- 2025 US Stock Market Holidays Schedule: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

US PE Ratio to Determine Undervalued Stock: A

US PE Ratio to Determine Undervalued Stock: A

Title: "http stocks.us.reuters.com st

Trump Us Stocks: How the President's Poli

Title: Defense Us Stocks: A Strategic Approach

MedMen US Stock Market: A Comprehensive Analys

http stocks.us.reuters.com stocks fulldescript

US Magnesium LLC Stock Price: A Comprehensive

Major US Airlines Stock: A Comprehensive Analy

The Last of Us 2 Out of Stock: A Comprehensive

US Corps of Engineers Stocking: Ensuring Prepa

The First Stock Market in the US: A Pivotal Mi

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Us Penny Stock Tips: How to Navigate the World"

- Title: US Stock Market Time: Understanding the"

- Title: Total US Stock Market Capitalization 20"

- Title: EU vs US Stock Market: A Comprehensive "

- Seafood Stocks US: The Impact of Aquaculture o"

- TPG US Stock: A Comprehensive Guide to Underst"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Title: Defense Us Stocks: A Strategic Approach"

- Unh Us Stock: The Ultimate Guide to Understand"

- Convert Us Air Stock Certificates: A Comprehen"