you position:Home > new york stock exchange > new york stock exchange

Understanding the Power of US Large Stock Index Funds

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Investing in the stock market can be an intimidating endeavor for many, especially those new to the world of finance. One investment vehicle that has gained significant popularity among investors is the US large stock index fund. These funds offer a unique blend of diversification, accessibility, and potential for growth, making them an appealing choice for investors of all levels. In this article, we will delve into the intricacies of US large stock index funds, exploring their benefits, risks, and the best strategies for investing in them.

What is a US Large Stock Index Fund?

A US large stock index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific large-cap index, such as the S&P 500. These funds are designed to provide investors with exposure to a basket of large-cap companies, which are typically well-established and financially stable. By investing in a large stock index fund, investors gain access to the broader market, allowing them to benefit from the overall growth of the economy.

Benefits of Investing in US Large Stock Index Funds

- Diversification: One of the primary advantages of investing in a large stock index fund is diversification. By investing in a wide range of companies across various industries, investors can reduce their exposure to the risks associated with individual stocks.

- Accessibility: US large stock index funds are easily accessible to individual investors. Many of these funds are available through online brokers and financial institutions, making it simple for investors to get started.

- Potential for Growth: Large-cap companies often have strong financial performance and growth prospects, making them a valuable investment for long-term investors.

- Low Fees: Many US large stock index funds have low fees, which can help maximize returns over time.

Risks of Investing in US Large Stock Index Funds

- Market Risk: Like all investments, US large stock index funds are subject to market risk, which is the potential for the overall market to decline.

- Lack of Control: Investors in index funds do not have the ability to choose individual stocks, which means they are subject to the performance of the entire index.

- Expense Ratios: While many US large stock index funds have low fees, some may have higher expense ratios, which can eat into returns over time.

Strategies for Investing in US Large Stock Index Funds

- Long-Term Investing: To maximize returns, consider investing in US large stock index funds for the long term. The stock market has historically shown significant growth over the long term, making long-term investing a sound strategy.

- Diversify Your Portfolio: Consider incorporating US large stock index funds into a well-diversified portfolio that includes other asset classes, such as bonds or real estate, to further reduce risk.

- Regular Contributions: Consider using dollar-cost averaging, which involves making regular contributions to your investment account. This strategy can help mitigate the impact of market volatility and potentially lower your average cost per share.

Case Studies

- Vanguard S&P 500 ETF (VOO): This ETF tracks the performance of the S&P 500 index and has become one of the most popular US large stock index funds among investors. Since its inception in 2001, VOO has generated an average annual return of 10.3%.

- iShares Core S&P 500 ETF (IVV): This ETF also tracks the S&P 500 index and has low fees, making it an attractive option for investors seeking exposure to the U.S. stock market.

In conclusion, US large stock index funds offer a valuable investment opportunity for investors looking to gain exposure to the broader market while enjoying the benefits of diversification and accessibility. By understanding the risks and employing the right strategies, investors can potentially achieve strong long-term returns through these funds.

so cool! ()

last:Best US Stocks to Scalp Today: Your Ultimate Guide to Quick Gains

next:nothing

like

- Best US Stocks to Scalp Today: Your Ultimate Guide to Quick Gains

- Title: Unlocking Growth: The Power of US Bank Stock Secured Loan

- Shell Stock in US: A Comprehensive Guide to Investing in Royal Dutch Shell

- Top 100 Cheapest Stocks in the US Market: A Comprehensive Guide

- How Can I Buy US Stocks?

- 2025 US Stock Market Crash: Reasons and Implications

- Prefilled Xmas Stockings US: The Ultimate Guide to Finding the Perfect Gift

- Stocks.US.Reuters.Com: A Detailed Analysis of Aby.O

- Title: Top Momentum Stocks in the US Market: Past 5 Days (October 2025)

- Title: Impact of US Government Shutdown on Indian Stock Market

- 2022 US Stock Forecast: What to Expect and How to Prepare

- Cryptocurrency on US Stock Exchange: The Emerging Trend

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding the Power of US Large Stock Inde

Understanding the Power of US Large Stock Inde

Invest in Us Oil Stocks: A Smart Move for Your

Title: Buying Stocks in Taiwan Stock Exchange:

How Can Canadians Buy US Stocks?

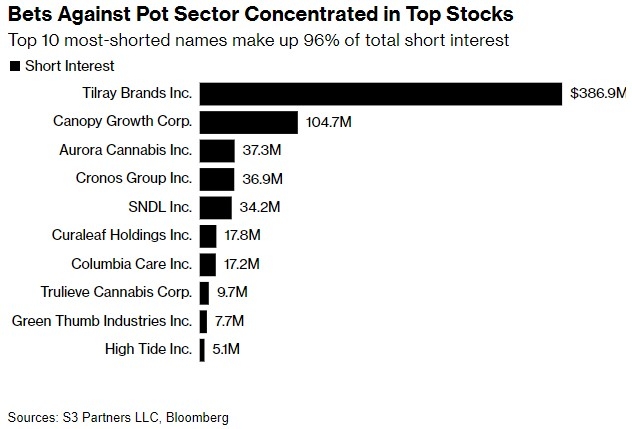

Most Shorted Stocks in the US: A Deep Dive int

Kirkland Signature Chicken and Rice Cat Food 2

Marine Harvest US Stock: An In-Depth Analysis

Robot Stocks in the US: Revolutionizing the In

Artificial Intelligence: A Game-Changer for US

Tlt Us Stock: Your Ultimate Guide to Trading S

Halifax Stocks and Shares ISA Contact Us: Your

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How Much Is the US Stock Market Down?"

- US Stock Earnings Announcements: The Key to In"

- Shell Stock in US: A Comprehensive Guide to In"

- Stock R Us Cebu: Your Ultimate Destination for"

- 3 Major Stock Exchanges in the US: A Comprehen"

- How to Invest in US Stocks from HDFC Securitie"

- Understanding the iShares S&P Total U."

- Us Penny Stock Tips: How to Navigate the World"

- US Large Cap Stocks: Highest Gains Past Week M"

- Can an NRA Gift Us Stock? Understanding the Po"