you position:Home > new york stock exchange > new york stock exchange

2025 US Stock Market Crash: Reasons and Implications

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The stock market is often unpredictable, and experts are always on the lookout for potential risks. As we approach 2025, concerns about a possible US stock market crash are growing. This article delves into the potential reasons behind such a crash and the potential implications it could have on the economy and investors.

Economic Factors

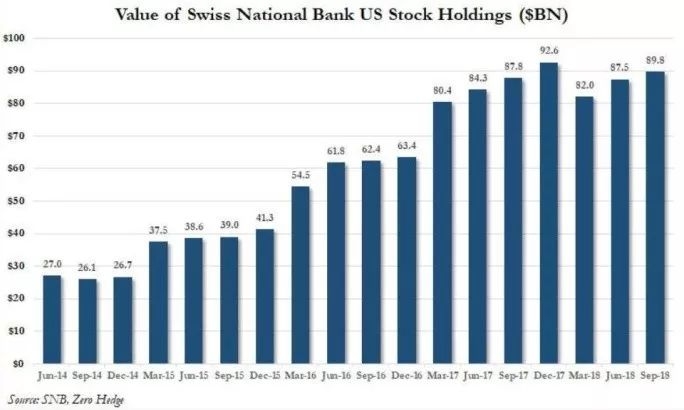

One of the primary reasons for a stock market crash is economic instability. In the case of a 2025 US stock market crash, several economic factors could contribute to such a downturn:

- Inflation: Rising inflation can erode purchasing power and lead to a decrease in consumer spending. This can have a negative impact on corporate earnings and, subsequently, stock prices.

- Interest Rates: The Federal Reserve has been increasing interest rates to combat inflation. However, higher interest rates can lead to increased borrowing costs for businesses, which can negatively impact their profitability.

- Trade Wars: Tensions between the US and other major economies, such as China, could lead to trade wars, which can disrupt global supply chains and affect corporate earnings.

Market Factors

Several market factors could also contribute to a potential stock market crash in 2025:

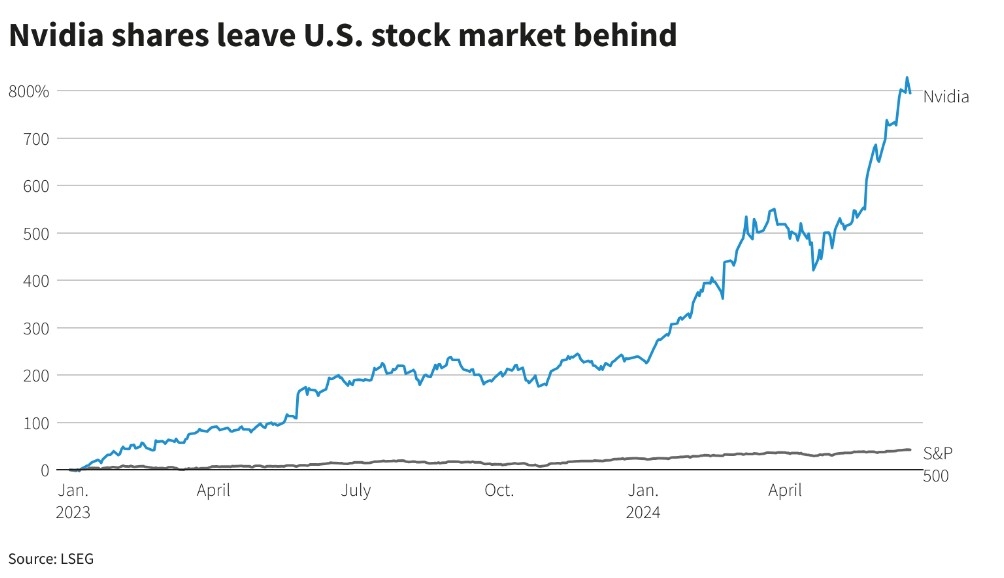

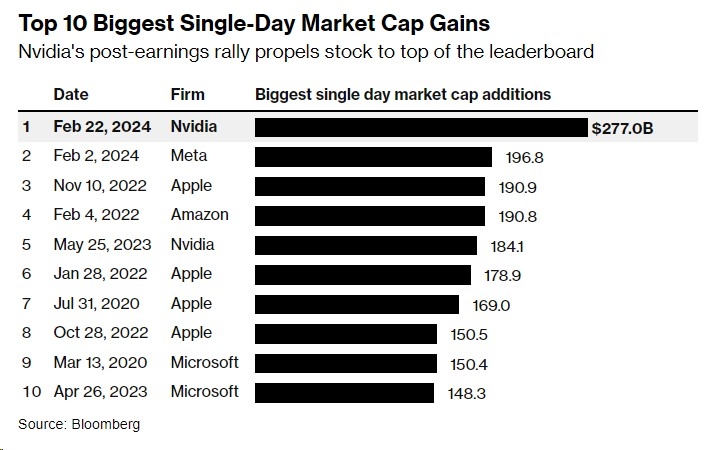

- Tech Bubble: The tech industry has been a major driver of the stock market's growth over the past decade. However, a bubble in the tech sector could burst, leading to a significant decline in stock prices.

- Market Speculation: Excessive speculation in certain sectors or stocks can lead to irrational price movements and an eventual crash.

- Volatility: Increased market volatility can make it difficult for investors to predict market movements, leading to uncertainty and a potential crash.

Political Factors

Political instability can also have a significant impact on the stock market:

- Political Turmoil: Civil unrest or political turmoil can lead to economic uncertainty, which can negatively impact the stock market.

- Regulatory Changes: Changes in regulations, particularly in the financial sector, can create uncertainty and lead to a potential crash.

Case Studies

Historical events, such as the 2008 financial crisis, provide valuable lessons about the potential causes of a stock market crash. In the case of the 2008 crash, a combination of factors, including the housing bubble, excessive risk-taking by financial institutions, and regulatory failures, contributed to the downturn.

Conclusion

While it is difficult to predict the future with certainty, it is important for investors to be aware of the potential risks and take appropriate measures to protect their investments. By understanding the potential reasons for a 2025 US stock market crash, investors can better prepare themselves for potential market downturns and make informed decisions to protect their wealth.

so cool! ()

like

- Prefilled Xmas Stockings US: The Ultimate Guide to Finding the Perfect Gift

- Stocks.US.Reuters.Com: A Detailed Analysis of Aby.O

- Title: Top Momentum Stocks in the US Market: Past 5 Days (October 2025)

- Title: Impact of US Government Shutdown on Indian Stock Market

- 2022 US Stock Forecast: What to Expect and How to Prepare

- Cryptocurrency on US Stock Exchange: The Emerging Trend

- How to Invest in Stocks from Outside the US

- Tlt Us Stock: Your Ultimate Guide to Trading Stocks in the U.S.

- Graphene Stocks 2016 on US Exchanges: A Comprehensive Review

- Toys "R" Us Canada Stock Price: A Comprehensive Analysis

- Rare Earth US Stocks to Buy: A Guide to Investing in the Future

- Total US Stock Fund: A Comprehensive Guide to Understanding and Investing

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

2025 US Stock Market Crash: Reasons and Implic

2025 US Stock Market Crash: Reasons and Implic

Current US Stock Market Outlook: Navigating th

Unlocking the Secrets of US Liquor Stock: A Co

Stocks.US.Reuters.Com: A Detailed Analysis of

US Large Cap Stocks: Highest Gains Past Week M

What Time Does the US Stock Market Open?

Title: US Stock Market 2017 Chart: A Comprehen

Ant Group Stock US: A Deep Dive into the Finan

The Number of Companies Listed on US Stock Exc

CATL Stock US: Understanding the Market Dynami

TPG US Stock: A Comprehensive Guide to Underst

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Leverage Stock US: A Strategic Guide to"

- Stock Market Cap to GDP: An Insight into the U"

- NSE Offering US Stocks: A Game-Changer for Glo"

- Title: Historical US Stock Market Performance "

- US Solar Stock Performance in May 2025: A Deep"

- US Navy Stocking: A Comprehensive Guide to Nav"

- 2018 US Stock Market Summary: A Comprehensive "

- LG on US Stock Exchange: A Comprehensive Guide"

- US Army Christmas Stocking: A Symbol of Holida"

- Title: US Cushing Stocks: The Cornerstone of E"