you position:Home > new york stock exchange > new york stock exchange

Dow Jones 20 Year Historical Chart: A Comprehensive Insight

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The 20 Year Historical Chart of the Dow Jones is a vital tool for investors and analysts alike. It offers a detailed view of the stock market's performance over two decades, revealing trends and insights that can inform investment decisions.

Understanding the Dow Jones

First, let's clarify what the Dow Jones is. The Dow Jones Industrial Average (DJIA), often just called the "Dow," is a price-weighted average of 30 large publicly traded companies in the United States. It's a widely recognized barometer of the U.S. economy and a benchmark for market performance.

Why is the 20-Year Historical Chart Important?

The 20-year historical chart of the Dow Jones is a critical resource for investors and traders for several reasons:

- Long-term Trends: This chart allows investors to analyze the long-term performance of the market. It helps identify patterns and trends that might not be visible on shorter-term charts.

- Market Cycles: The 20-year chart shows the broader market cycles, such as bull markets and bear markets, which can provide valuable insights into market psychology and economic conditions.

- Comparison: It enables investors to compare the current market performance with past trends, which can help predict future movements.

Key Insights from the Dow Jones 20 Year Historical Chart

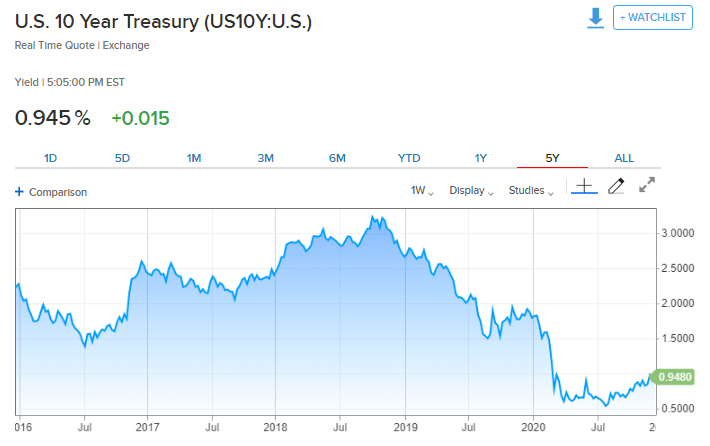

- Bull Markets and Bear Markets: The chart clearly illustrates the periods of bull and bear markets over the past two decades. For example, the tech boom in the late 1990s, followed by the 2008 financial crisis, and the subsequent recovery.

- Market Volatility: The chart shows periods of high market volatility, such as the financial crisis and the COVID-19 pandemic. These periods can significantly impact investor sentiment and decision-making.

- Economic Factors: The chart reflects major economic factors, such as interest rates, inflation, and geopolitical events, which have influenced the market.

Analyzing the Chart: A Case Study

Let's take a closer look at the Dow Jones 20-year historical chart using the tech bubble as an example:

- Tech Bubble (1998-2000): During this period, the Dow Jones soared, driven by high expectations for technology companies. However, this bubble eventually burst, leading to a significant market downturn.

- Post-Bubble Recovery (2002-2007): After the burst, the market experienced a gradual recovery. This period was characterized by low interest rates and strong economic growth.

- 2008 Financial Crisis: The Dow Jones fell sharply during the financial crisis, reflecting the broader economic downturn.

- Post-Crisis Recovery (2009-Present): The market has recovered strongly since the crisis, with the Dow Jones reaching record highs.

Conclusion

The Dow Jones 20-year historical chart is a valuable tool for understanding the long-term performance of the stock market. By analyzing the chart, investors can gain valuable insights into market trends, cycles, and economic factors that can inform their investment decisions. Remember, while historical data can provide guidance, it's important to stay informed and adapt to changing market conditions.

so cool! ()

like

- 500 to US: The Ultimate Guide to Converting Currency and Understanding its Implic

- S and P Chart History: A Deep Dive into Quality Control's Evolution"

- India Stock ETF in the US: A Lucrative Investment Opportunity"

- Yahoo Finance: Your Ultimate Resource for Investment Insights and Market Analysis

- How to Buy Nintendo Stock in the US: A Step-by-Step Guide

- Basic Stock Market: A Comprehensive Guide for Beginners

- Dow Past 5 Years: A Comprehensive Analysis of the Stock Market's Performance

- In-Depth Analysis of ZLAB.O: A Look into the Stock's Performance and Potenti

- Understanding Stocks Market Futures: A Comprehensive Guide

- Best Stock Advice: Unveiling the Secrets to Investment Success"

- Accessing Option Trading US Stocks from Australia: A Comprehensive Guide

- US Shariah Compliant Stocks List: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Dow Jones 20 Year Historical Chart: A Comprehe

Dow Jones 20 Year Historical Chart: A Comprehe

Stock Trading in the US: A Comprehensive Guide

July 2025 US Stock Market Outlook: A Comprehen

Russia Stock in US: A Comprehensive Guide to I

In-Depth Analysis of Qtwwq.pk: A Look into Reu

Unveiling the Potential of Us Energy Developme

Deutsche Bank US Stock Market: A Comprehensive

Short Positions on US Stocks: A Strategic Appr

LG Uplus Corp US Stock: A Comprehensive Guide

Top Stock in US: How to Identify and Invest in

Title: Khiron Stock Yahoo US: A Comprehensive

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Dis Stock Us News: The Latest on Disruptive St"

- How Did the Stock Market Do Today in the US?"

- CNN Money Markets: A Comprehensive Guide to Un"

- Teva Pharma Stock: A Comprehensive Analysis of"

- Unlock the Secrets of "Stock for Amon"

- Stocks and Shares ISA: A Comprehensive Guide f"

- Us Stock Market Account Opening: A Comprehensi"

- What is Dow Jones All-Time High: Understanding"

- Is Stock Market Open Tomorrow in US?"

- US Momentum Stocks to Watch in 2025: A Strateg"