you position:Home > new york stock exchange > new york stock exchange

Momentum Stocks: US Large Cap RSI Analysis

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

In the dynamic world of stock trading, identifying momentum stocks is crucial for investors seeking to capitalize on market trends. This article delves into the realm of US large cap stocks and analyzes their Relative Strength Index (RSI) to determine their potential for growth. By understanding the RSI and its application to large cap stocks, investors can make informed decisions about their investments.

Understanding RSI

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is commonly used to identify overbought or oversold conditions in a stock. An RSI above 70 is typically considered overbought, indicating that a stock may be due for a pullback. Conversely, an RSI below 30 is often viewed as oversold, suggesting a potential for a price rebound.

Analyzing US Large Cap Stocks

When analyzing US large cap stocks, it's essential to consider their RSI values to gauge their momentum. Large cap stocks are typically those with a market capitalization of over $10 billion, and they often represent the most significant companies in their respective industries. By focusing on these stocks, investors can gain exposure to established companies with strong fundamentals.

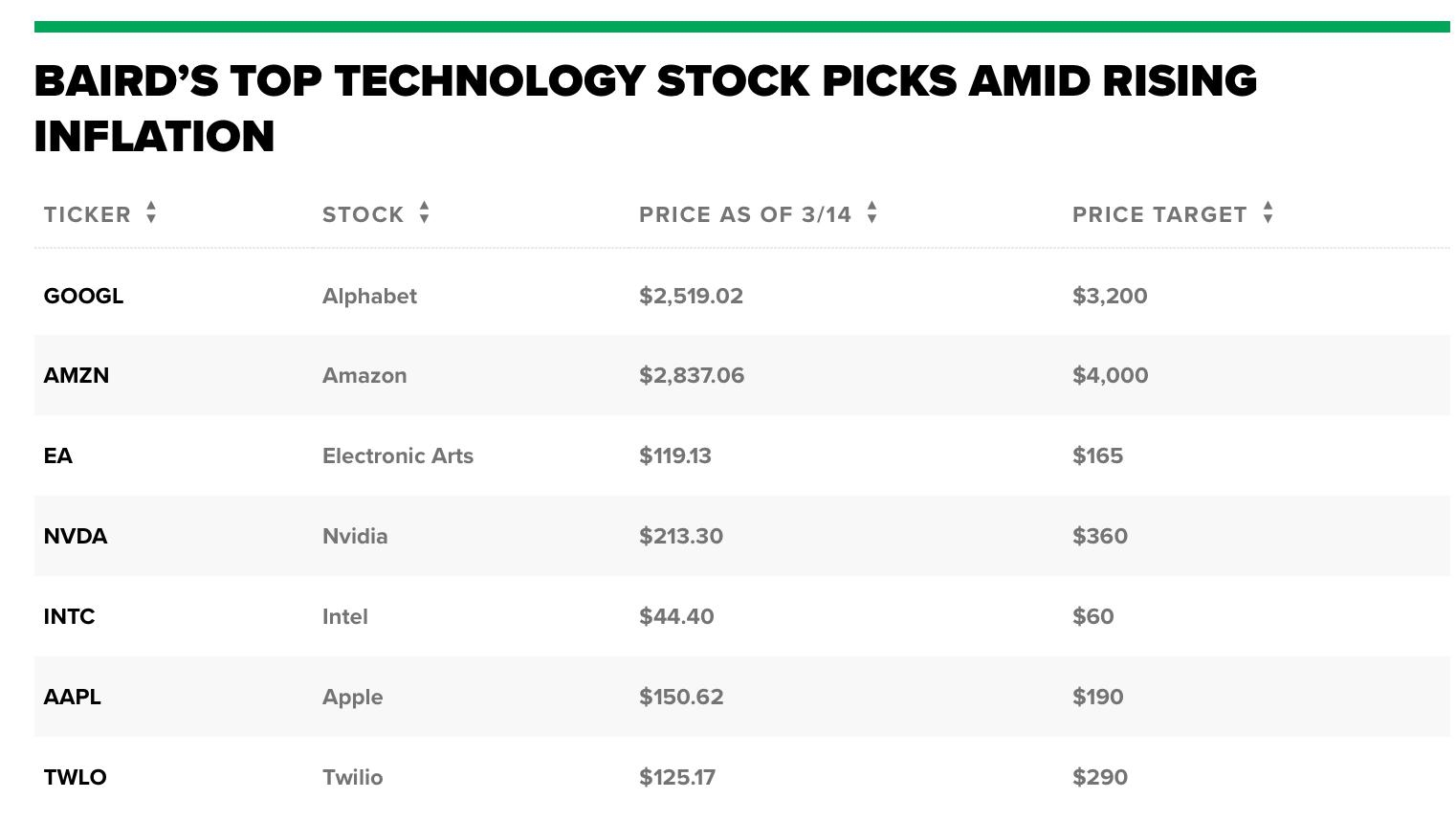

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL), a leading technology company with a market capitalization of over $2 trillion. Over the past year, Apple's RSI has fluctuated between 30 and 70, indicating that the stock has experienced both overbought and oversold conditions. During periods when the RSI was above 70, the stock experienced pullbacks, while periods below 30 saw price rebounds.

Interpreting RSI Signals

When analyzing the RSI of a large cap stock, it's crucial to pay attention to the signals it provides. For example, if a stock's RSI falls below 30, it may be a good entry point for investors looking to capitalize on a potential rebound. Conversely, if the RSI rises above 70, it may be an indication to take profits or consider selling the stock.

RSI and Market Trends

In addition to analyzing individual stocks, the RSI can also be used to identify broader market trends. For instance, if the RSI of the S&P 500 index is above 70, it may indicate that the market is overbought and due for a pullback. Conversely, an RSI below 30 may suggest that the market is oversold and poised for a rebound.

Conclusion

In conclusion, the RSI is a valuable tool for analyzing momentum stocks, particularly in the realm of US large cap stocks. By understanding how to interpret RSI signals and applying them to large cap stocks, investors can make informed decisions about their investments. As always, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Unlocking the Potential of BND: A Deep Dive into the BND Stock

next:nothing

like

- Unlocking the Potential of BND: A Deep Dive into the BND Stock

- Best Stocks to Invest in 2017: Top Picks for US Investors

- "US Silica Stock Quote: The Ultimate Guide to Investing in the Industria

- Maximizing Returns with the Among Us App Stock: A Comprehensive Guide

- Invest in US Stock Market Easily: A Step-by-Step Guide

- How to Trade US Stocks from Nigeria: A Comprehensive Guide

- Japanese Real Estate Companies List in US Stock Market: A Comprehensive Guide

- US Small Cap Stock Index: A Lucrative Investment Avenue for Risk-Takers

- Maximizing Returns: Understanding US Stock Investment in India

- Top 7 Best Stocks to Invest in the US Now

- List of US Stocks Available on Etoro: Your Ultimate Guide

- Us Ecology Inc Stock: A Comprehensive Analysis

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Momentum Stocks: US Large Cap RSI Analysis

Momentum Stocks: US Large Cap RSI Analysis

Title: "US Steel Stock Value: Current

Tech Stocks: US Indexes Lower Amid Market Vola

Halifax Stocks and Shares ISA Contact Us: Your

Bloomberg Stocks US: A Comprehensive Guide to

U.S.-China Trade Deal Stocks to Buy: Top Inves

US Stock Market August 26, 2025 Summary

Unilever Stock Price US: Key Factors Influenci

Understanding the Role of Social Security Numb

Maximize Your Trading Potential with the Ultim

"http stocks.us.reuters.com stocks fu

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Steel Stock Price Forecast 2019: Insights a"

- Current US Stock Market Trends: A Comprehensiv"

- Can an Australian Invest in the US Stock Marke"

- Semiconductor Companies in US Stock: A Compreh"

- The NYSE's Institutional Ownership: A Key"

- How to Buy Nintendo Stock in the US: A Step-by"

- Title: US China Trade Tensions Stocks: Underst"

- Stocks.US.Reuters.Com: Full Description of KEM"

- AMC Stock US: A Comprehensive Guide to Underst"

- Title: Comprehensive List of All US Stock Symb"