you position:Home > new york stock exchange > new york stock exchange

Understanding Tradable Shares: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's fast-paced financial markets, the concept of tradable shares has become a cornerstone for investors and traders alike. Whether you're a seasoned pro or a beginner looking to dive into the stock market, understanding what tradable shares are and how they work is crucial. This article will delve into the essence of tradable shares, their benefits, and the factors to consider when investing in them.

What Are Tradable Shares?

Tradable shares, also known as trading shares, are stocks that can be bought and sold on a stock exchange. When you purchase tradable shares, you become a shareholder in the company and have the right to receive dividends and potentially participate in the company's growth. These shares represent a portion of the ownership in the company and can be easily bought and sold by investors.

Benefits of Tradable Shares

One of the primary benefits of tradable shares is their liquidity. Unlike some other types of investments, tradable shares can be bought and sold quickly, making them a flexible investment option. This liquidity allows investors to react swiftly to market changes and capitalize on opportunities.

Diversification

Another key advantage of tradable shares is the potential for diversification. By investing in a variety of tradable shares, you can spread your risk across different industries and sectors. This diversification can help protect your portfolio from the volatility of individual stocks.

Access to Dividends

Many companies that issue tradable shares also offer dividends. Dividends are payments made to shareholders from the company's profits and can provide a steady stream of income. Investing in tradable shares with a history of paying dividends can be an excellent way to generate passive income.

Factors to Consider When Investing in Tradable Shares

Before diving into the world of tradable shares, it's important to consider several factors:

1. Research

Thorough research is essential when selecting tradable shares. Look into the company's financial health, industry trends, and market performance. Consider factors like revenue growth, profitability, and management team.

2. Risk Tolerance

Your risk tolerance will play a significant role in determining which tradable shares to invest in. High-risk stocks can offer high returns, but they also come with a higher likelihood of loss. Assess your risk tolerance and invest accordingly.

3. Investment Goals

Your investment goals will also influence your choice of tradable shares. Are you looking for long-term growth or short-term gains? Do you prefer income-generating investments? Understanding your goals will help you make informed decisions.

Case Studies

To illustrate the benefits and challenges of tradable shares, let's consider a few case studies:

Apple Inc.: As one of the most successful companies in the world, Apple Inc. offers tradable shares with strong performance and a history of paying dividends. However, the stock's volatility can make it a risky investment for some.

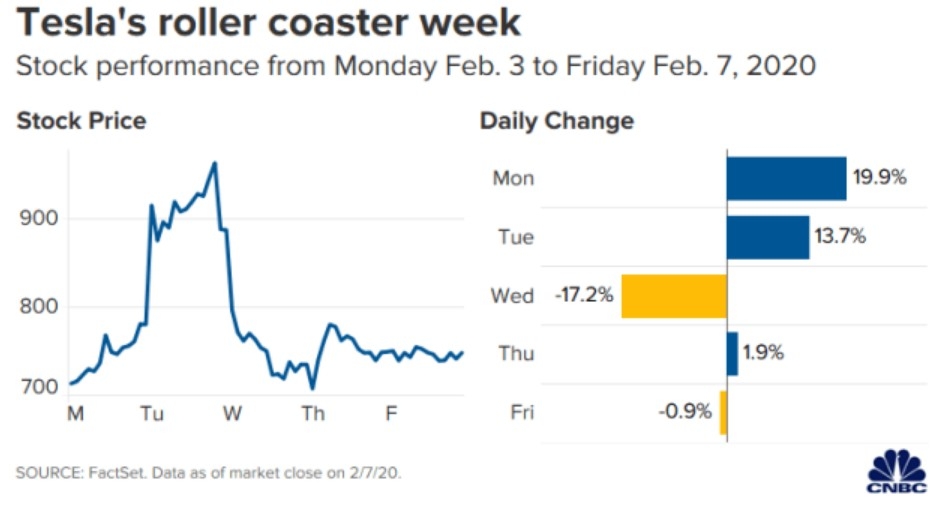

Tesla Inc.: Tesla has gained a reputation for its innovative electric vehicles and renewable energy solutions. While the company's tradable shares have seen significant growth, they also come with high volatility and risk.

In conclusion, tradable shares offer numerous benefits, including liquidity, diversification, and the potential for dividends. However, it's crucial to conduct thorough research and consider your risk tolerance and investment goals before investing. By understanding the intricacies of tradable shares, you can make informed decisions and potentially achieve your financial objectives.

so cool! ()

last:Understanding Stock Inflation: A Comprehensive Guide

next:nothing

like

- Understanding Stock Inflation: A Comprehensive Guide

- Banks Stocks: A Comprehensive Guide to Understanding US Bank Investments

- Unlocking the Power of the Dow Jones Year to Date Return

- Exploring the Future of Gold: GDXJ Stocks on Reuters

- Unlock the Power of Free US Government Stock Photos"

- Yahoo Stock Price History Chart: A Comprehensive Overview

- Trader Live": Mastering the Art of Live Trading

- What is the Stock Market Doing Right Now? Live Updates!

- Largest Weekly Drop in Two Years: US Stock Market Takes a Dramatic Plunge

- US Marijuana Penny Stocks: The NASDAQ Opportunity

- Stock Movers Today: Unveiling the Most Impressive Market Movements

- US Stock Futures Market News: Key Developments & Insights"

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding Tradable Shares: A Comprehensive

Understanding Tradable Shares: A Comprehensive

NSE Offering US Stocks: A Game-Changer for Glo

Title: US HIMARS Stock: A Lucrative Investment

Stocks to Buy if the US Goes to War

The Last of Us 2 Out of Stock: A Comprehensive

Walmart Shares Slip as S&P 500 Gains M

July 6, 2025: A Pivotal Day in the US Stock Ma

Unlocking the Pre-Market Stock US: Your Ultima

US Silver Stocks: A Comprehensive Guide to Inv

GDC Stock US: Unveiling the Potential of a Ris

Title: US Booze Stocks: A Comprehensive Guide

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Steel Co Stock Price Today: Key Insights an"

- Title: Small Cap Clean Energy Stocks: A Bright"

- Toys "R" Us Seasonal Overnig"

- Examples of US Mid Cap Stocks: A Comprehensive"

- How to Buy US Stocks from the Philippines: A C"

- Buying U.S. OTC Stocks in Poland: A Comprehens"

- Aurora Stock Chart US: Unveiling the Potential"

- Walmart Shares Slip as S&P 500 Gains M"

- Is the US Stock Market Open? Understanding Mar"

- First 24-Hour US Stock Exchange Approved: Revo"