you position:Home > new york stock exchange > new york stock exchange

Banks Stocks: A Comprehensive Guide to Understanding US Bank Investments

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving financial landscape of the United States, investing in bank stocks has become a crucial component for many investors. The term "banks stocks US" encapsulates the vast world of banking and financial institutions that offer a unique blend of stability and growth potential. This article delves into the nuances of investing in bank stocks in the US, highlighting key factors, market trends, and strategies for potential investors.

Understanding Bank Stocks

Firstly, it's essential to grasp what bank stocks represent. Bank stocks are shares of ownership in a bank or financial institution. When you invest in bank stocks, you become a partial owner of the company, entitled to a portion of its profits and voting rights in certain corporate decisions.

Key Factors to Consider

Several factors influence the performance of bank stocks. These include:

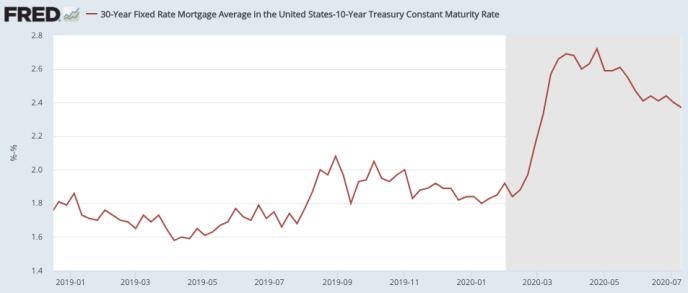

- Interest Rates: Banks earn income from the difference between the interest they charge on loans and the interest they pay on deposits. Fluctuations in interest rates can significantly impact their profitability.

- Economic Conditions: The overall economic climate plays a pivotal role in determining the performance of bank stocks. Economic growth tends to lead to increased lending and, consequently, higher profits for banks.

- Regulatory Environment: Banking regulations can have a substantial impact on the operations and profitability of banks. Changes in regulations can either benefit or hinder their performance.

Market Trends

Understanding current market trends is crucial for making informed investment decisions. Here are some key trends in the US banking sector:

- Digital Transformation: Many banks are investing heavily in technology to enhance customer experience and streamline operations. This trend is expected to continue, driving growth in the sector.

- Mergers and Acquisitions: The US banking industry has seen a wave of mergers and acquisitions in recent years. These consolidations aim to improve efficiency, expand market share, and increase profitability.

- Regulatory Compliance: Banks must comply with a myriad of regulations, which can be costly and time-consuming. However, regulatory compliance is essential for maintaining stability and reputation.

Investment Strategies

Investing in bank stocks requires a well-thought-out strategy. Here are some tips for potential investors:

- Diversify Your Portfolio: Investing in a variety of bank stocks can help mitigate risk. Focus on banks across different regions, asset sizes, and business models.

- Research and Analyze: Conduct thorough research on individual banks and the broader banking sector. Look for companies with strong fundamentals, including profitability, capital adequacy, and management quality.

- Stay Informed: Keep up-to-date with market trends, economic indicators, and regulatory changes that could impact the banking industry.

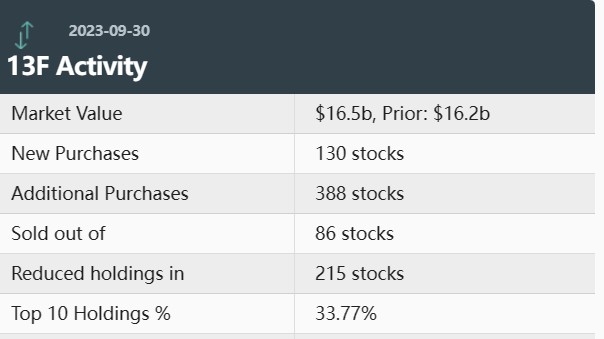

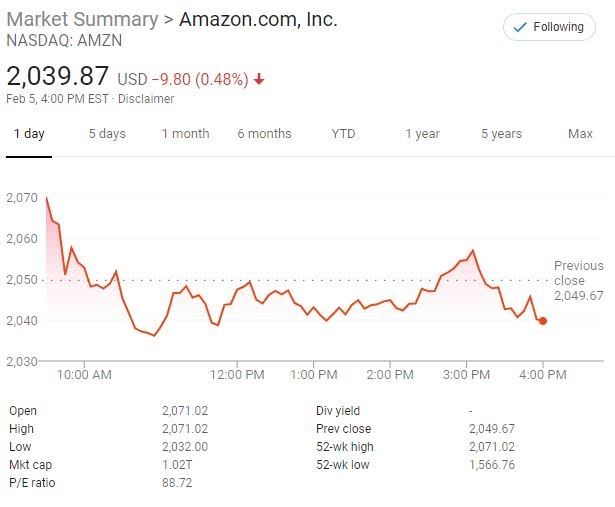

Case Study: JPMorgan Chase

To illustrate the potential of investing in bank stocks, consider JPMorgan Chase (NYSE: JPM), one of the largest banks in the US. JPMorgan Chase has a long history of strong performance, driven by its diverse business lines, global reach, and innovative approach to banking.

Since its inception in 2000, JPMorgan Chase has experienced significant growth, with its stock price more than doubling. This growth can be attributed to the bank's focus on innovation, strong management, and a diversified revenue stream.

In conclusion, investing in bank stocks in the US offers a unique opportunity for investors seeking stability and growth potential. By understanding key factors, market trends, and investment strategies, investors can make informed decisions and potentially reap substantial returns.

so cool! ()

last:Unlocking the Power of the Dow Jones Year to Date Return

next:nothing

like

- Unlocking the Power of the Dow Jones Year to Date Return

- Exploring the Future of Gold: GDXJ Stocks on Reuters

- Unlock the Power of Free US Government Stock Photos"

- Yahoo Stock Price History Chart: A Comprehensive Overview

- Trader Live": Mastering the Art of Live Trading

- What is the Stock Market Doing Right Now? Live Updates!

- Largest Weekly Drop in Two Years: US Stock Market Takes a Dramatic Plunge

- US Marijuana Penny Stocks: The NASDAQ Opportunity

- Stock Movers Today: Unveiling the Most Impressive Market Movements

- US Stock Futures Market News: Key Developments & Insights"

- Loc 5635 1st Avenue Stock Island FL US: A Premier Commercial Hub

- US Stock Market Bull Runs: What You Need to Know

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Banks Stocks: A Comprehensive Guide to Underst

Banks Stocks: A Comprehensive Guide to Underst

SoftBank US Stock: A Comprehensive Guide to In

Td Group Us Holdings Llc Stock: A Comprehensiv

Exploring the Heart of American Finance: The N

UK Stock Tax: How It Helps Your US Company Tax

Stock Invest: Top 100 Companies in the United

Nes Classic Toys R Us Stock: The Ultimate Guid

US Oil Companies Stock Prices: What You Need t

Goldman Sachs US Stock Forecast: Key Insights

About Us Stock Image: Capturing the Essence of

Are Chinese Stocks Affected by US Stocks?&

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Hot Stocks to Watch in the US and Canada: Top "

- Current US Stock Market Index: A Comprehensive"

- US Midterm Elections 2018: How Did They Impact"

- Best Online Broker to Buy US Stocks: Your Ulti"

- Super Stock Honda 2000 US Nationals: A Thrilli"

- Travel Stocks: US Investors' New Frontier"

- US Stock Market Bull Runs: What You Need to Kn"

- How to Invest in the US Stock Market from Indi"

- Can U.S. Citizens Invest in the Indian Stock M"

- Momentum Stocks: US Large Cap 5-Day Performanc"