you position:Home > new york stock exchange > new york stock exchange

Top Alcohol Stocks in the US: Investing Opportunities Unveiled

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the bustling world of investment, the alcohol industry has often been overlooked. However, with a growing consumer base and evolving market trends, investing in alcohol stocks in the US could be a game-changer for your portfolio. This article delves into the top alcohol stocks, their market potential, and the factors that make them stand out.

Bacardi Ltd. (BAC)

Bacardi Ltd., a global leader in spirits, has a strong presence in the US market. The company's diverse portfolio, which includes rum, vodka, and cognac, has helped it maintain a competitive edge. Bacardi's commitment to innovation and expansion has not only secured its position as a market leader but has also opened up new revenue streams.

Constellation Brands, Inc. (STZ)

Constellation Brands is another significant player in the US alcohol industry. Known for its extensive portfolio of beer, wine, and spirits, the company has successfully navigated the market's challenges. Constellation's strategic acquisitions and focus on premium products have propelled its growth, making it a compelling investment option.

Diageo PLC (DIG)

Diageo, a British multinational beverage company, has a significant footprint in the US. The company's diverse range of spirits, including Johnnie Walker, Smirnoff, and Captain Morgan, has made it a favorite among consumers. Diageo's focus on emerging markets and its commitment to sustainability have further strengthened its position in the industry.

Anheuser-Busch InBev SA/NV (BUD)

As the world's largest brewer, Anheuser-Busch InBev offers a wide array of beer brands, including Budweiser, Bud Light, and Michelob Ultra. The company's strong distribution network and global reach have contributed to its market dominance. Anheuser-Busch's focus on innovation and its ability to adapt to changing consumer preferences have made it a reliable investment choice.

Case Study: Brown-Forman Corporation (BF.B)

Brown-Forman Corporation, known for its Jack Daniel's whiskey and Southern Comfort, has been a consistent performer in the US alcohol industry. The company's strategic approach to marketing and its commitment to product innovation have helped it maintain its market leadership. For instance, its acquisition of Woodford Reserve Distillery in 2012 has significantly boosted its premium whiskey portfolio.

Factors to Consider When Investing in Alcohol Stocks

When considering alcohol stocks, it's crucial to evaluate several factors:

- Market Trends: Stay updated with the latest market trends and consumer preferences.

- Financial Health: Assess the financial stability and growth potential of the company.

- Regulatory Environment: Be aware of the regulatory landscape that could impact the industry.

In conclusion, investing in alcohol stocks in the US can be a rewarding venture. With the right analysis and strategy, you can identify promising opportunities in this dynamic industry. Remember, while alcohol stocks can offer significant returns, they also come with inherent risks. Conduct thorough research and consider seeking professional advice before making investment decisions.

so cool! ()

like

- US Large Cap Stocks Near 52 Week Lows: A Golden Opportunity in October 2024

- US Steel Co Stock Price Today: Key Insights and Analysis

- Understanding US Bancorp Preferred Stock Series B: A Comprehensive Guide

- US Missile Stocks: A Comprehensive Guide to Investing in Defense

- Stake Us Stocks: The Ultimate Guide to Investing in American Equity

- Toys "R" Us Stock Price in 2005: A Look Back at the Retail Gian

- Stock Options Tax Rate: A Comprehensive Look at Historical Data in the US&quo

- Best App to Buy Stocks in the US: Your Ultimate Guide

- Buying U.S. Stocks from Nigeria: A Guide to Investment Opportunities

- US Pacific Marine Mammal Stock Assessments 2017: Comprehensive Overview and Insig

- In-Depth Analysis of ROP Stock: What You Need to Know"

- Maximizing Returns: Top US Engineering Firm Stocks to Watch

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

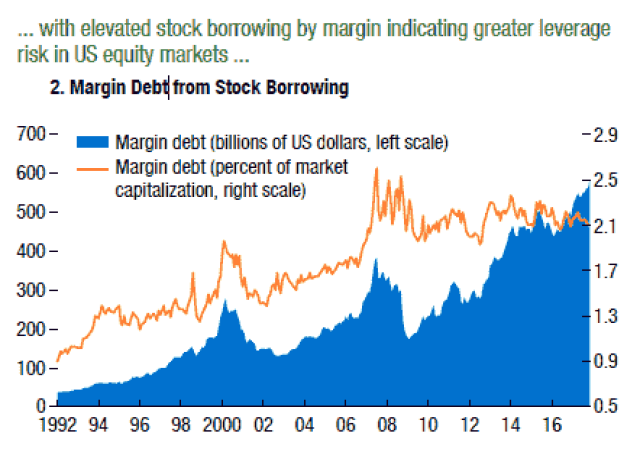

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Top Alcohol Stocks in the US: Investing Opport

Top Alcohol Stocks in the US: Investing Opport

US Bank vs Wells Fargo Stock: A Comprehensive

Major Stock Indexes in the US: A Comprehensive

Understanding the iShares S&P Total U.

Us Investors Eyeing Toronto Stock Exchange for

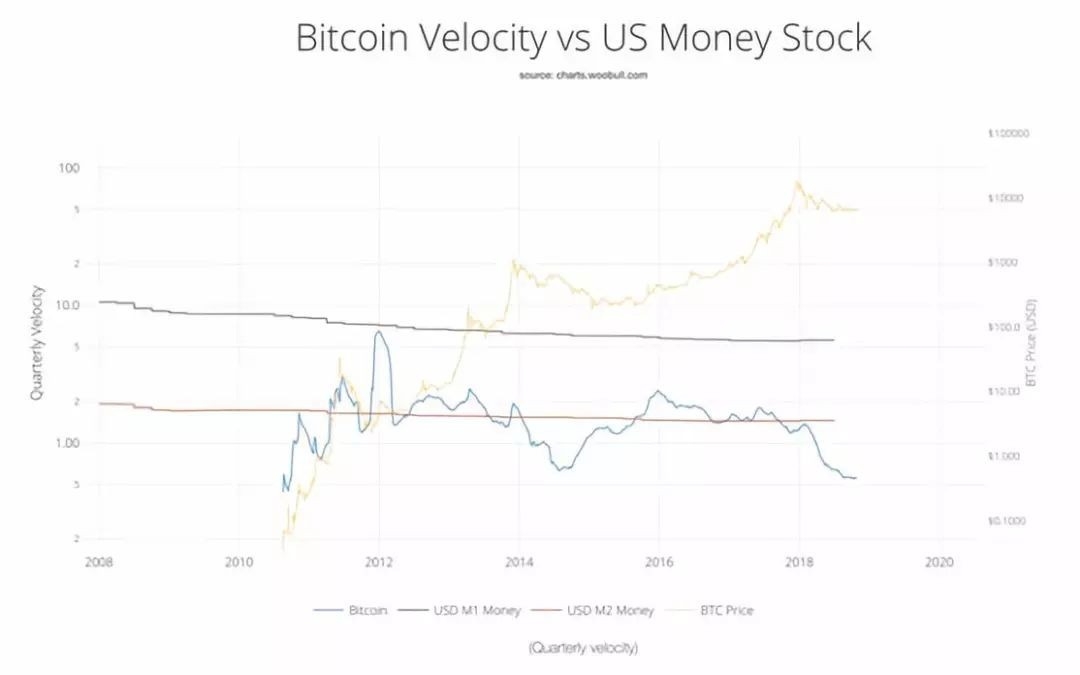

US Stock Market and Bitcoin: A Comprehensive A

Taiwan Stock in US: A Comprehensive Guide for

AMD US Stock Market: An In-Depth Analysis

Bilibili US Stock: A Comprehensive Analysis

Nestle US Stock Symbol: A Comprehensive Guide

US Growth Stocks: Are They Really Cheaper Than

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- http stocks.us.reuters.com stocks fulldescript"

- Title: Stock Price in US Recession 2001: A Com"

- Addy Us Stock: The Ultimate Guide to Investing"

- Does US Stocks Give Dividends? Understanding D"

- Title: Mednax US Stocks: A Comprehensive Guide"

- US Retirement Funds Heavy on Stocks Brace for "

- US Delist Stocks: Understanding the Reasons an"

- "US Bank Stocks with Low PE Ratio in "

- US Oil Companies Stock Prices: What You Need t"

- US Army Christmas Stocking: A Heartwarming Tra"