you position:Home > new york stock exchange > new york stock exchange

Title: Stock Price in US Recession 2001: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction: The year 2001 marked a significant downturn in the US economy, commonly referred to as the dot-com bubble burst and the 9/11 attacks. This recession had a profound impact on various sectors, including the stock market. In this article, we delve into the stock price trends during the 2001 recession, exploring the factors that contributed to the decline and the subsequent recovery.

Stock Market Performance in 2001:

The stock market experienced a sharp decline during the 2001 recession. The S&P 500, a widely followed benchmark index, dropped by approximately 45% from its peak in March 2000 to its trough in October 2002. This decline can be attributed to several factors:

Dot-Com Bubble Burst: The rapid growth of internet companies in the late 1990s led to a speculative bubble in the stock market. As investors realized that many of these companies were not profitable and lacked sustainable business models, the bubble burst, causing a significant drop in stock prices.

9/11 Attacks: The terrorist attacks on September 11, 2001, had a profound impact on the stock market. The attacks led to increased uncertainty and fear, causing investors to sell off their stocks en masse. The S&P 500 fell by 14.3% on the day of the attacks and continued to decline in the following weeks.

Economic Slowdown: The recession was characterized by a slowdown in economic growth, with GDP contracting by 0.8% in 2001. This slowdown was primarily driven by reduced consumer spending, lower business investment, and a tightening of credit conditions.

Factors Contributing to the Stock Market Recovery:

Despite the sharp decline in stock prices, the US stock market began to recover in 2002. This recovery can be attributed to several factors:

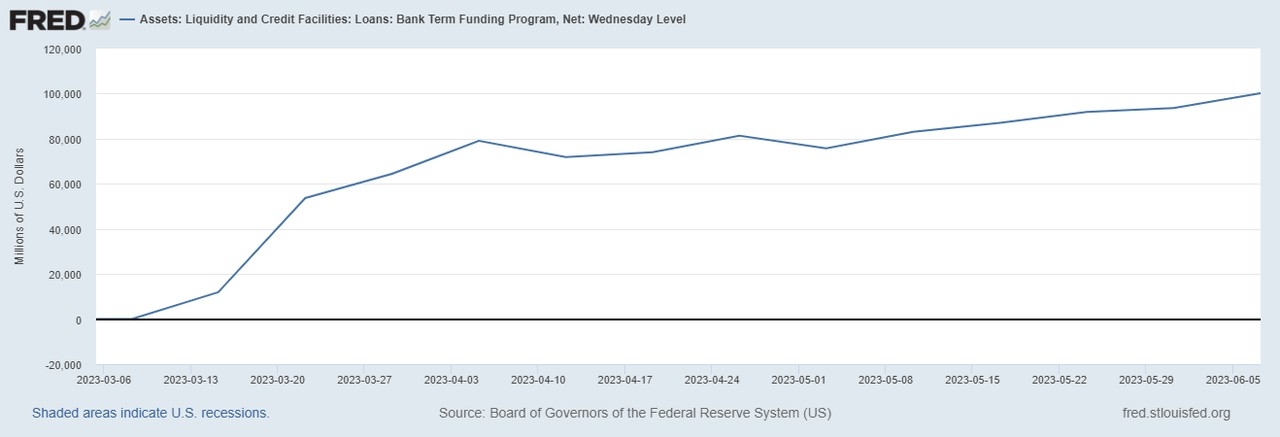

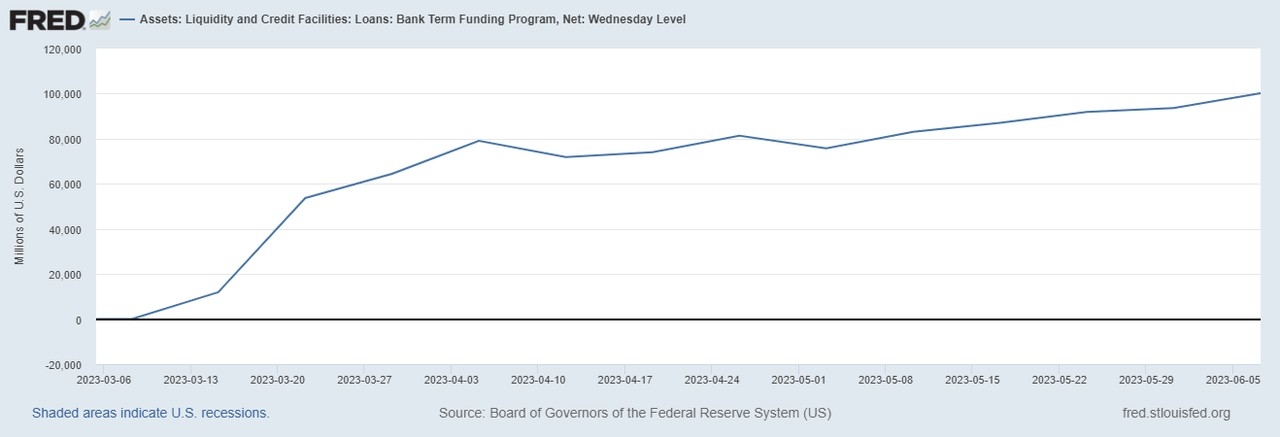

Monetary Policy: The Federal Reserve responded to the recession by lowering interest rates, which helped stimulate economic growth and boost investor confidence.

Corporate Profits: Many companies began to focus on cost-cutting and efficiency measures, which helped improve their profitability. This, in turn, led to higher stock prices.

Technology Advances: The dot-com bubble may have burst, but the technology sector continued to evolve and innovate. Companies like Apple and Microsoft emerged as market leaders, driving growth and stability in the stock market.

Case Study:

One notable example of a company that performed well during the 2001 recession was Wal-Mart. Despite the economic downturn, Wal-Mart's stock price increased by approximately 20% from 2001 to 2002. This can be attributed to several factors:

Cost Leadership: Wal-Mart's strategy of offering low prices and efficient operations helped it maintain strong sales during the recession.

Diversification: Wal-Mart's product offerings extended beyond groceries, including clothing, electronics, and home goods, which helped it attract a broad customer base.

Strong Management: Wal-Mart's management team focused on executing its business strategy effectively, which contributed to its success during the recession.

Conclusion: The 2001 recession had a significant impact on the US stock market, with stock prices falling sharply. However, the market eventually recovered, driven by factors such as monetary policy, corporate profitability, and technological advances. By understanding the factors that contributed to the stock market's performance during this period, investors can gain valuable insights into the dynamics of the market and make informed decisions.

so cool! ()

last:New Millennium Steel Dynamics: A Deep Dive into US Stock Price Trends

next:nothing

like

- New Millennium Steel Dynamics: A Deep Dive into US Stock Price Trends

- Title: Best US Stocks to Buy Now for Long-Term Investment

- 10 US Stocks to Buy for Long-Term Investment

- Iraq Agrees to Establish a Strategic Stock Exchange with the US

- Airbnb Stock Price: A Comprehensive Analysis

- 2018 US Stock Market Summary: A Comprehensive Review

- Chinese Companies Listed on the US Stock Exchange: An Insight into the Growing In

- RAAS Stock US: A Comprehensive Guide to Understanding the Market Dynamics

- US Presidential Election: How It Affects the Stock Market

- Bloomberg Stocks US: A Comprehensive Guide to Understanding the U.S. Stock Market

- Us Penny Stock Tips: How to Navigate the World of Micro-Cap Investments

- Title: "US Steel Stock Value: Current Trends and Future Projections&

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Institutional Investors Net Sellers of US Stoc"

- Best US Value Stocks: Unveiling the Hidden Gem"

- Title: Best US Stocks to Buy Now for Long-Term"

- Current US Stock Market Outlook: Navigating th"

recommend

Title: Stock Price in US Recession 2001: A Com

Title: Stock Price in US Recession 2001: A Com

Is the US Stock Market Open on Columbus Day?

Best Stocks to Buy Today: US Markets Analysis

Understanding the Ishares US Preferred Stock E

Can I Buy US Stocks with CAD?

Chinese Companies Listed on the US Stock Excha

Top Momentum Stocks: September 2025 US Large C

Does US Stocks Give Dividends? Understanding D

New Millennium Steel Dynamics: A Deep Dive int

LG Chem Stock in US Dollars: A Comprehensive G

CATL Stock US: Understanding the Market Dynami

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: EU vs US Stock Market: A Comprehensive "

- Gold Stocks: A Lucrative Investment in the US "

- AMD US Stock Market: An In-Depth Analysis"

- Bloomberg Stocks US: A Comprehensive Guide to "

- Amazon B Stock US: A Comprehensive Guide to Un"

- Top Momentum Stocks: September 2025 US Large C"

- Best Stocks to Buy Today: US Markets Analysis"

- Best Quantum Computing Stocks in the US"

- Momentum Stocks: Best Performing Large Cap US "

- Invest in Us Oil Stocks: A Smart Move for Your"