you position:Home > new york stock exchange > new york stock exchange

US Retirement Funds Heavy on Stocks Brace for Losses

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial market, American retirement funds are facing a pivotal moment. With a significant portion of these funds heavily invested in stocks, investors and financial advisors alike are bracing for potential losses. This article delves into the reasons behind this concern and examines the potential impact on retirement savings.

The Current Scenario

Stock Market Volatility has been a hallmark of recent years. While stocks have historically offered high returns, the volatile nature of the market has led to uncertainty. Retirement funds that heavily rely on stocks are now at risk of deteriorating value due to market fluctuations.

Investment Diversification has been a cornerstone of sound financial planning. However, many retirement funds have been over-reliant on stocks, neglecting other investment vehicles such as bonds, real estate, and commodities. This over-exposure to stocks has left these funds vulnerable to market downturns.

Market Analysis

Several factors contribute to the current market volatility:

- Economic Uncertainty: The global economic landscape is fraught with uncertainty, with factors such as trade tensions, political instability, and economic downturns playing a significant role.

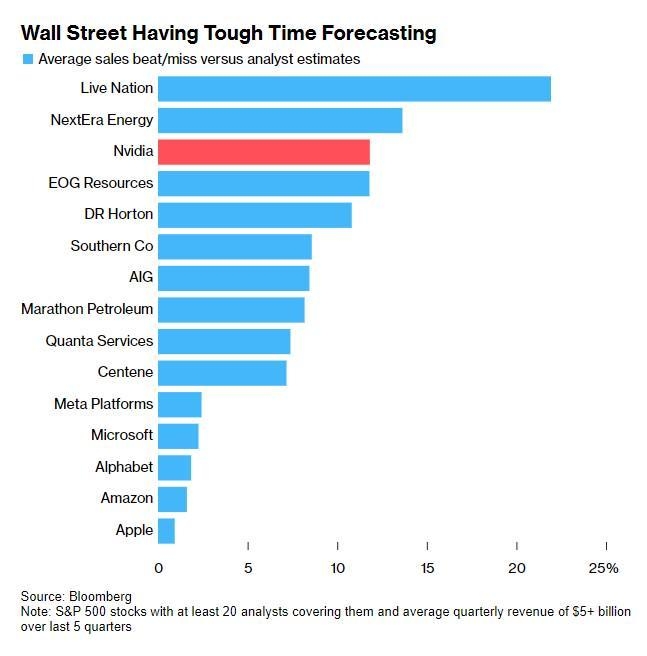

- Tech Stock Decline: The tech sector, which has been a major driver of stock market growth, has recently experienced a decline in value, impacting retirement funds heavily invested in this sector.

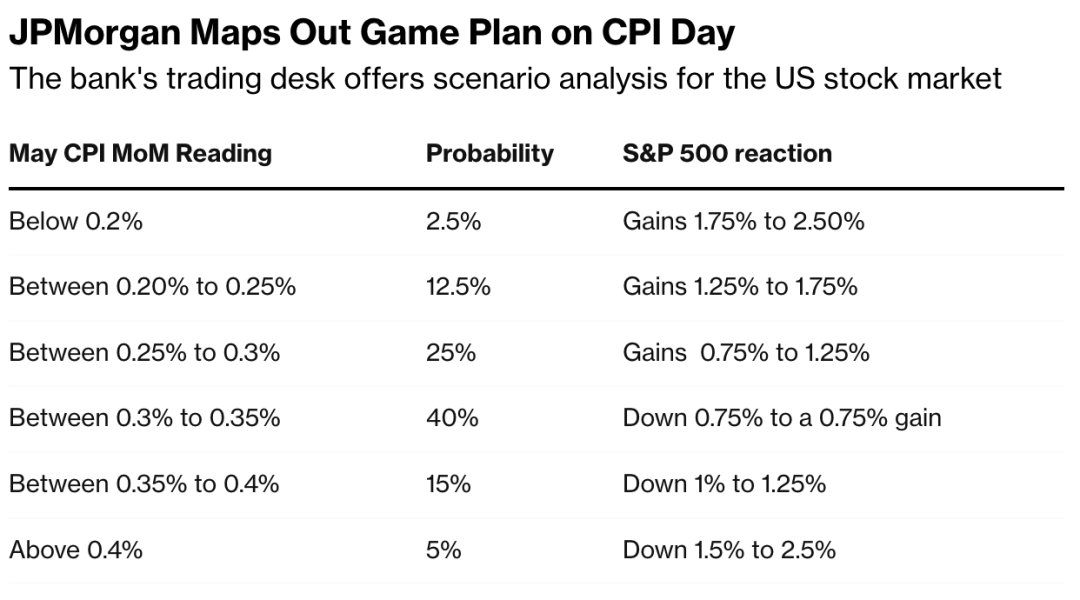

- Interest Rate Hikes: The Federal Reserve's decision to hike interest rates has adversely affected stock prices, as higher rates make borrowing more expensive and reduce the attractiveness of stocks.

Impact on Retirement Savings

The potential losses in retirement funds could have severe implications for future retirement savings. Individuals who are nearing retirement age may find their savings significantly diminished, making it challenging to maintain their desired lifestyle in their golden years.

Case Study

Consider the hypothetical case of John, a 65-year-old retiree who had his retirement fund heavily invested in stocks. Over the past year, the stock market has experienced significant volatility, leading to a loss in the value of his retirement fund. This situation has left John worried about his financial security in retirement.

Strategies for Mitigating Risk

To mitigate the risk of potential losses, financial advisors recommend the following strategies:

- Diversify Your Investments: Investing in a variety of assets can help offset the risk associated with any single investment.

- Review Your Portfolio Regularly: Regularly reviewing and adjusting your portfolio can help ensure that it aligns with your risk tolerance and investment goals.

- Seek Professional Advice: Consulting with a financial advisor can provide valuable insights and guidance on managing your retirement fund.

In conclusion, the heavy reliance on stocks in retirement funds has left many investors bracing for potential losses. Understanding the risks and implementing sound investment strategies is crucial for ensuring financial security in retirement.

so cool! ()

last:Best US Aluminum Stocks: Top Picks for Investors in 2023

next:nothing

like

- Best US Aluminum Stocks: Top Picks for Investors in 2023

- Strong Fundamentals: Why US Stocks Are a Solid Investment

- Small Stock Investment for Non-US Citizens: A Guide to Global Opportunities

- Best Dividend Stocks in the US Market: Top Picks for 2023

- In-Depth Analysis: AEPi.O Stock Performance and Future Outlook

- US Stock Collapse 2015: A Deep Dive into the Market's Turmoil

- Unlocking the Potential of Knorr Co Stock: A Deep Dive into the US Stock Market

- Understanding the Daily Volume of the US Stock Market

- Best US Penny Stocks to Buy in 2017: Top Picks for Investors

- Trade US Stocks from Indonesia: A Comprehensive Guide

- Us Stock Broker Philippines: Your Gateway to Global Investment Opportunities&

- Progreen US Stock: A Sustainable Investment Opportunity

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Retirement Funds Heavy on Stocks Brace for

US Retirement Funds Heavy on Stocks Brace for

US Stock Market: Top 5 Must-Know Factors for M

Title: US Border Pot Stocks: The Growing Indus

How to Buy Stock from Canada in the US Online

Top US Mid Cap Stocks: A Guide to Investment O

AMD US Stock Market: A Comprehensive Analysis

Us Laughing Stock: The Misunderstood Side of A

Progreen US Stock: A Sustainable Investment Op

Heat Map US Stock: A Visual Guide to Understan

Title: US Large Cap Momentum Stocks: Top Perfo

Us Stock Market Account Opening: A Comprehensi

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Best Quantum Computing Stocks in the US"

- Ukraine Russia US Stock Market: How the Confli"

- Coronavirus and Us Stock Market: The Unravelin"

- Hot Stocks to Watch in the US and Canada: Top "

- Title: Geometric Average Return of US Stock Ma"

- Toys "R" Us Canada Stock Pri"

- Can I Buy US Stocks with CAD?"

- Prefilled Xmas Stockings US: The Ultimate Guid"

- Taxes on Foreigners Investing in the U.S. Stoc"

- Title: Unlocking Growth: The Power of US Bank "