you position:Home > new york stock exchange > new york stock exchange

How to Do Intraday Trading in US Stocks from India

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are you an aspiring trader in India looking to tap into the vast opportunities of the US stock market? Intraday trading can be a lucrative venture, but navigating the complexities of trading across borders can be daunting. This article will guide you through the process of how to do intraday trading in US stocks from India, providing you with the knowledge and tools to make informed decisions.

Understanding Intraday Trading

What is Intraday Trading? Intraday trading involves buying and selling stocks within the same trading day. This strategy requires a quick and informed decision-making process, as the market can fluctuate rapidly. Traders aim to profit from small price movements within a short time frame.

Navigating the US Stock Market

1. Open a Brokerage Account To begin trading US stocks from India, you need to open a brokerage account with a reputable online brokerage firm. Ensure the broker offers access to US stock exchanges and provides reliable trading platforms.

2. Research and Education Before diving into intraday trading, it's crucial to research and educate yourself about the US stock market. Understand the key differences between the Indian and US markets, such as trading hours, market capitalization, and liquidity.

3. Choose the Right Stocks Identify stocks that align with your trading strategy and risk tolerance. Focus on companies with high liquidity and strong fundamentals. Utilize tools like technical analysis and fundamental analysis to make informed decisions.

Tools and Resources for Intraday Trading

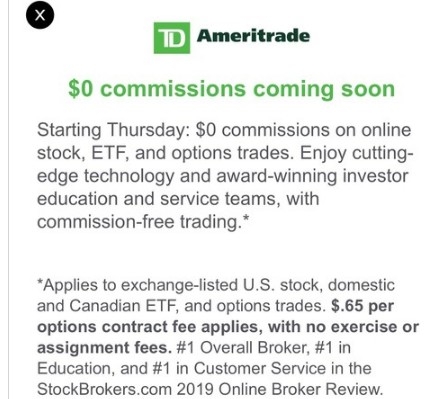

1. Trading Platforms Choose a trading platform that offers real-time data, advanced charting tools, and technical indicators. Popular platforms include TD Ameritrade, E*TRADE, and Charles Schwab.

2. Market Analysis Tools Leverage market analysis tools to stay updated with market trends and news. Use financial news websites, stock market apps, and social media platforms to gather insights.

3. Risk Management Implement risk management strategies to protect your investments. Set stop-loss orders to limit potential losses and avoid over-leverage.

Case Study: Successful Intraday Trading Strategy

Let's consider a hypothetical scenario where a trader in India decides to trade Apple Inc. (AAPL) using an intraday trading strategy.

1. Research and Analysis

2. Entry and Exit Points

Based on their analysis, the trader decides to buy AAPL at

3. Execution and Monitoring

The trader places a buy order for 100 shares of AAPL. As the stock price reaches

4. Review and Adapt After the trade, the trader reviews their strategy and adapts it for future trades. They also analyze their performance and learn from their mistakes.

Conclusion

Intraday trading in US stocks from India requires research, education, and a solid trading strategy. By opening a brokerage account, utilizing the right tools, and managing risks effectively, you can successfully navigate the US stock market. Remember, practice and continuous learning are key to success in intraday trading.

so cool! ()

last:Dow Jones Industrial Average by Day: A Comprehensive Guide

next:nothing

like

- Dow Jones Industrial Average by Day: A Comprehensive Guide

- Top US Construction Stocks to Watch in 2023

- Nvax Yahoo: Revolutionizing the Tech Industry

- US Entertainment Stocks: The Dynamic and Lucrative Landscape

- Unlocking the Potential: Exploring OpenDoor Stock (US)

- Indices of NASDAQ: A Comprehensive Guide to Understanding the NASDAQ Stock Market

- Dow Jones After Hours Market: A Comprehensive Guide

- Dow Jones 20 Year Historical Chart: A Comprehensive Insight

- 500 to US: The Ultimate Guide to Converting Currency and Understanding its Implic

- S and P Chart History: A Deep Dive into Quality Control's Evolution"

- India Stock ETF in the US: A Lucrative Investment Opportunity"

- Yahoo Finance: Your Ultimate Resource for Investment Insights and Market Analysis

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

How to Do Intraday Trading in US Stocks from I

How to Do Intraday Trading in US Stocks from I

Invest in Us Stock Market vs. India: A Compara

How Much Are Our Tower Stream Stocks Worth in

Brcc US Stock: A Comprehensive Guide to Invest

Largest Weekly Drop in Two Years: US Stock Mar

Impact of Tariffs on the US Stock Market: A Co

Understanding the Dynamics of US Pot Stock Pri

The First Stock Market in the US: A Pivotal Mi

Navigating US Capital Gains Tax on Stock Sales

US Stock Exchange Chart: A Comprehensive Analy

In-Depth Analysis of Snap Inc.'s Stock Pe

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- MSN Stock Ticker: Your Ultimate Guide to Real-"

- Understanding US Energy Stocks ETF: A Comprehe"

- How to Buy Nintendo Stock in the US: A Step-by"

- The Stock Market Crash: A Brief Look into US H"

- IPOs March 2020: A Deep Dive into the US Stock"

- "http stocks.us.reuters.com stocks fu"

- US Stock Market August 26, 2025 Summary"

- Loc 5635 1st Avenue Stock Island FL US: A Prem"

- "June 2025 US Stock Market Forecast: "

- Joint Stock Companies: A Pivotal Force in U.S."