you position:Home > new york stock exchange > new york stock exchange

Dow Jones After Hours Market: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the fast-paced world of finance, staying ahead of the curve is crucial. One of the most vital tools for investors is the Dow Jones After Hours Market, which provides real-time updates on the market's performance even after the regular trading session has ended. This guide will delve into what the Dow Jones After Hours Market is, how it works, and why it's essential for investors looking to make informed decisions.

Understanding the Dow Jones After Hours Market

The Dow Jones After Hours Market, often abbreviated as DJAH, is an electronic trading platform that allows investors to trade stocks, futures, and other financial instruments outside of the regular trading hours. This means that you can buy or sell assets 24 hours a day, 5 days a week, even when the stock exchanges are closed.

How Does the Dow Jones After Hours Market Work?

The DJAH operates similarly to the regular trading market, with a few key differences. Here's a breakdown of how it works:

- Real-Time Updates: Just like during regular trading hours, the DJAH provides real-time updates on stock prices, market indexes, and other financial data.

- Electronic Trading: All transactions are conducted electronically, ensuring quick and efficient trading.

- No Physical Exchanges: Unlike the traditional stock exchanges, the DJAH doesn't have a physical location. It operates entirely online.

Why is the Dow Jones After Hours Market Important?

The Dow Jones After Hours Market offers several benefits for investors:

- Stay Ahead of the Curve: By trading after hours, you can react quickly to market news and events that may impact your investments.

- Access to Global Markets: The DJAH allows you to trade assets from around the world, giving you a broader investment portfolio.

- Risk Management: You can use the after-hours market to manage risks by adjusting your portfolio before the next trading day.

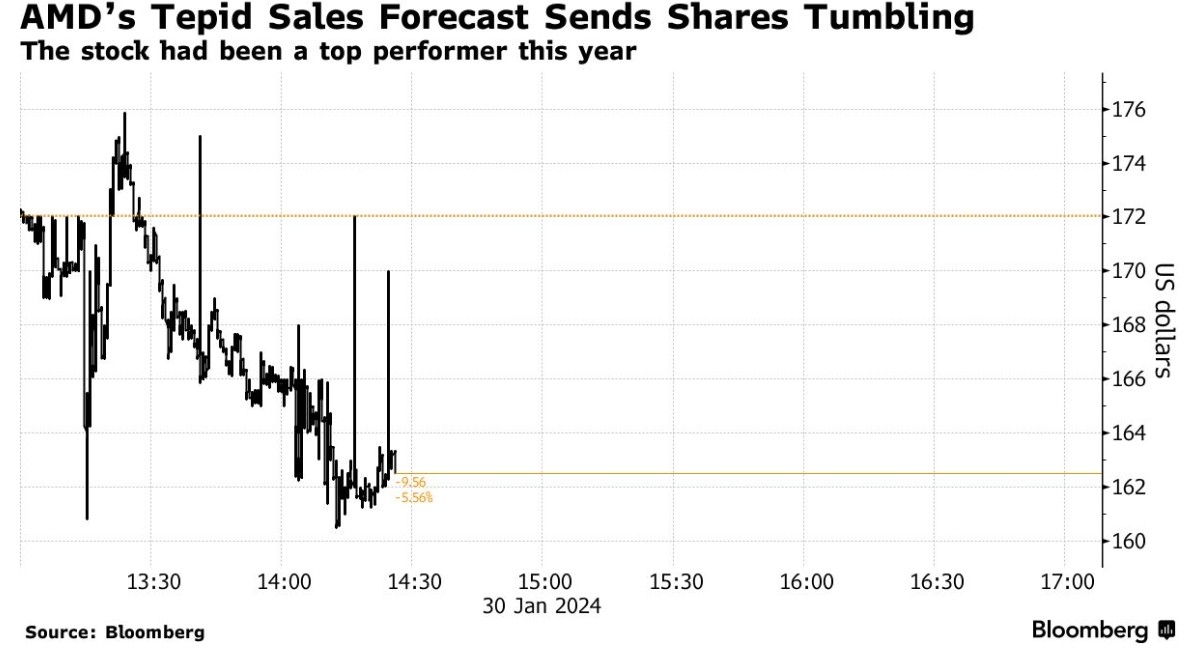

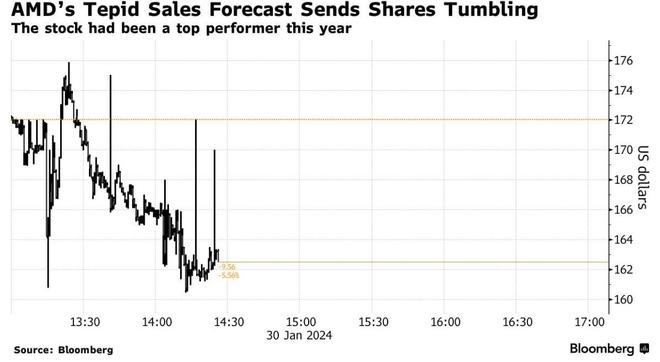

Case Study: Reacting to After-Hours News

Consider a scenario where a major company releases disappointing earnings reports after the regular trading session ends. If you're aware of this news and have access to the Dow Jones After Hours Market, you can take immediate action to adjust your portfolio and minimize potential losses.

How to Access the Dow Jones After Hours Market

To trade in the DJAH, you'll need to open an account with a brokerage firm that offers after-hours trading. Once you have an account, you can access the market through the brokerage's platform or a third-party trading app.

Conclusion

The Dow Jones After Hours Market is a powerful tool for investors looking to stay informed and make informed decisions. By understanding how it works and the benefits it offers, you can leverage this valuable resource to enhance your investment strategy. Whether you're a seasoned investor or just starting out, the Dow Jones After Hours Market is an essential tool for navigating the complex world of finance.

so cool! ()

last:Dow Jones 20 Year Historical Chart: A Comprehensive Insight

next:nothing

like

- Dow Jones 20 Year Historical Chart: A Comprehensive Insight

- 500 to US: The Ultimate Guide to Converting Currency and Understanding its Implic

- S and P Chart History: A Deep Dive into Quality Control's Evolution"

- India Stock ETF in the US: A Lucrative Investment Opportunity"

- Yahoo Finance: Your Ultimate Resource for Investment Insights and Market Analysis

- How to Buy Nintendo Stock in the US: A Step-by-Step Guide

- Basic Stock Market: A Comprehensive Guide for Beginners

- Dow Past 5 Years: A Comprehensive Analysis of the Stock Market's Performance

- In-Depth Analysis of ZLAB.O: A Look into the Stock's Performance and Potenti

- Understanding Stocks Market Futures: A Comprehensive Guide

- Best Stock Advice: Unveiling the Secrets to Investment Success"

- Accessing Option Trading US Stocks from Australia: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Dow Jones After Hours Market: A Comprehensive

Dow Jones After Hours Market: A Comprehensive

Buy LVMH Stock in US: A Smart Investment Move

Empower Clinics Stock: How It's Changing

Current US Stock Market PE Ratio: A Comprehens

Stock Market US Closed Days: Understanding the

Forcast for Us Stock Market: What Experts Say

Unlocking the Potential of US Geothermal Energ

Title: US Magnesium Stock Price: What You Need

Short Term US Stocks to Buy: Top Picks for 202

Unlocking the Potential of IT Stocks in the US

Title: Total Assets in US Stock Market: An In-

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Sibanye Stillwater Stock US: A Comprehensive A"

- Brainsway Stock in US Dollars: A Comprehensive"

- Title: Stock Invest US Free: Your Guide to Fre"

- International Stocks Outperforming US Stocks i"

- How Will the US Elections Affect the Stock Mar"

- Record-Breaking US Stocks Inflows: The Ultimat"

- Stock Price for US Bank: A Comprehensive Guide"

- Us All Stock List: Your Ultimate Guide to Navi"

- Understanding the US Food Stock Price: What Yo"

- Understanding the Stock Symbol: US Anesthesia "