you position:Home > new york stock exchange > new york stock exchange

Can US Central Banks Buy Stocks? A Comprehensive Analysis

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving landscape of global financial markets, the question of whether U.S. central banks can buy stocks has sparked considerable debate. This article delves into the topic, exploring the legal implications, potential benefits, and risks associated with such an action.

Legal Framework

The U.S. Federal Reserve, the central banking system of the United States, is primarily tasked with maintaining the stability of the nation's monetary and financial system. Historically, the Fed's role has been to regulate interest rates, control the money supply, and provide financial services to banks and the federal government. The question of whether the Fed can directly purchase stocks is a complex one, as it involves interpreting the Federal Reserve Act and other regulatory frameworks.

Under the Federal Reserve Act, the Fed's primary responsibilities are to conduct monetary policy, supervise and regulate banks, and provide financial services to the federal government. There is no explicit provision allowing the Fed to directly invest in stocks. However, some argue that the Fed's mandate to maintain financial stability could indirectly lead to stock market interventions.

Potential Benefits

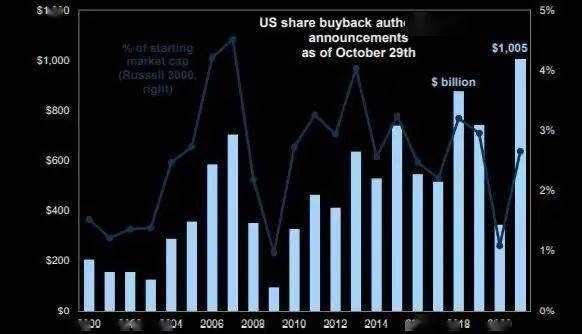

Proponents of the idea suggest that central banks can buy stocks to stabilize the financial system during times of crisis. By injecting capital into the stock market, the Fed could potentially prevent excessive market volatility and support economic growth. This approach is often referred to as "quantitative easing" (QE), where central banks purchase government securities or other financial assets to inject money into the economy.

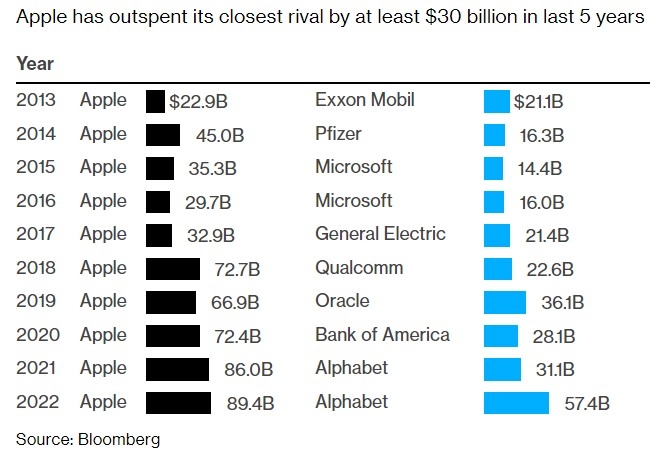

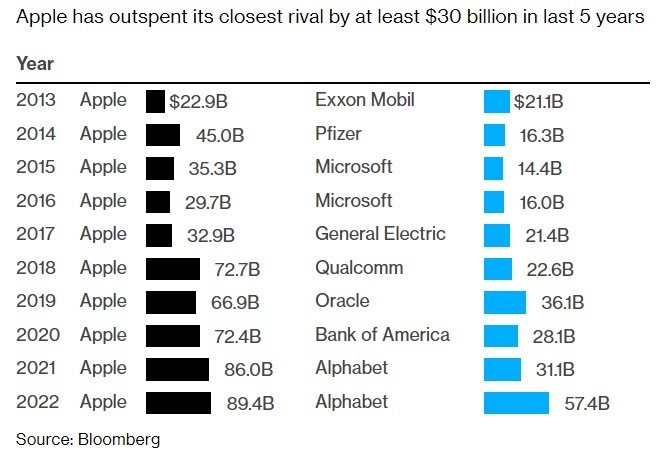

Another argument is that buying stocks can help central banks achieve their inflation and employment goals. By supporting the stock market, which is closely tied to corporate profits and economic activity, the Fed may indirectly foster a more robust economic environment.

Risks and Concerns

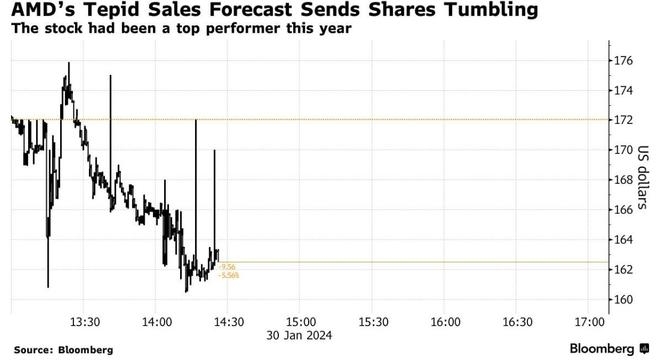

Despite the potential benefits, there are significant risks and concerns associated with central banks buying stocks. One major concern is the potential for moral hazard, where financial institutions may take excessive risks knowing that the central bank will step in to support the market. This could lead to long-term distortions in the financial system and undermine the effectiveness of monetary policy.

Moreover, there is a risk of asset bubbles. If central banks buy stocks, it could drive up asset prices, leading to overvaluation and potential market crashes in the future. This could also create a perception that the central bank is manipulating the market, which could erode public trust in the institution.

Case Studies

One notable example is the Fed's quantitative easing programs during the financial crisis of 2008. While the primary focus was on purchasing government securities, some critics argued that the Fed's actions indirectly supported the stock market. This has sparked a debate on whether the Fed's actions were appropriate and effective.

Another example is the European Central Bank's (ECB) bond purchasing program, known as "quantitative easing," which included the purchase of corporate bonds. While the ECB's program was broader than the Fed's, the underlying principles remain similar.

Conclusion

The question of whether U.S. central banks can buy stocks is a complex one, with both potential benefits and risks. While there is no explicit legal authority allowing the Fed to directly invest in stocks, some argue that the Fed's mandate to maintain financial stability could indirectly lead to such interventions. However, the potential risks and moral hazard concerns make this a topic that requires careful consideration and debate.

so cool! ()

last:US Multibagger Stocks: Top Investment Opportunities for 2023

next:nothing

like

- US Multibagger Stocks: Top Investment Opportunities for 2023

- How Much Foreign Investment in the US Stock Market: A Comprehensive Analysis

- Understanding US Small Company Stock Funds: A Comprehensive Guide from Investoped

- Best Performing US Stocks This Week: Momentum in October 2025

- Top Momentum Stocks to Watch in September 2025: US Market Insights

- Maximize Your Portfolio: The Ultimate Guide to US Large Stock Index Funds&quo

- Unveiling the World of US Cannabis Penny Stocks on Robinhood

- Momentum Stocks: Large Cap US September 2025 Outlook"

- How to Buy US Stocks from the Philippines: A Comprehensive Guide

- US Small Cap Growth Stocks List: Your Guide to High-Potential Investments

- US Stock Market: Bull or Bear? A Comprehensive Analysis

- Unlocking the Potential of CSL US Stock: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Can US Central Banks Buy Stocks? A Comprehensi

Can US Central Banks Buy Stocks? A Comprehensi

Tech Stocks: US Indexes Lower Amid Market Vola

Alexion Pharmaceuticals: A Leader in US Biotec

Meli Us Stock Price: A Comprehensive Analysis

List of Blue Chip Stocks in the US: Your Ultim

Steel Stock US: The Ultimate Guide to Understa

Is the US Stock Market Open on Easter Monday?

Best Stocks to Buy Now: Top Picks for 2023

US Airways Ticket Stock Number: Understanding

Automation Stocks: The Future of Investment in

Current US Stock Market Themes for 2025: A Dee

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- US Stock Indices Today: A Comprehensive Overvi"

- Current Margin Debt in the US Stock Market: An"

- Tech Stocks: US Indexes Lower Amid Market Vola"

- How Much Are Our Tower Stream Stocks Worth in "

- Top 10 Penny Stocks in the US Market: Your Gui"

- Highest Priced Stock in US: A Deep Dive into t"

- DHT-US Stock Price: Insights and Analysis for "

- US Aging Population Stocks: A Lucrative Invest"

- 3 Major Stock Exchanges in the US: A Comprehen"

- All Us Penny Stocks: The Ultimate Guide to Fin"