you position:Home > new york stock exchange > new york stock exchange

US Aging Population Stocks: A Lucrative Investment Opportunity

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the United States, the aging population presents a significant economic shift that is reshaping the stock market. As the Baby Boomer generation retires, their financial needs and lifestyle preferences are creating new investment opportunities. This article delves into the potential of US aging population stocks, offering insights into the most profitable sectors to invest in.

Understanding the Aging Population Trend

The aging population refers to the increase in the number of older adults in a population. In the U.S., this demographic trend is driven by the Baby Boomer generation, born between 1946 and 1964, reaching retirement age. This shift is expected to continue over the next two decades, presenting both challenges and opportunities for investors.

The Impact on the Stock Market

The aging population has a direct impact on the stock market. As older adults retire, they often reduce their savings and investment in stocks. However, they also increase their spending on healthcare, leisure, and other age-related products and services. This creates a demand for stocks in sectors that cater to the needs of the aging population.

Top Sectors to Invest In

Healthcare Stocks: The healthcare sector is a primary beneficiary of the aging population. Companies that specialize in medical devices, pharmaceuticals, and healthcare services are likely to see significant growth.

- Case Study: Johnson & Johnson (JNJ) is a healthcare giant with a strong presence in the medical devices and pharmaceuticals market. The company has seen steady growth, partly due to the increasing demand for healthcare products from the aging population.

Senior Housing and Care Stocks: As people age, they often require housing and care services. Companies that provide senior housing, assisted living, and home care services are poised to benefit from this demographic shift.

- Case Study: Senior Housing Properties Trust (SNH) is a real estate investment trust (REIT) that invests in senior housing properties. The company has seen strong growth, driven by the increasing demand for senior housing from the aging population.

Consumer Goods Stocks: Companies that produce age-related consumer goods, such as mobility aids, nutritional supplements, and personal care products, are also likely to benefit from the aging population.

- Case Study: Medline Industries (MDLZ) is a medical supply company that provides a wide range of products for the aging population. The company has seen significant growth, driven by the increasing demand for medical supplies from older adults.

Financial Services Stocks: Financial institutions that provide services tailored to the needs of the aging population, such as annuities, long-term care insurance, and retirement planning services, are also poised to benefit.

- Case Study: T. Rowe Price Group, Inc. (TROW) is a financial services company that offers a range of investment products and services tailored to the needs of the aging population. The company has seen steady growth, driven by the increasing demand for financial services from older adults.

Conclusion

The aging population in the U.S. presents a significant opportunity for investors. By focusing on sectors such as healthcare, senior housing, consumer goods, and financial services, investors can tap into the growing demand for products and services from the aging population. As the Baby Boomer generation continues to retire, these sectors are likely to see continued growth, making them a lucrative investment opportunity.

so cool! ()

like

- How to Invest in the US Stock Market from Overseas: A Comprehensive Guide

- Stock Market US Closed Days: Understanding the Impact on Trading and Economy

- "St. Simon Stock Pray for Us: A Devotion with Deep Historical Roots&

- Can You Trade Us Stocks from Australia? Exploring the Possibilities

- US Airlines Stocks: A Comprehensive Guide to Investing in the Sky

- Top Ten US Pot Stocks to Watch in 2023"

- Unlocking the Potential of THC.CD: A Deep Dive into the Full Description of This

- Us Stock 3D Sublimation Vacuum Heat Press: Revolutionizing Printing Technology&am

- Stock of Toys "R" Us: A Comprehensive Guide to the Largest Toy

- Title: Comprehensive List of All US Stock Symbols - Your Ultimate Guide

- New Listed Stocks in US: Exploring Exciting Opportunities for Investors

- Upcoming Events Affecting Us Stock Market in May 2025

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

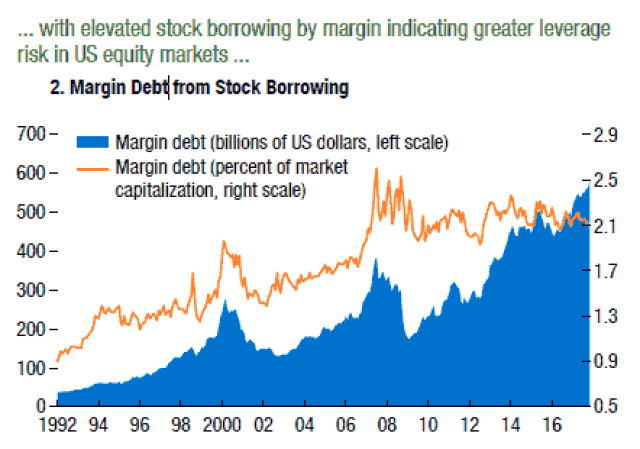

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Aging Population Stocks: A Lucrative Invest

US Aging Population Stocks: A Lucrative Invest

NY Times Less Stock in US Market: Understandin

Understanding the US Crude Oil Stock Prices: W

Trend of the US Stock Market: Navigating the C

Understanding the US Steel Stock Future: A Com

Unlocking the Potential of US Hybrid Corporati

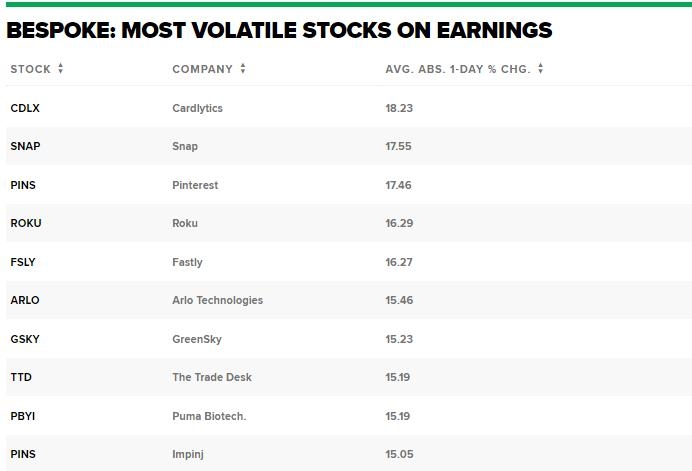

Recent Strong Earnings Momentum Stocks in the

Top US Lithium Stocks: Your Guide to Investmen

US Stock Car Racing Association: The Heartbeat

Total Value of US Housing Stock: A Comprehensi

How to Invest in the US Stock Market from Outs

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- "Last of Us 2 Out of Stock: What'"

- $1.11 Trillion Wiped Out from US Stock Market "

- US Delta Airlines Stock: A Comprehensive Analy"

- Maximize Your Returns: Top Tips for Stock Inve"

- Us Laughing Stock: The Misunderstood Side of A"

- Jollibee Stock in the US: A Thriving Investmen"

- How to Invest in Stocks from Outside the US"

- Unlocking the Power of US Stock CSV: Your Ulti"

- Marijuana Stocks Available in the US: A Compre"

- Unlocking the Potential of MET Stocks: A Compr"