you position:Home > new york stock exchange > new york stock exchange

Buying US Stocks in Malaysia: A Comprehensive Guide

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Investing in US stocks from Malaysia can be a strategic move for investors looking to diversify their portfolio and tap into the world's largest and most diversified stock market. With the rise of digital platforms and financial technology, accessing US stocks has never been easier. This guide will provide you with essential information on how to buy US stocks in Malaysia, including the benefits, risks, and the steps involved.

Understanding the US Stock Market

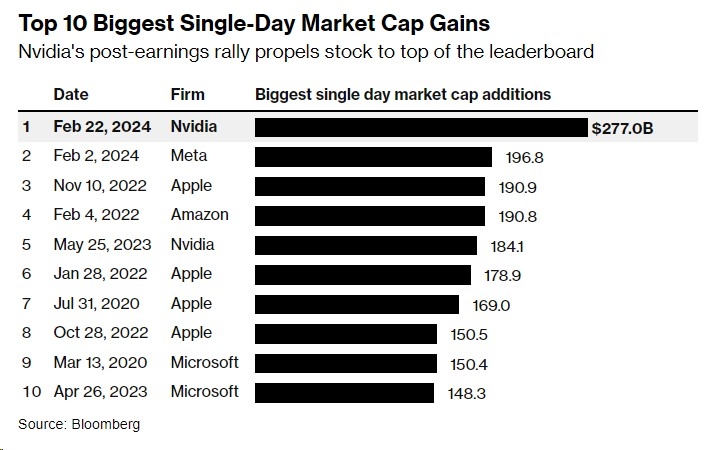

The US stock market is home to some of the world's most successful and innovative companies. The S&P 500, for example, includes companies like Apple, Microsoft, and Amazon, which have a significant impact on global markets. Investing in US stocks can offer several advantages, including:

- Diversification: Investing in US stocks can help diversify your portfolio, reducing the risk associated with investing in a single market.

- Access to Top Companies: The US stock market offers access to some of the world's largest and most successful companies.

- Potential for High Returns: Historically, the US stock market has provided higher returns than many other markets.

Risks to Consider

While investing in US stocks can be beneficial, it's important to be aware of the risks involved:

- Currency Fluctuations: Investing in US stocks from Malaysia means you'll be exposed to currency fluctuations, which can impact your returns.

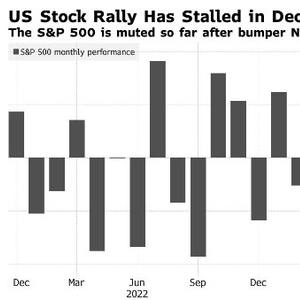

- Market Volatility: The US stock market can be volatile, leading to significant price fluctuations.

- Regulatory Differences: There are differences in regulations between the US and Malaysia, which can impact your investment decisions.

Steps to Buy US Stocks in Malaysia

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to US stocks. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

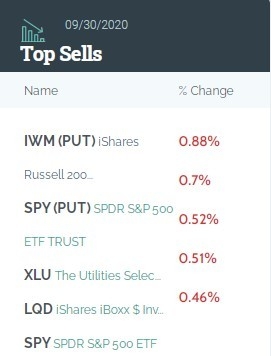

Research and Select Stocks: Once you have your brokerage account, research and select the stocks you want to invest in. Consider factors like the company's financial health, growth prospects, and market trends.

Fund Your Account: Transfer funds from your Malaysian bank account to your brokerage account. Ensure that you understand the currency conversion and any associated fees.

Place Your Order: Once your account is funded, place your order to buy US stocks. You can choose to buy shares of individual companies or invest in a US stock index fund.

Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company performance. Consider setting up alerts to notify you of significant price movements or news updates.

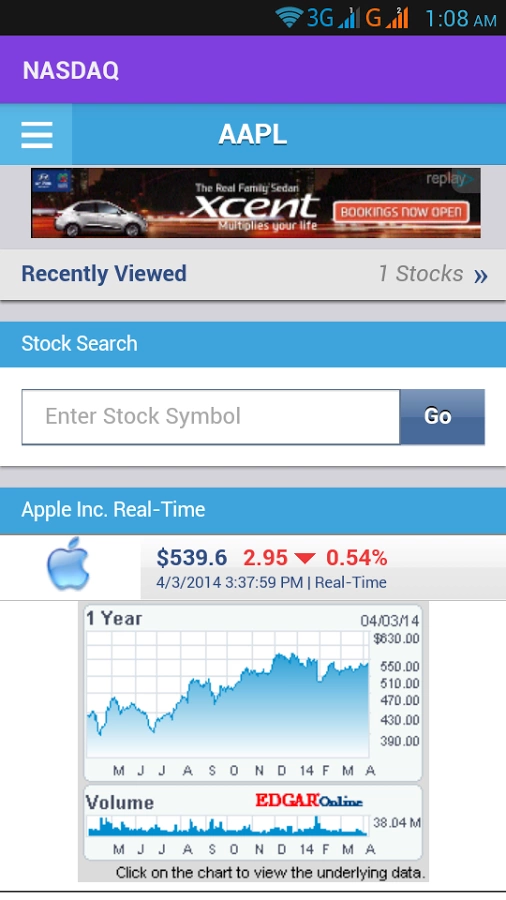

Case Study: Investing in Apple Stock

Let's consider a hypothetical scenario where an investor in Malaysia decides to invest in Apple stock. By following the steps outlined above, the investor can open a brokerage account, research Apple's financial health and growth prospects, and place an order to buy shares.

Assuming the investor buys 100 shares of Apple stock at

Conclusion

Buying US stocks in Malaysia can be a valuable investment strategy for diversifying your portfolio and accessing some of the world's most successful companies. By understanding the risks and following the steps outlined in this guide, you can make informed investment decisions and potentially achieve significant returns.

so cool! ()

like

- TGOD US Stock: A Comprehensive Guide to Investing in The Green Organic Dutchman

- Title: Understanding Stock Options Taxation in the US

- US Brokers: Unlocking the World of Foreign Stocks

- The Number of Companies Listed on US Stock Exchanges: An Overview

- Meli Us Stock Price: A Comprehensive Analysis

- How Did the US Stock Market React to Nixon's Impeachment?

- AMC Stock US: A Comprehensive Guide to Understanding AMC Entertainment Holdings

- Live Us Stocks: Your Ultimate Guide to Active Stock Investing

- Hive US Stock Price: An In-Depth Analysis

- 2018 US Stock Market Loses: A Comprehensive Analysis

- US Steel Stock: Elon Musk's Influence on the Market

- Semiconductor Companies in US Stock: A Comprehensive Guide to Investment Opportun

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Buying US Stocks in Malaysia: A Comprehensive

Buying US Stocks in Malaysia: A Comprehensive

Title: National Stock Exchange US: The Corners

What Time Does the US Stock Market Open?

CATL Stock US: Understanding the Market Dynami

Canadian Investing in the US Stock Market: A G

Smarter Web Company US Stock: Unveiling the Fu

Title: Top US Cannabis Stocks 2020: A Guide to

How to Buy US Stocks in the UAE: A Comprehensi

Title: TGIF Stock US: Unveiling the Potential

2018 US Stock Market Loses: A Comprehensive An

The Largest Stock Markets in the US: A Compreh

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Stock Invest US Free: Your Guide to Fre"

- Title: 2018 US Stock Market Holidays: A Compre"

- Nonresident Alien US Stock Capital Gains Tax: "

- Hatchimals Toys R Us in Stock: The Ultimate Gu"

- US Stock Futures: Navigating Muted Rate Uncert"

- Title: US Border Pot Stocks: The Growing Indus"

- Highest Dividend Stocks in the US Market: A Co"

- US Global Jets ETF Stock Price: A Comprehensiv"

- US Stock Indices Real Time: Unveiling the Puls"

- US Cellular Stock Price Performance: A Compreh"