you position:Home > new york stock exchange > new york stock exchange

2018 US Stock Market Loses: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In 2018, the US stock market experienced a significant downturn, marking a stark contrast to the previous year's robust performance. This article delves into the factors that contributed to the market's losses, the impact on investors, and the lessons learned from this tumultuous period.

Economic Factors Contributing to the Market Downturn

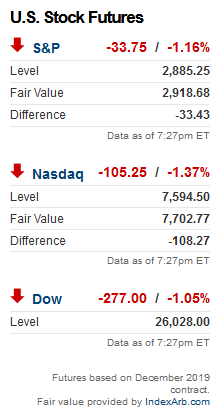

Several economic factors played a pivotal role in the 2018 US stock market losses. One of the primary factors was the Federal Reserve's decision to raise interest rates. As the Fed increased rates, borrowing costs rose, leading to higher corporate debt and reduced consumer spending. This, in turn, affected the profitability of companies and the overall stock market.

Another significant factor was the trade tensions between the United States and China. The escalating trade war resulted in tariffs on goods and services, leading to increased costs for businesses and uncertainty in the market. This uncertainty, coupled with the rising interest rates, created a perfect storm for the stock market.

Impact on Investors

The 2018 US stock market losses had a profound impact on investors. Many individuals and institutions experienced significant losses in their portfolios, leading to widespread concern and anxiety. However, it is important to note that the market's losses were not uniform across all sectors. For instance, technology stocks, which had been the darlings of the market, saw some of the most significant declines.

Despite the losses, some investors chose to view the downturn as an opportunity to buy undervalued stocks. This strategy, known as "buying the dip," has proven to be effective for many investors over the long term.

Lessons Learned

The 2018 US stock market losses provided several valuable lessons for investors and market participants. Firstly, it highlighted the importance of diversification. By investing in a variety of sectors and asset classes, investors can mitigate the impact of market downturns. Secondly, it emphasized the importance of risk management. Investors should be aware of their risk tolerance and invest accordingly.

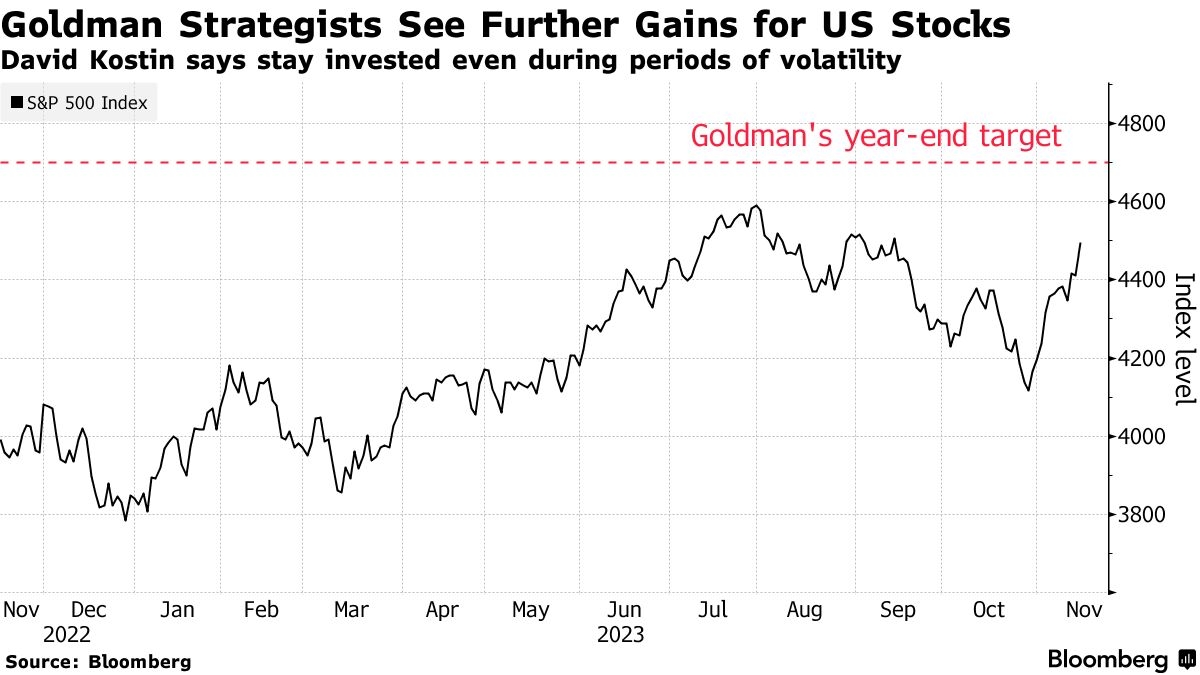

Furthermore, the downturn underscored the need for patience and long-term investing. While short-term market fluctuations can be unsettling, focusing on long-term growth and stability is crucial for successful investing.

Case Studies

One notable case study from the 2018 US stock market losses is the decline of tech giant Apple. As the market softened, Apple's stock price plummeted, leading to significant losses for investors. However, over the long term, Apple has recovered and continues to be a leading player in the technology industry.

Another example is the decline of oil and gas stocks. As oil prices fell, so did the stock prices of many oil and gas companies. However, as oil prices stabilized, these companies began to recover, providing investors with an opportunity to profit from the market's rebound.

Conclusion

The 2018 US stock market losses were a challenging period for investors. However, by understanding the factors that contributed to the downturn and learning from the experience, investors can navigate future market fluctuations more effectively. Diversification, risk management, and long-term investing are key strategies for success in the volatile stock market.

so cool! ()

last:US Steel Stock: Elon Musk's Influence on the Market

next:nothing

like

- US Steel Stock: Elon Musk's Influence on the Market

- Semiconductor Companies in US Stock: A Comprehensive Guide to Investment Opportun

- Analyst Upgrades US Stocks: Pre-Market News to Watch Out For

- Trade Indian Stocks from US: A Comprehensive Guide

- US Army Christmas Stocking: A Symbol of Holiday Cheer and Support

- US Large Cap Stocks Momentum Analysis 2024

- Title: US Share of Global Stock Market Capitalization in 2024: A Closer Look

- US Bank Stock Outlook: What to Expect in 2023

- Title: Can Foreigners Invest in the US Stock Market?

- Tesla Stock: A Comprehensive Analysis in US Dollars

- Understanding RRSP US Stock Withholding Tax

- Brainsway Stock in US Dollars: A Comprehensive Analysis

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

2018 US Stock Market Loses: A Comprehensive An

2018 US Stock Market Loses: A Comprehensive An

NVIDIA and FedEx Warnings Send Us Stocks Plumm

Impact of Middle East War on US Stock Market

http stocks.us.reuters.com stocks fulldescript

Title: Best US Stocks App: Your Ultimate Inves

Stock Market Cap to GDP: An Insight into the U

US Natural Gas Stock Quote: A Comprehensive Gu

Tech Stocks: US Indexes Lower Amid Market Vola

Morgan Stanley Strategists Say Weaker Dollar C

Foreign Companies on the US Stock Exchange: Op

RAAS Stock US: A Comprehensive Guide to Unders

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top US Penny Stocks to Buy Now: Your Guide to "

- Title: APT US Stock Exchange: Your Ultimate Gu"

- SoftBank US Stock: A Comprehensive Guide to In"

- Best US Stock: Unveiling the Top Performers fo"

- Stock Trading in the US: A Comprehensive Guide"

- 10 US Stocks to Buy for Long-Term Investment"

- Title: Stock Invest US Free: Your Guide to Fre"

- Is the US Stock Market Open on Columbus Day 20"

- US Stock Futures Ticker: A Comprehensive Guide"

- Convert Us Air Stock Certificates: A Comprehen"