you position:Home > new york stock exchange > new york stock exchange

US Stock Futures: Navigating Muted Rate Uncertainty

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial markets, investors are constantly seeking clarity amidst uncertainty. One of the most significant factors that influence stock market movements is the Federal Reserve's interest rate decisions. This article delves into the current state of US stock futures and the muted rate uncertainty that is shaping investor sentiment.

Understanding Muted Rate Uncertainty

"Muted rate uncertainty" refers to the situation where investors are uncertain about the future direction of interest rates, leading to cautious trading behavior. This uncertainty often arises from mixed economic indicators and the Federal Reserve's cautious approach to monetary policy.

Economic Indicators and Rate Decisions

Economic indicators such as inflation, employment, and GDP growth play a crucial role in shaping the Federal Reserve's interest rate decisions. However, recent data has been mixed, leading to uncertainty about the future path of interest rates.

Mixed Economic Indicators

For instance, while the unemployment rate has reached pre-pandemic levels, inflation remains above the Federal Reserve's target of 2%. This has led to a cautious approach by the Federal Reserve, with policymakers expressing concerns about both inflation and economic growth.

Cautious Approach by the Federal Reserve

As a result, the Federal Reserve has adopted a cautious approach to monetary policy, with policymakers indicating that interest rates are likely to remain low for an extended period. This has led to muted rate uncertainty in the market, as investors await further clarity on the future direction of interest rates.

Impact on US Stock Futures

The muted rate uncertainty has had a significant impact on US stock futures. Investors are cautious, with many opting to maintain a defensive posture in their portfolios. This has led to a flattening of the yield curve, as investors seek safety in fixed-income securities.

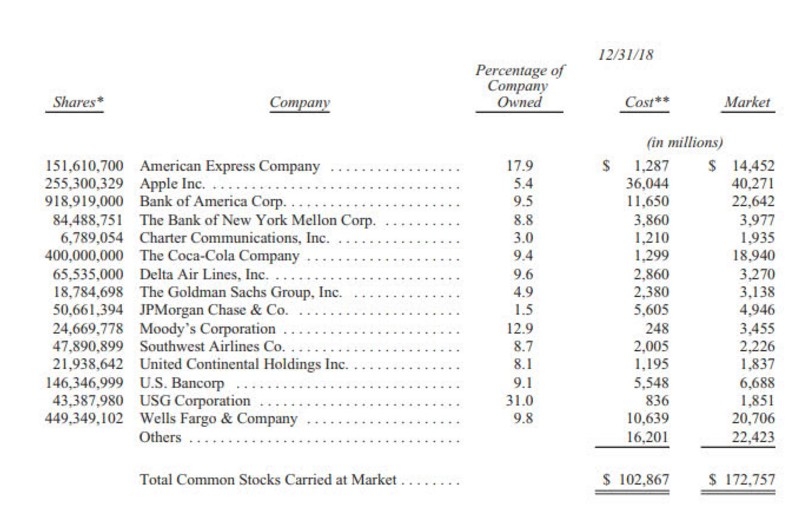

Case Study: Apple Inc.

One case study that illustrates the impact of muted rate uncertainty on US stock futures is Apple Inc. Despite the company's strong fundamentals, investors have been cautious, with the stock trading in a narrow range. This cautious behavior can be attributed to the muted rate uncertainty, as investors await further clarity on the future direction of interest rates.

Navigating Muted Rate Uncertainty

To navigate muted rate uncertainty, investors need to focus on a few key factors:

- Diversification: Diversifying their portfolios across different asset classes can help mitigate the impact of muted rate uncertainty.

- Quality over Quantity: Investing in high-quality companies with strong fundamentals can provide a level of stability in uncertain times.

- Long-term Perspective: Maintaining a long-term perspective can help investors ride out periods of uncertainty and benefit from market recoveries.

In conclusion, muted rate uncertainty is a significant factor shaping investor sentiment in the US stock market. By understanding the economic indicators and the cautious approach of the Federal Reserve, investors can navigate this uncertainty and make informed investment decisions.

so cool! ()

last:Stock R Us Cebu: Your Ultimate Destination for Stock Market Education

next:nothing

like

- Stock R Us Cebu: Your Ultimate Destination for Stock Market Education

- Momentum Stocks: US Large Cap 5-Day Performance Analysis

- Title: Top US Cannabis Stocks 2020: A Guide to the Leading Investments

- Understanding the Role of a US Nonresident Stockholder

- Bump Stock Ban: A Federal Decision That Shaped Gun Safety in the US

- Daqin Railway Stock: A Deep Dive into the Chinese Railway Sector's US Presen

- Title: US Border Pot Stocks: The Growing Industry at the Crossroads

- Top US Pot Stocks to Buy: Your Guide to Investing in the Cannabis Industry

- Nonresident Alien US Stock Capital Gains Tax: Understanding the Implications

- Bny Mellon US Stock Index III Fund: A Comprehensive Guide to Investment Opportuni

- Tech Stocks: US Indexes Lower Amid Market Volatility

- How Much Are Our Tower Stream Stocks Worth in US Dollars?

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- Highest Yielding US Stocks: Your Guide to Top "

- Title: "US Stock Exchange Open UK Tim"

recommend

US Stock Futures: Navigating Muted Rate Uncert

US Stock Futures: Navigating Muted Rate Uncert

Airbus Stock Symbol: US - Everything You Need

Ukraine War: How It Impacts the US Stock Marke

Title: Best US Stocks to Buy Now for Long-Term

US MSO Cannabis Stocks: The Future of Legal Ca

Title: US Cushing Stocks: The Cornerstone of E

Title: APT US Stock Exchange: Your Ultimate Gu

Title: Latest Momentum Stocks in the US

Title: Stock Invest US Free: Your Guide to Fre

Housing Stock Market News US: A Comprehensive

Steel Stock US: The Ultimate Guide to Understa

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Understanding the US Small Company Stoc"

- Toshiba US Stock Symbol: Everything You Need t"

- How to Buy Raspberry Pi Stock in the US"

- http stocks.us.reuters.com stocks fulldescript"

- Understanding US Large Cap Stocks Sector Class"

- All Stock Exchanges in the US: A Comprehensive"

- US 1 Industries Stock Quote: A Comprehensive G"

- Title: US Stock Market Time: Understanding the"

- Seafood Stocks US: The Impact of Aquaculture o"

- Samsung S8 Plus G955U Stock Firmware US Cellul"