you position:Home > aphria us stock > aphria us stock

Understanding the Current US Stock Markets: A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the ever-evolving world of finance, staying informed about the current US stock markets is crucial for investors and traders. The stock market reflects the economic health of a country and can offer valuable insights into market trends and future opportunities. This article delves into the current state of the US stock market, highlighting key factors, recent trends, and potential areas of growth.

Market Overview

The US stock market has been a significant driver of economic growth and wealth creation over the years. It is home to some of the world's largest and most influential companies, including tech giants like Apple, Microsoft, and Amazon. The market is divided into two main indices: the Dow Jones Industrial Average (DJIA) and the S&P 500.

The DJIA represents 30 of the largest and most influential companies in the United States, while the S&P 500 tracks the performance of 500 large companies across various sectors. Both indices have experienced significant growth over the past decade, with the S&P 500 reaching an all-time high in early 2022.

Recent Trends

Several key trends have shaped the current US stock market:

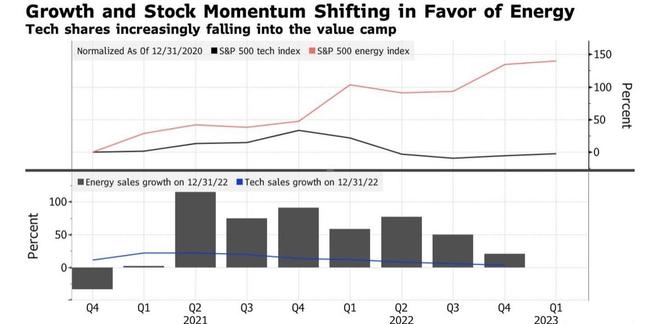

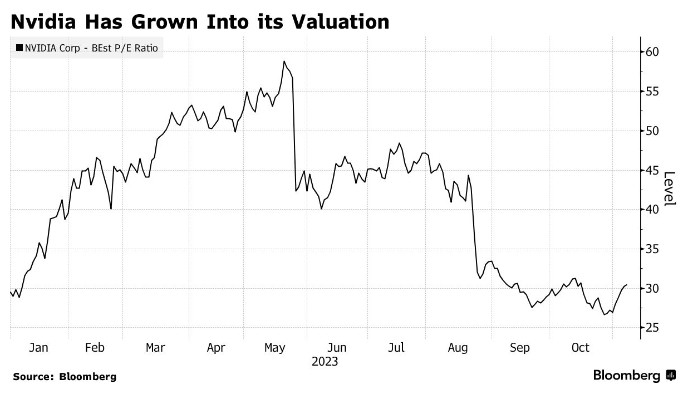

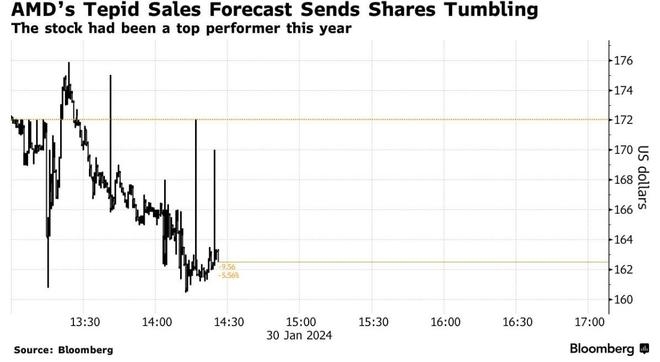

Tech Stocks Dominate: Tech stocks, particularly those in the cloud computing, AI, and biotechnology sectors, have been leading the market's growth. Companies like NVIDIA and Tesla have seen substantial gains, driven by strong fundamentals and innovation.

Economic Recovery: As the global economy recovers from the COVID-19 pandemic, many sectors are experiencing a surge in demand. This has led to increased optimism and investment in stocks across various industries.

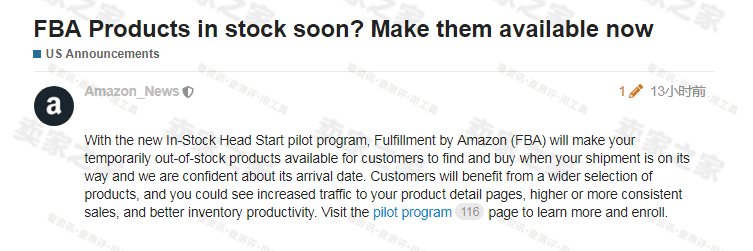

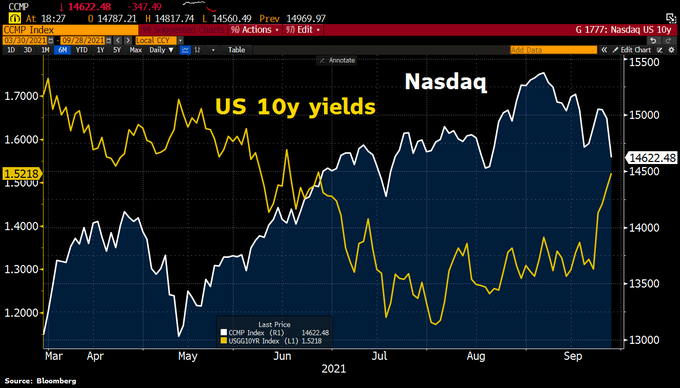

Inflation Concerns: While the economy is recovering, inflation remains a concern. The Federal Reserve has been closely monitoring inflation and has taken measures to control it, including interest rate hikes.

Dividend Stocks Attract Investors: In times of uncertainty, investors often turn to dividend-paying stocks for stability and income. Companies with strong financial health and consistent dividend payments have seen increased interest.

Sector Performance

Different sectors have performed differently in the current market environment:

- Tech: As mentioned earlier, tech stocks have been leading the market, driven by strong fundamentals and innovation.

- Energy: The energy sector has seen a surge in demand due to the global energy crisis and increased focus on renewable energy sources.

- Healthcare: The healthcare sector has been a stable performer, driven by the growing demand for medical services and pharmaceuticals.

- Consumer Discretionary: The consumer discretionary sector has seen a rebound in demand as the economy recovers, with companies in the retail and leisure sectors experiencing growth.

Case Studies

To illustrate these trends, let's take a look at some notable companies:

- Apple: Apple has been a leader in the tech sector, with its stock consistently rising due to its strong fundamentals and innovation.

- Tesla: Tesla's stock has seen significant growth, driven by its leadership in electric vehicles and renewable energy solutions.

- ExxonMobil: ExxonMobil has seen a rebound in its stock, driven by the increasing demand for energy and the company's focus on renewable energy sources.

Conclusion

Understanding the current US stock market is essential for investors and traders looking to make informed decisions. By analyzing key trends, sector performance, and notable companies, investors can gain valuable insights into market opportunities and risks. As always, it's crucial to conduct thorough research and consult with financial advisors before making investment decisions.

so cool! ()

last:DBV Technologies Stock: The Ultimate Investment Opportunity

next:nothing

like

- DBV Technologies Stock: The Ultimate Investment Opportunity

- Namaste Stock: An In-Depth Look at the US Ticker

- Stock Market in US Now: Current Trends and Predictions

- Understanding RRSP Withholding Tax on US Stocks

- Us Long Term Capital Gains Tax Stocks: Unlocking Long-Term Wealth

- How U.S. Taxes Impact Investments in Chinese Stocks

- Is the US Stock Market Open on Veterans Day?

- US News Best Stocks for 2021: Top Picks to Watch

- How to Buy IPO Stock in the US: A Comprehensive Guide

- Percentage of US Population Investing in Stock Market 2021: A Comprehensive Insig

- June 17, 2025: US Stock Market Summary

- Rare Earth Metals US Stocks: A Golden Opportunity for Investors"

recommend

Understanding the Current US Stock Markets: A

Understanding the Current US Stock Markets: A

Meg Energy Corp US Stock Symbol: Understanding

Understanding the Stocks Tax Rate in the US

Top 10 GDR US Stock Investments: A Comprehensi

RDS Stock: A Smart Investment for US Citizens

US Military Stock Photos: A Diverse Collection

Top Short-Term Momentum Stocks in the US Marke

Stock Market Holidays 2019: A Comprehensive Gu

US Bank Stocks Decline: Understanding the Mark

How to Invest in US Stocks from India: A Compr

Understanding the Stock Symbol of Tod's S

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Title: Colony Capital US Real Estate Stocks: A"

- mid cap stocks"

- RDS Stock: A Smart Investment for US Citizens"

- Enbridge US Stock Price: Current Trends and Fu"

- How Many Stocks Are Listed in the U.S. Stock M"

- coffee stocks"

- Hatchimals Toys R Us Stock: A Comprehensive Gu"

- Understanding US Stock Asset Allocation: A Com"

- US Stock Market August Outlook: What to Expect"

- Stock Drive Yellow Sign: Understanding the US "