you position:Home > aphria us stock > aphria us stock

Enbridge US Stock Price: Current Trends and Future Outlook

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

The stock market is a dynamic landscape, where the value of stocks fluctuates based on various economic factors and corporate performance. Among the numerous stocks traded on the market, Enbridge Inc. (NYSE: ENB) stands out as a major player in the energy sector. In this article, we delve into the current trends of Enbridge US stock price and analyze its future outlook.

Understanding Enbridge Inc.

Enbridge Inc. is a leading energy infrastructure company in North America, with a strong presence in the United States. The company operates a vast network of pipelines that transport crude oil, natural gas, and liquid petroleum products. Its diversified portfolio includes upstream, midstream, and downstream operations, making it a critical link in the energy supply chain.

Current Trends of Enbridge US Stock Price

In recent years, Enbridge has witnessed significant volatility in its stock price. Several factors contribute to this trend, including global oil prices, regulatory changes, and market dynamics. Here's a closer look at some of the current trends:

- Global Oil Prices: As a pipeline company, Enbridge's earnings are closely tied to global oil prices. The recent rise in oil prices has had a positive impact on the company's revenue and profitability, reflecting in its stock price.

- Regulatory Changes: Changes in regulations, such as the approval of new pipelines or the relaxation of environmental restrictions, can significantly impact Enbridge's operations and, consequently, its stock price.

- Market Dynamics: The energy sector is highly sensitive to market dynamics, including the demand for energy, technological advancements, and competition. These factors can influence Enbridge's stock price in both the short and long term.

Future Outlook for Enbridge US Stock Price

Predicting the future of Enbridge's stock price is challenging, given the unpredictable nature of the energy sector. However, here are some factors that could shape its future:

- Energy Transition: The shift towards renewable energy sources and the reduction of carbon emissions could impact Enbridge's operations, particularly in the oil and gas sectors. The company is already exploring opportunities in renewable energy, which could mitigate the impact of this transition.

- Expansion Projects: Enbridge has several expansion projects in the pipeline, which could boost its revenue and growth prospects. The success of these projects will be crucial in determining the company's future stock price.

- Economic Conditions: The global economy's performance, including factors like inflation, interest rates, and consumer spending, can influence Enbridge's stock price.

Case Study: Enbridge's Dakota Access Pipeline

One of Enbridge's most significant projects is the Dakota Access Pipeline (DAPL), which transports crude oil from North Dakota to Illinois. The project faced strong opposition from environmentalists and indigenous groups, leading to a prolonged legal battle. Despite the challenges, Enbridge successfully completed the pipeline, demonstrating its resilience and commitment to its projects.

Conclusion

Enbridge Inc. is a critical player in the energy sector, with a diverse portfolio and robust operations. While the company's stock price is subject to various factors, including global oil prices, regulatory changes, and market dynamics, its long-term prospects remain strong. As the energy transition continues and new opportunities emerge, Enbridge is well-positioned to adapt and thrive.

so cool! ()

last:Stocks with Catalysts This Week: US Market Insights

next:nothing

like

- Stocks with Catalysts This Week: US Market Insights

- Portion of U.S. Population Owning S&P 500 Stocks: An Insightful Look

- Top 10 GDR US Stock Investments: A Comprehensive Guide

- US Small Cap Stock Recommendations for 2025: Top Picks for Growth Investors

- Fractional Investment in US Stocks: Unlocking Opportunities with a Smarter Approa

- Unlocking Potential: The Thriving US Heritage Cannabis Stock Market

- Barron's US Marijuana Stocks: A Comprehensive Guide to Investment Opportunit

- Toys R Us Seasonal Stock Crew Salary: Understanding the Pay for Temporary Workers

- Strong US Stocks Fundamentals: A Deep Dive into Market Stability and Growth

- Market Cap Weight of Top 10 Largest US Stocks: A Comprehensive Analysis"

- Title: All Us Stock ETF: A Comprehensive Guide to Understanding and Investing

- US News Best Stocks: Unveiling the Top Picks for 2023

recommend

Enbridge US Stock Price: Current Trends and Fu

Enbridge US Stock Price: Current Trends and Fu

Nuclear Fusion Stocks: Powering the Future of

US Stock Exchange Open Hours: A Comprehensive

How to Buy Taiwan Stock in the US

Title: US Insurance Companies Stocks: A Compre

US Stock Market 2020: A Comprehensive Chart An

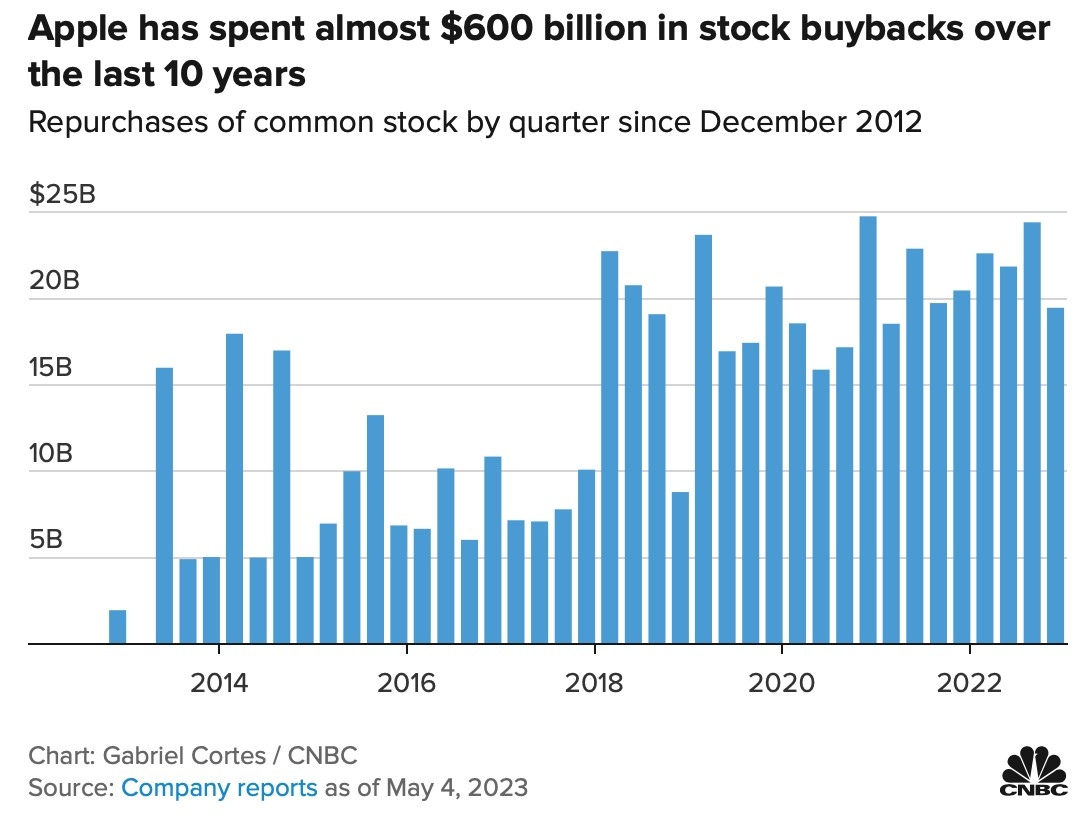

How Much US Companies Spent on Stock Buyback:

Dividend Stocks Traded in the US: A Comprehens

Confidence Flight Indicators: How to Navigate

SMIC US Stock: A Comprehensive Guide to Semico

Top 10 US Stocks to Watch in 2023

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Current Market Conditions: US Stocks Outlook f"

- Can I Trade US Stocks from Another Country?"

- US Stock Market Bottom: A Comprehensive Guide "

- Kinross Gold Stock US: A Comprehensive Guide t"

- financial etf"

- Unlocking Opportunities: Argentina Stock Perfo"

- Title: Domestic Stocks Outperform Foreign-Faci"

- Understanding the Fair Value of US Stock Futur"

- airbnb stock forecast"

- Title: US Stock Future Index: A Comprehensive "