you position:Home > aphria us stock > aphria us stock

Us Long Term Capital Gains Tax Stocks: Unlocking Long-Term Wealth

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Investing in stocks can be a powerful way to build wealth over time, especially when you focus on long-term capital gains. In the United States, long-term capital gains are taxed at a lower rate compared to short-term gains, making certain stocks particularly attractive for investors looking to maximize their returns. In this article, we'll explore some of the best US long-term capital gains tax stocks that can help you achieve your financial goals.

Understanding Long-Term Capital Gains Tax

Before diving into the stocks, it's important to understand the concept of long-term capital gains tax. In the US, long-term capital gains are taxed at a lower rate depending on your taxable income. For individuals in the 10% to 15% tax bracket, the rate is 0%; for those in the 25% to 35% bracket, the rate is 15%; and for those in the 37% bracket, the rate is 20%. This lower rate applies to investments held for more than a year.

Top US Long-Term Capital Gains Tax Stocks

Apple (AAPL)

- Long-Term Performance: Apple has been a top performer in the tech industry for decades, with a long history of strong revenue growth and dividends.

- Dividends: The company offers a solid dividend yield, providing investors with regular income.

- Sector: Technology

Microsoft (MSFT)

- Long-Term Performance: Microsoft has been a leader in the software industry, with consistent revenue growth and dividends.

- Dividends: The company offers a competitive dividend yield, making it an attractive investment for income seekers.

- Sector: Technology

Amazon (AMZN)

- Long-Term Performance: Amazon has been a disruptor in the retail industry, with significant revenue growth and a strong position in the e-commerce market.

- Sector: Technology/Consumer Discretionary

Johnson & Johnson (JNJ)

- Long-Term Performance: Johnson & Johnson is a diversified healthcare company with a long history of strong performance and dividends.

- Dividends: The company offers a solid dividend yield, making it an attractive investment for income seekers.

- Sector: Healthcare

Procter & Gamble (PG)

- Long-Term Performance: Procter & Gamble is a consumer goods giant with a long history of strong performance and dividends.

- Dividends: The company offers a competitive dividend yield, making it an attractive investment for income seekers.

- Sector: Consumer Staples

Exxon Mobil (XOM)

- Long-Term Performance: Exxon Mobil is one of the largest oil and gas companies in the world, with a long history of strong performance and dividends.

- Dividends: The company offers a substantial dividend yield, making it an attractive investment for income seekers.

- Sector: Energy

Case Study: Apple (AAPL) Apple has been a top performer in the tech industry, with a long history of strong revenue growth and dividends. Since 2012, the company's stock has returned over 1,300%, significantly outperforming the S&P 500. By investing in Apple's long-term capital gains tax stocks, investors can benefit from the company's strong performance and lower tax rates on long-term gains.

Conclusion

Investing in US long-term capital gains tax stocks can be a powerful way to build wealth over time. By focusing on companies with strong long-term performance and dividends, investors can maximize their returns while enjoying the benefits of lower tax rates. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.

so cool! ()

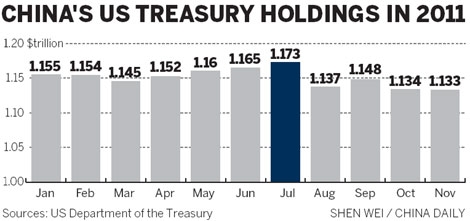

last:How U.S. Taxes Impact Investments in Chinese Stocks

next:nothing

like

- How U.S. Taxes Impact Investments in Chinese Stocks

- Is the US Stock Market Open on Veterans Day?

- US News Best Stocks for 2021: Top Picks to Watch

- How to Buy IPO Stock in the US: A Comprehensive Guide

- Percentage of US Population Investing in Stock Market 2021: A Comprehensive Insig

- June 17, 2025: US Stock Market Summary

- Rare Earth Metals US Stocks: A Golden Opportunity for Investors"

- Strike Us Stock: Unveiling the Power of Short Selling

- Best US Dividend Stocks 2018: Top Picks for Income Investors

- Undervalued Large Cap Stocks: A Treasure Trove for Investors

- Astellas US Stock Symbol: A Comprehensive Guide

- Maximizing Returns with Google Finance: A Deep Dive into US Stocks

recommend

Us Long Term Capital Gains Tax Stocks: Unlocki

Us Long Term Capital Gains Tax Stocks: Unlocki

Unlocking the Potential: How Sleeping Giant CB

AMD Stock: The US Dollar Connection

Axsome Therapeutics: A Leading US Biotech Stoc

ODM US Stock Sex Dolls: The Ultimate Guide to

All the Us Stocks Penny: A Comprehensive Guide

Cielo Stock US: A Comprehensive Guide to Inves

Is the US Stock Market Open on July 3, 2023?

Understanding "US Stock Before Hours&

Unlocking the Potential of US Hemp Oil Stocks:

US Military Stock Photos: A Diverse Collection

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- best cheap stocks"

- should i sell my stocks"

- Royal Bank of Canada (RY) US Stock Price: What"

- swing trading strategies"

- market outlook"

- Understanding UK Tax Treatment of US Restricte"

- New US Stocks to Watch: Emerging Opportunities"

- Bid Us Stock: A Comprehensive Guide to Stock T"

- Title: How Many Publicly Traded US Stocks?"

- Is the US Stock Market Open on July 4, 2025?"