you position:Home > aphria us stock > aphria us stock

Stock Market in US Now: Current Trends and Predictions

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the ever-evolving world of finance, the stock market remains a pivotal indicator of economic health and investment opportunities. The US stock market, in particular, has been a cornerstone of global financial markets for decades. This article delves into the current trends and predictions for the stock market in the US now.

The Current State of the US Stock Market

The US stock market has experienced a rollercoaster of emotions over the past few years. However, as of now, the market is showing signs of stability and growth. The S&P 500, a widely followed index, has been on an upward trajectory, reflecting the overall health of the market.

Key Trends in the US Stock Market

Technology Stocks Leading the Charge: Technology stocks, particularly those in the tech giants like Apple, Microsoft, and Amazon, have been driving the market's growth. These companies have shown remarkable resilience and innovation, making them attractive investments.

Diversification is Key: Investors are increasingly focusing on diversification to mitigate risks. This includes investing in sectors such as healthcare, energy, and consumer discretionary, which have shown promising growth potential.

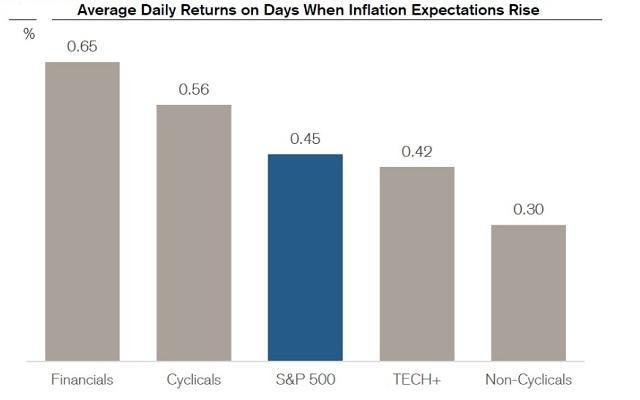

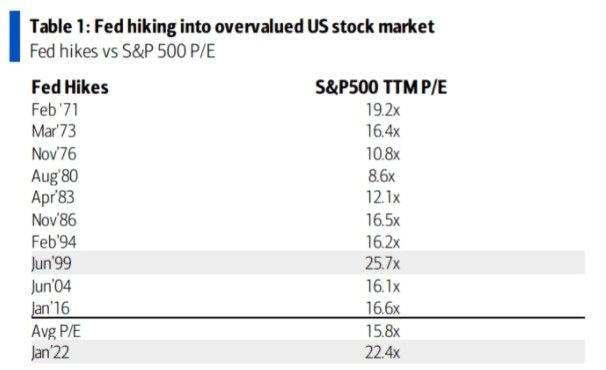

Interest Rates and Inflation: The Federal Reserve's monetary policy, particularly interest rates and inflation, continues to be a major factor affecting the stock market. While recent hikes have caused some volatility, investors are closely monitoring future moves by the Fed.

Predictions for the Future

Moderate Growth: Experts predict that the US stock market will continue to experience moderate growth in the coming years. This is driven by factors such as strong corporate earnings, technological advancements, and a recovering economy.

Volatility: Despite the overall upward trend, the stock market is expected to remain volatile. Factors such as geopolitical tensions, trade disputes, and economic uncertainties can cause fluctuations in the market.

Earnings Season: The upcoming earnings season is expected to play a crucial role in shaping the market's direction. Strong earnings reports can boost investor confidence, while weak reports can lead to market corrections.

Case Study: Tesla's Stock Surge

A prime example of the stock market's potential is Tesla's meteoric rise. In just a few years, Tesla's stock has soared, making it one of the most valuable companies in the world. This surge can be attributed to several factors, including the company's innovative technology, strong leadership, and growing market demand for electric vehicles.

Conclusion

The US stock market is currently in a state of stability and growth, driven by factors such as technology stocks, diversification, and moderate economic growth. While volatility is expected, investors can capitalize on these trends by staying informed and making strategic investments.

so cool! ()

last:Understanding RRSP Withholding Tax on US Stocks

next:nothing

like

- Understanding RRSP Withholding Tax on US Stocks

- Us Long Term Capital Gains Tax Stocks: Unlocking Long-Term Wealth

- How U.S. Taxes Impact Investments in Chinese Stocks

- Is the US Stock Market Open on Veterans Day?

- US News Best Stocks for 2021: Top Picks to Watch

- How to Buy IPO Stock in the US: A Comprehensive Guide

- Percentage of US Population Investing in Stock Market 2021: A Comprehensive Insig

- June 17, 2025: US Stock Market Summary

- Rare Earth Metals US Stocks: A Golden Opportunity for Investors"

- Strike Us Stock: Unveiling the Power of Short Selling

- Best US Dividend Stocks 2018: Top Picks for Income Investors

- Undervalued Large Cap Stocks: A Treasure Trove for Investors

recommend

Stock Market in US Now: Current Trends and Pre

Stock Market in US Now: Current Trends and Pre

US Stock Historical Tick Data: A Comprehensive

How to Buy Stock in the US Dollar: A Comprehen

Buy Us Stocks from Nigeria: A Lucrative Invest

Title: "US Marijuana Stock Exchange:

US Machine Gun Triangle Stock and Adapter: A C

Title: Total Assets in US Stock Market: An In-

US Bank Stocks in 2018: A Comprehensive Review

Spirit Airlines: A Rising Star in the US Airli

US Bank ETF Stock Price: A Comprehensive Guide

Best US Small Cap Stocks to Buy: Your Guide to

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- US Oil Stock Down: What You Need to Know About"

- Jim Rogers Sold All US Stocks: What It Means f"

- Eisai Stock US: A Comprehensive Analysis"

- cheap stocks"

- Stock Market News Today: US-China Phase 1 Deal"

- Understanding the Intricacies of US Stock Grap"

- Title: US Based Pot Stock: A Growing Industry "

- Top Performing US Stocks Past 5 Trading Days: "

- Top Trending US Stocks Today: A Comprehensive "

- penny stocks to buy"