you position:Home > aphria us stock > aphria us stock

Understanding US Stock Asset Allocation: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In today's dynamic financial landscape, effective asset allocation is crucial for investors seeking to optimize their portfolios. US stock asset allocation refers to the strategic distribution of investments across various stocks in the United States. This approach helps investors manage risk, maximize returns, and align their investment strategy with their financial goals. In this article, we will delve into the key aspects of US stock asset allocation, providing you with valuable insights to make informed decisions.

The Importance of Asset Allocation

Asset allocation plays a pivotal role in portfolio management. By diversifying your investments across different asset classes, you can reduce the impact of market volatility and mitigate risk. Stocks are a popular asset class among investors due to their potential for high returns. However, it is essential to understand the importance of allocating stocks appropriately within your portfolio.

Factors Influencing US Stock Asset Allocation

Several factors influence the allocation of stocks in the US market. These include:

Investor Risk Tolerance: Risk tolerance varies from one investor to another. Aggressive investors may allocate a higher percentage of their portfolio to stocks, while conservative investors may prefer bonds or other low-risk assets.

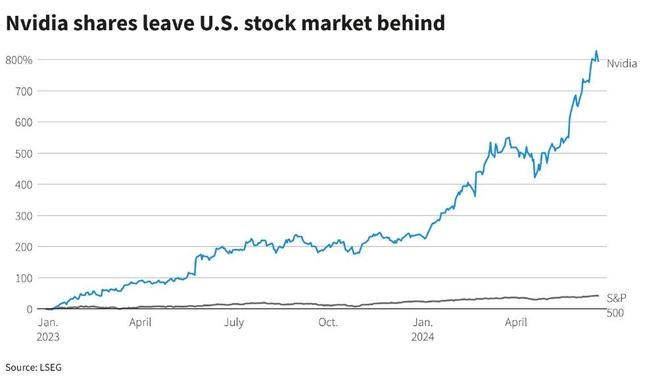

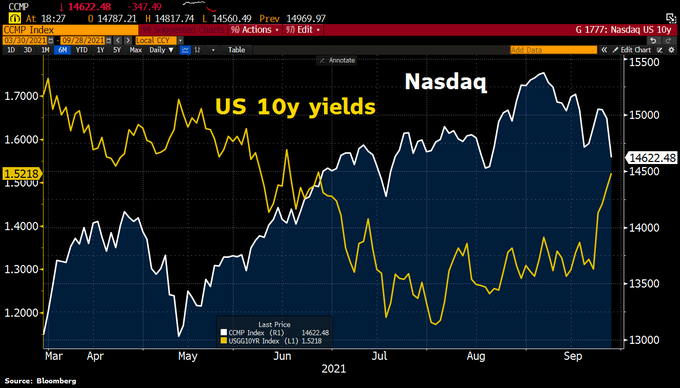

Market Conditions: Market conditions play a significant role in determining the allocation of stocks. During periods of economic growth and low interest rates, stocks may offer attractive returns. Conversely, during economic downturns or high-interest-rate environments, investors may seek safer investment options.

Investment Goals: Investment goals also influence the allocation of stocks. Investors with long-term goals, such as retirement, may allocate a higher percentage of their portfolio to stocks, while those with short-term goals may prefer more conservative investments.

Strategies for US Stock Asset Allocation

Here are some strategies to consider when allocating stocks in the US market:

Diversification: Diversification is a key principle in asset allocation. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of market-specific risks.

Asset Class Allocation: Asset class allocation involves dividing your investments among different asset classes, such as stocks, bonds, and real estate. This approach helps balance risk and return in your portfolio.

Geographical Diversification: Geographical diversification involves investing in stocks from different regions or countries. This strategy can help mitigate the impact of regional economic downturns.

Sector Rotation: Sector rotation involves shifting investments between different sectors based on market trends and economic conditions. This strategy requires careful analysis and a willingness to take on higher risk.

Case Study: Asset Allocation in Action

Consider the following scenario: John, a 45-year-old investor, is planning for his retirement in 20 years. After assessing his risk tolerance and investment goals, John decides to allocate 60% of his portfolio to stocks, 30% to bonds, and 10% to real estate. Within the stock allocation, John diversifies his investments across different sectors, including technology, healthcare, and consumer discretionary.

By following this strategy, John aims to achieve long-term growth while balancing risk. Over time, he monitors his portfolio's performance and adjusts his asset allocation as needed to align with his changing financial goals.

Conclusion

US stock asset allocation is a critical component of successful portfolio management. By understanding the factors influencing asset allocation and employing effective strategies, investors can optimize their portfolios for long-term growth and risk management. Remember to consider your risk tolerance, investment goals, and market conditions when allocating stocks in the US market.

so cool! ()

last:Title: US Stock Average: Understanding the Market's Pulse

next:nothing

like

- Title: US Stock Average: Understanding the Market's Pulse

- Buy Us Stock in Malaysia: A Smart Investment Opportunity

- Samsung Stock Price Per Share in US Dollars: A Comprehensive Analysis

- US Debt and Stock Market: The Interconnected Dance

- US Stock Exchange Public Holidays 2015: A Comprehensive Guide

- News Stock US: Unveiling the Latest Trends and Insights

- Title: List of US Penny Stocks Under $1: A Guide to High-Potential Investments

- Title: US Rare Earth Companies Stock: A Comprehensive Guide

- Title: Total Stock Buybacks in the US After Tax Cut: Impact and Analysis

- Penny Stocks to Watch in the US: 2023's Must-Have Investments

- Understanding the US Currency Stock: A Comprehensive Guide

- US Stock Market April 27, 2025 Closing Summary

recommend

Understanding US Stock Asset Allocation: A Com

Understanding US Stock Asset Allocation: A Com

Rheinmetall US Stock: A Comprehensive Analysis

Adyen US Stock: A Comprehensive Guide to Inves

Stock Analysis in the U.S.: A Comprehensive Gu

ACB Stock Price: A Comprehensive Analysis in U

US Petroleum Stock Piles: The Cornerstone of E

Title: "US Large Cap Stocks Momentum:

Stock Image Electrical Symbols: A Comprehensiv

Chinese Stock Market Crash: Its Effect on the

Iran-US Stock Market: A Comprehensive Analysis

US Bank Stocks Decline: Understanding the Mark

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Micro Cap Stocks Under $300 Million Market "

- Predictions for the Stock Market with Trump as"

- LED 32000LM Cycling Bicycle Bike Front Headlig"

- pfizer dividend"

- alibaba stock forecast"

- Meg Energy Corp US Stock Symbol: Understanding"

- LDS Stock US: A Comprehensive Guide to LDS Cor"

- Title: Japan Stock Banks in US Markets: A Comp"

- subordinated debt"

- How to Trade Taiwanese Stock in the US"