you position:Home > aphria us stock > aphria us stock

Title: Stock Market and US Economy: A Dynamic Duo

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: In the ever-evolving landscape of finance, the stock market and the US economy are closely intertwined. Understanding how these two entities interact can provide valuable insights into the health and direction of the American financial landscape. This article explores the relationship between the stock market and the US economy, highlighting key factors that influence their interplay.

The Stock Market: A Mirror of Economic Health

The stock market is often regarded as a barometer of economic health. When companies perform well, investors are more likely to purchase their stocks, leading to an increase in share prices. Conversely, when the economy is struggling, investors tend to sell off stocks, causing prices to fall. This dynamic makes the stock market a crucial indicator of economic trends.

Key Factors Influencing the Stock Market

Corporate Earnings: Strong corporate earnings can boost investor confidence, driving up stock prices. Conversely, poor earnings can lead to a selloff and a decline in market sentiment.

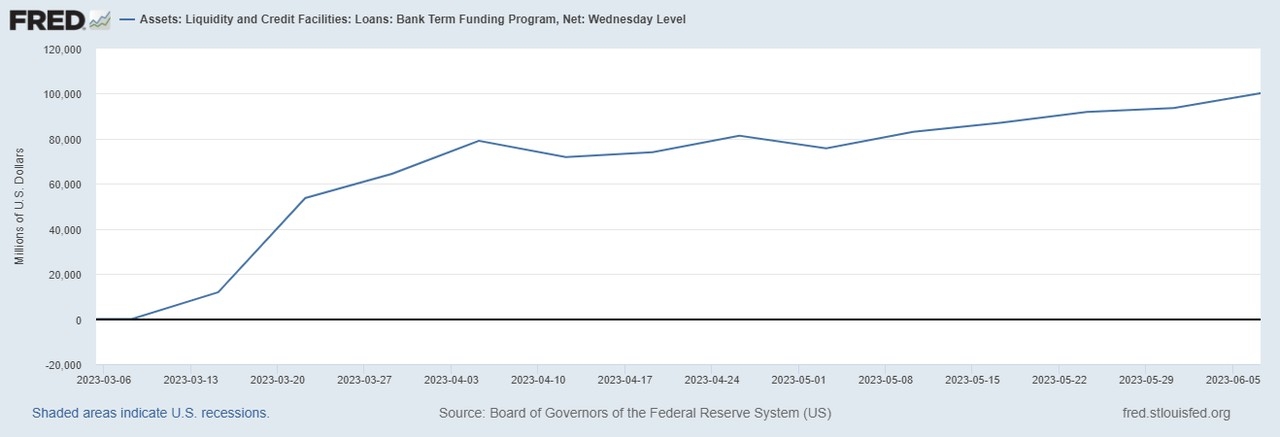

Interest Rates: Central banks, such as the Federal Reserve, adjust interest rates to control inflation and stimulate economic growth. Lower interest rates can make borrowing cheaper, encouraging businesses and consumers to spend more, which can positively impact the stock market.

Economic Indicators: Economic indicators like GDP growth, unemployment rates, and consumer spending can provide insights into the overall health of the economy and, by extension, the stock market.

The US Economy: A Complex Machine

The US economy is a complex machine composed of various sectors, including manufacturing, services, and finance. Understanding how these sectors interact can help us gain a clearer picture of economic performance.

Key Sectors Driving the US Economy

Technology: The technology sector has been a major driver of economic growth in recent years. Companies like Apple, Google, and Microsoft have contributed significantly to the US economy through their innovation and expansion.

Finance: The financial sector, including banking, insurance, and investment firms, plays a crucial role in channeling capital to various sectors of the economy.

Manufacturing: While manufacturing has seen a decline in recent years, it remains a vital sector, particularly in terms of exports and job creation.

The Interplay Between the Stock Market and the US Economy

The relationship between the stock market and the US economy is a two-way street. The stock market can influence economic growth, and vice versa.

Stock Market and Economic Growth: A strong stock market can boost economic growth by providing businesses with access to capital for expansion and by increasing consumer confidence.

Economic Growth and the Stock Market: Conversely, economic growth can lead to higher corporate earnings, driving up stock prices and, in turn, bolstering investor confidence.

Case Study: The 2008 Financial Crisis

The 2008 financial crisis serves as a prime example of how the stock market and the US economy can be closely linked. The crisis began with the collapse of the housing market, which led to a credit crunch and a significant decline in stock prices. This, in turn, caused the economy to enter a deep recession, further exacerbating the crisis.

Conclusion:

The stock market and the US economy are inextricably linked. Understanding the interplay between these two entities can help investors and policymakers navigate the complex financial landscape. By keeping a close eye on economic indicators and corporate earnings, we can better anticipate market trends and make informed decisions.

so cool! ()

last:Title: Top 10 Market Cap Stocks in the US

next:nothing

like

- Title: Top 10 Market Cap Stocks in the US

- Understanding US Stock Asset Allocation: A Comprehensive Guide

- Title: US Stock Average: Understanding the Market's Pulse

- Buy Us Stock in Malaysia: A Smart Investment Opportunity

- Samsung Stock Price Per Share in US Dollars: A Comprehensive Analysis

- US Debt and Stock Market: The Interconnected Dance

- US Stock Exchange Public Holidays 2015: A Comprehensive Guide

- News Stock US: Unveiling the Latest Trends and Insights

- Title: List of US Penny Stocks Under $1: A Guide to High-Potential Investments

- Title: US Rare Earth Companies Stock: A Comprehensive Guide

- Title: Total Stock Buybacks in the US After Tax Cut: Impact and Analysis

- Penny Stocks to Watch in the US: 2023's Must-Have Investments

recommend

Title: Stock Market and US Economy: A Dynamic

Title: Stock Market and US Economy: A Dynamic

Philippine Stock Market PSEi US Downgrade: Wha

Title: "US Remains Only Game in Town

Is the US Stock Market Open on Monday, Novembe

Lithium Mining Stocks: A Lucrative Investment

Title: "US Bank Stock Price History:

US Silica Stock Forecast: A Comprehensive Anal

Title: US Airways Merger with American Airline

US Energy Development Corporation Stock: A Com

US Stock Market Bubble 2024: Is It Time to Wor

Title: How Much Was the US Stock Market Down i

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- chevron dividend"

- top tech stocks"

- nvda dividend"

- How to Trade on the London Stock Exchange from"

- How to Buy US Stocks Using RBC Direct"

- How to Buy US Stock from India: A Comprehensiv"

- Jim Rogers Sold All US Stocks: What It Means f"

- Best US Robotics Stocks: Top Picks for 2023"

- energy etf"

- Stock Drive Yellow Sign: Understanding the US "