you position:Home > aphria us stock > aphria us stock

US Debt and Stock Market: The Interconnected Dance

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the ever-evolving world of finance, the relationship between the U.S. debt and the stock market is a subject that has piqued the interest of investors and economists alike. This intricate dance is characterized by a complex interplay of economic indicators, political decisions, and market sentiment. Understanding this relationship is crucial for anyone looking to navigate the tumultuous waters of the financial markets.

The U.S. Debt: A Growing Concern

The U.S. national debt has been on the rise for decades, with no signs of slowing down. As of 2021, the national debt stands at over $28 trillion. This figure is a stark reminder of the country's financial obligations and the potential long-term consequences of such a high level of debt.

The primary drivers of the U.S. debt are government spending and tax policies. Over the years, the government has increased spending on various programs, including social security, healthcare, and defense. Additionally, tax cuts and other fiscal policies have contributed to the growing debt burden.

The Stock Market: A Reflection of Economic Health

The stock market is often seen as a barometer of the economy's health. When the market is performing well, it typically indicates that the economy is strong and growing. Conversely, a struggling stock market can signal economic trouble ahead.

The relationship between the U.S. debt and the stock market is a two-way street. On one hand, the debt can impact the stock market by affecting interest rates and investor sentiment. On the other hand, the stock market can influence the debt by affecting government revenue through capital gains taxes and other sources.

Interest Rates and the Stock Market

One of the most significant factors affecting the stock market is interest rates. When interest rates are low, borrowing costs are lower, which can stimulate economic growth and boost stock prices. Conversely, higher interest rates can lead to increased borrowing costs, which can slow economic growth and put downward pressure on stock prices.

The Federal Reserve plays a crucial role in setting interest rates. When the Fed raises interest rates, it can signal a strong economy, which is generally positive for the stock market. However, if the Fed raises rates too quickly, it can lead to an economic slowdown, which can negatively impact the stock market.

Investor Sentiment and the Stock Market

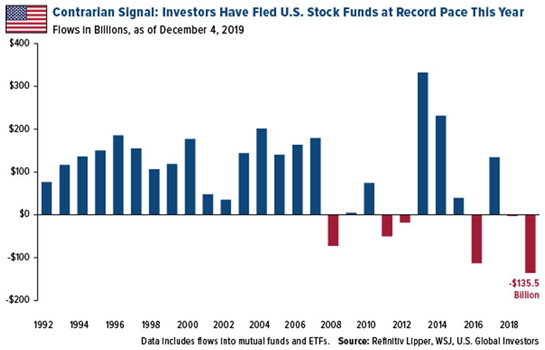

Investor sentiment is another critical factor in the relationship between the U.S. debt and the stock market. When investors are optimistic about the economy and the future of the stock market, they are more likely to invest, which can drive stock prices higher. Conversely, when investors are pessimistic, they are more likely to sell, which can drive stock prices lower.

The U.S. debt can influence investor sentiment by creating uncertainty and anxiety. For example, if investors are concerned about the government's ability to manage its debt, they may become more cautious and sell off stocks, leading to a decline in the stock market.

Case Study: The 2020 Market Crash

A prime example of the interconnectedness between the U.S. debt and the stock market is the 2020 market crash. The COVID-19 pandemic led to a significant increase in the U.S. debt as the government implemented various stimulus measures to support the economy. At the same time, the stock market experienced a historic crash, with the S&P 500 falling over 30% in a matter of weeks.

This case study highlights how the U.S. debt and the stock market can be affected by external shocks and economic uncertainties. It also underscores the importance of understanding the complex relationship between these two critical components of the financial system.

Conclusion

The relationship between the U.S. debt and the stock market is a complex and ever-evolving one. Understanding this relationship is crucial for investors and economists alike. By analyzing economic indicators, political decisions, and market sentiment, one can gain valuable insights into the potential risks and opportunities associated with the U.S. debt and the stock market.

so cool! ()

last:US Stock Exchange Public Holidays 2015: A Comprehensive Guide

next:nothing

like

- US Stock Exchange Public Holidays 2015: A Comprehensive Guide

- News Stock US: Unveiling the Latest Trends and Insights

- Title: List of US Penny Stocks Under $1: A Guide to High-Potential Investments

- Title: US Rare Earth Companies Stock: A Comprehensive Guide

- Title: Total Stock Buybacks in the US After Tax Cut: Impact and Analysis

- Penny Stocks to Watch in the US: 2023's Must-Have Investments

- Understanding the US Currency Stock: A Comprehensive Guide

- US Stock Market April 27, 2025 Closing Summary

- Low Risk High Reward Stocks: US Stocks to Watch in April 2019

- Title: US Steel Companies Stocks: A Comprehensive Guide

- Interactive Brokers US Stock Commission Fees 2025: What You Need to Know

- US Propane Stocks: What the EIA Data Reveals

recommend

US Debt and Stock Market: The Interconnected D

US Debt and Stock Market: The Interconnected D

Global Stocks Slip as US-China Tensions Add to

Understanding US Stock Capital Gain Tax for Fo

US ADR Stocks: A Comprehensive Guide to Invest

US Cannabis Stock IPO: A Game-Changing Investm

US Bank ETF Stock Price: A Comprehensive Guide

How to Trade on the London Stock Exchange from

How to Buy Eutelsat Stock in the US

US Stock Exchange Symbols Ending with X: A Com

Is the US Stock Exchange Open on Veterans Day?

Tomorrow: US Stock Market Drop – What You Ne

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Calculator: A Comprehensive Guide to "

- http stocks.us.reuters.com stocks fulldescript"

- How Much Did the US Stock Market Lose Today?"

- Title: Best US Stock for Long-Term Investment"

- Dividend Stocks Traded in the US: A Comprehens"

- IPOs March 2022: A Comprehensive List of US St"

- Is the US Stock Market Open on December 31?"

- American Tower US Real Estate Stocks: A Compre"

- silver stocks"

- Understanding "US Stock Before Hours&"