you position:Home > aphria us stock > aphria us stock

Title: US Rare Earth Companies Stock: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: In the ever-evolving global market, the importance of rare earth elements cannot be overstated. These elements are vital for various high-tech industries, including electronics, renewable energy, and defense. With the increasing demand for these elements, investing in US rare earth companies has become a hot topic among investors. This article provides a comprehensive guide to understanding the US rare earth companies stock market, highlighting key factors to consider and offering insights into potential investment opportunities.

Understanding Rare Earth Elements and Their Importance Rare earth elements are a group of 17 elements with unique magnetic, luminescent, and catalytic properties. They are essential for many modern technologies, such as smartphones, electric vehicles, wind turbines, and missile guidance systems. The United States has historically been a leading producer of rare earth elements, but the industry has faced challenges in recent years.

US Rare Earth Companies: A Snapshot Several US-based companies are involved in the mining, processing, and manufacturing of rare earth elements. Some of the notable players include:

- Molycorp Inc. – A leading producer of rare earth minerals, Molycorp has mines in California and Wyoming.

- Alkane Resources Inc. – An Australian company with a significant presence in the US, Alkane Resources is involved in the exploration and development of rare earth elements.

- MP Materials Corporation – MP Materials owns the Mountain Pass Mine in California, one of the largest rare earth element mines in the world.

Factors Influencing US Rare Earth Companies Stock Several factors can influence the stock performance of US rare earth companies:

- Global Demand: The demand for rare earth elements is driven by the growth of high-tech industries. An increase in demand can lead to higher stock prices.

- Supply Chain Issues: Any disruptions in the supply chain, such as mining accidents or trade disputes, can impact the availability of rare earth elements and, consequently, the stock prices.

- Government Policies: Government policies, such as subsidies and trade agreements, can significantly impact the rare earth industry and the associated stocks.

Investment Opportunities in US Rare Earth Companies Investing in US rare earth companies can be a lucrative opportunity, but it is crucial to conduct thorough research. Here are some tips for potential investors:

- Analyze Financial Statements: Review the financial statements of the companies to assess their profitability, revenue growth, and debt levels.

- Understand the Business Model: Familiarize yourself with the company's business model, including its mining operations, processing facilities, and end-market applications.

- Stay Informed: Keep up-to-date with industry news, including technological advancements, regulatory changes, and geopolitical events.

Case Study: Molycorp Inc. Molycorp Inc. is a prime example of a US rare earth company that has experienced significant growth and challenges. After the acquisition of the Mountain Pass Mine, Molycorp's stock price surged. However, the company faced challenges in processing and marketing its products, leading to a decline in stock prices. This case study highlights the importance of understanding the complexities of the rare earth industry.

Conclusion: Investing in US rare earth companies stock can be a rewarding venture, but it requires thorough research and a clear understanding of the industry's dynamics. By considering factors such as global demand, supply chain issues, and government policies, investors can make informed decisions and identify potential investment opportunities in this exciting sector.

so cool! ()

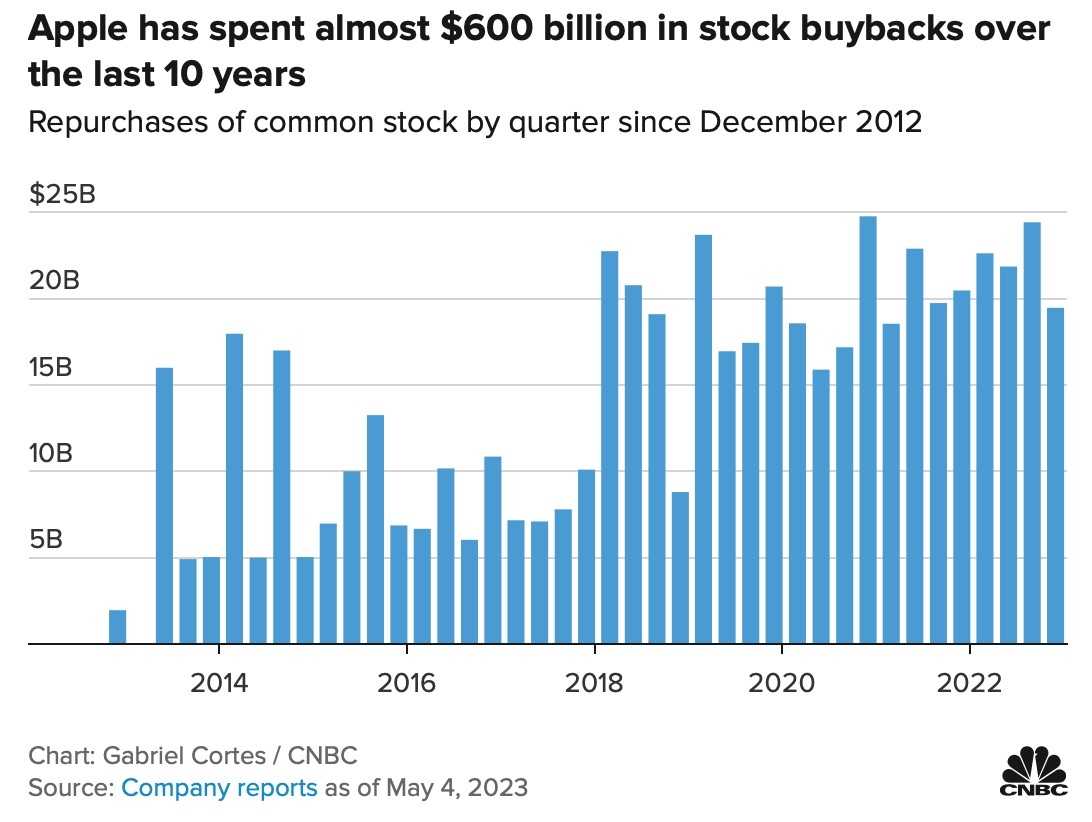

last:Title: Total Stock Buybacks in the US After Tax Cut: Impact and Analysis

next:nothing

like

- Title: Total Stock Buybacks in the US After Tax Cut: Impact and Analysis

- Penny Stocks to Watch in the US: 2023's Must-Have Investments

- Understanding the US Currency Stock: A Comprehensive Guide

- US Stock Market April 27, 2025 Closing Summary

- Low Risk High Reward Stocks: US Stocks to Watch in April 2019

- Title: US Steel Companies Stocks: A Comprehensive Guide

- Interactive Brokers US Stock Commission Fees 2025: What You Need to Know

- US Propane Stocks: What the EIA Data Reveals

- Title: China's Renminbi Stocks Gain After Reports of US-China Trade Progress

- US Home Builder Stock Index: A Comprehensive Guide

- Should I Buy US Bank Stock?

- Top Trending US Stocks Today: A Comprehensive Guide

recommend

Title: US Rare Earth Companies Stock: A Compre

Title: US Rare Earth Companies Stock: A Compre

AMD Stock: The US Dollar Connection

Nuclear Fusion Stocks: Powering the Future of

IPOs March 2022: A Comprehensive List of US St

How Can an Indian Buy Stocks in the US?

Eisai Stock US: A Comprehensive Analysis

Dates of US Stock Market Crashes: A Timeline o

Title: Is the US Stock Market Currently Overva

Top Momentum Stocks: Large Cap US September 20

PMTs and the US Stock Price: Understanding the

Is the US Stock Market Open on July 3, 2023?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Track Us Stock Market: Your Ultimate Guide to "

- Understanding TFSA US Stock Capital Gain: What"

- green energy stocks"

- Foreign Governments Own Us Stocks: The Implica"

- Understanding the US Smokeless Tobacco Stock S"

- Title: Direction of the U.S. Stock Market: Wha"

- Title: US Airways Merger with American Airline"

- Title: US Olive Oil Stocks: A Deep Dive into t"

- Title: Top 3 Stock Exchanges in the US"

- The Biggest Companies in the US Stock Market: "