you position:Home > aphria us stock > aphria us stock

How to Trade on the London Stock Exchange from the US

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you looking to diversify your investment portfolio and tap into one of the world's largest and most liquid stock markets? If so, trading on the London Stock Exchange (LSE) from the US could be a great option for you. In this article, we will explore how to get started trading on the LSE as an American investor.

Understanding the London Stock Exchange

The London Stock Exchange is one of the oldest and most respected stock exchanges in the world. It's home to a wide range of companies across various sectors, including some of the most prominent global businesses. As an American investor, trading on the LSE can provide you with access to international markets, potentially increasing your investment opportunities.

Eligibility for Trading

To trade on the LSE from the US, you must be an eligible investor. Generally, this means you should have a brokerage account that allows you to trade international stocks. Several brokerage firms offer this service, so be sure to check with your broker to ensure they provide access to the LSE.

Choosing a Broker

One of the first steps in trading on the LSE is choosing a brokerage firm. It's crucial to select a broker that offers access to the LSE and has a good reputation. Some well-known brokers that cater to US investors and offer LSE trading include:

- Charles Schwab

- TD Ameritrade

- Fidelity

When choosing a broker, consider factors such as fees, customer service, and the availability of educational resources. It's also important to note that some brokers may have minimum investment requirements for trading on the LSE.

Understanding the Process

Once you've chosen a broker and opened an account, you can start trading on the LSE. Here's a step-by-step guide to get you started:

- Fund Your Account: Before you can start trading, you'll need to fund your brokerage account. This can be done through electronic transfers, bank wires, or by depositing cash at a local branch.

- Research and Analyze: Like any other investment, it's essential to conduct thorough research and analysis before buying or selling stocks. This includes analyzing financial statements, market trends, and company news.

- Place an Order: Once you've decided on a stock, you can place an order through your broker's platform. Orders can be placed to buy or sell at a specific price or as market orders, which are executed immediately at the current market price.

- Monitor Your Investments: After placing your order, it's important to monitor your investments. Keep track of market news and company updates to stay informed about any potential changes that could impact your investments.

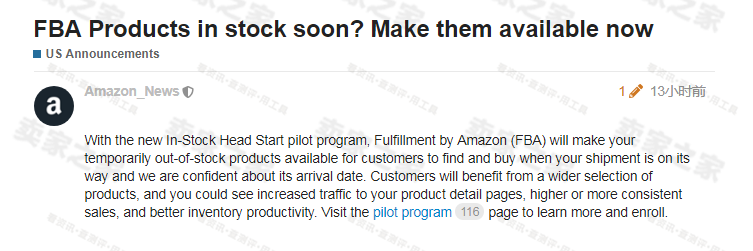

Case Study: Amazon on the LSE

An interesting example of a US company listed on the LSE is Amazon. In 2018, Amazon became the first US company to list on the LSE's main market, offering investors access to the company's shares in the UK.

By trading Amazon's shares on the LSE, investors gained exposure to the company's stock in the UK, which may have provided some benefits, such as currency diversification and exposure to different market conditions.

Conclusion

Trading on the London Stock Exchange from the US can be a valuable addition to your investment strategy. By choosing the right brokerage firm, conducting thorough research, and understanding the trading process, you can start investing in international stocks and potentially increase your investment returns. Remember to stay informed and keep an eye on market trends and company news to make informed investment decisions.

so cool! ()

last:Title: US Stock Market Averages Today

next:nothing

like

- Title: US Stock Market Averages Today

- Title: Direction of the U.S. Stock Market: What Investors Need to Know

- US Mining Company Stocks: A Comprehensive Guide to Investment Opportunities

- Title: Scynthian Stock Ticker US: Unveiling the Secrets of the Financial World

- Current High Momentum Stocks in the US Market

- Should I Sell My US Stocks?

- The Worst Day in US Stock Market History

- Title: Us Satisfied Stock: The Key to Successful Investment

- US Hospital Stocks: A Comprehensive Guide to Investing in the Healthcare Sector

- Title: Stock Market in US History: A Timeline of Milestones and Transformations

- Joint Stock Company Effect on Us: Transforming the Business Landscape

- Title: "US Bank Stock Price History: A Comprehensive Overview"

recommend

How to Trade on the London Stock Exchange from

How to Trade on the London Stock Exchange from

Dow Jones Reaches 25,000 Milestone: A Deep Div

Stock Drive Yellow Sign: Understanding the US

How to Trade in the US Stock Market from Singa

Apple Stock Price in the US Market on April 18

Top US Steel Companies Stocks: A Comprehensive

US Stock Calculator: A Comprehensive Guide to

JD US Stock: A Comprehensive Guide to Investin

US Large Cap Value Stocks: Market Cap Over 2 B

How Are US Stocks Doing? A Comprehensive Analy

Is the US Stock Market Open on July 3, 2023?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- DeepSeek US Stock: Unveiling the Potential of "

- President Trump's Tariff Announcements Ca"

- Dogecoin Stock US: A Comprehensive Guide to Un"

- Global Stocks Slip as US-China Tensions Add to"

- Can I Trade US Stocks from Another Country?"

- Is the US Stock Market Open on December 31?"

- Ahold Delhaize Stock US: A Closer Look at the "

- Is the US Stock Market Open on Good Friday 202"

- KFC Stock Price US: What You Need to Know"

- Understanding the Chinese Corporation Stock Op"